Consumers bought the September dip

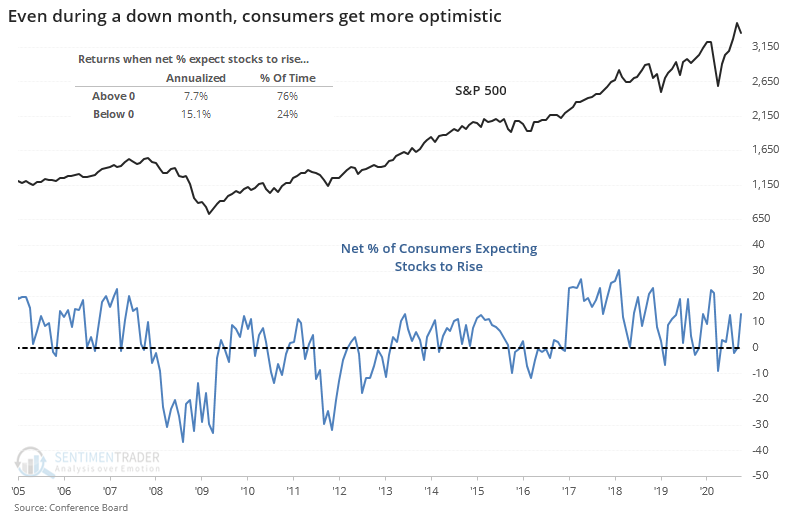

The worst performance in months didn't deter consumers. Even though the S&P 500 lost several percent in September, there was an increase in the net percentage of consumers who expect stocks to rise according to the monthly Conference Board survey.

There is a modest contrary bias to this data. When more consumers expect stocks to rise than fall, the S&P 500 has returned an annualized +7.7%. When more expect stocks to fall than rise, that return more than doubles to +15.1%.

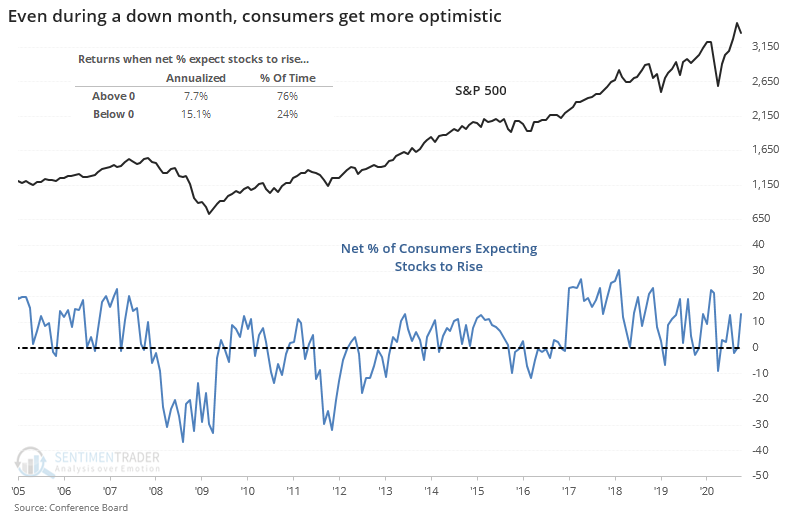

So, it seems like this increase in confidence despite lower prices should be a bad thing. To check, let's go back as far as we can and look for any month when the S&P lost 3% or more, and yet there was at least a 10% increase in the net percentage of consumers looking for stocks to rise vs. decline.

It wasn't such a bad sign after all. Over the next 3 months, the S&P rose 14 out of 16 times, with an excellent median return and decent (but not great) risk/reward skew. Over the next year, several of those rallies saw gains peter out, but still, there was an overall positive bias.

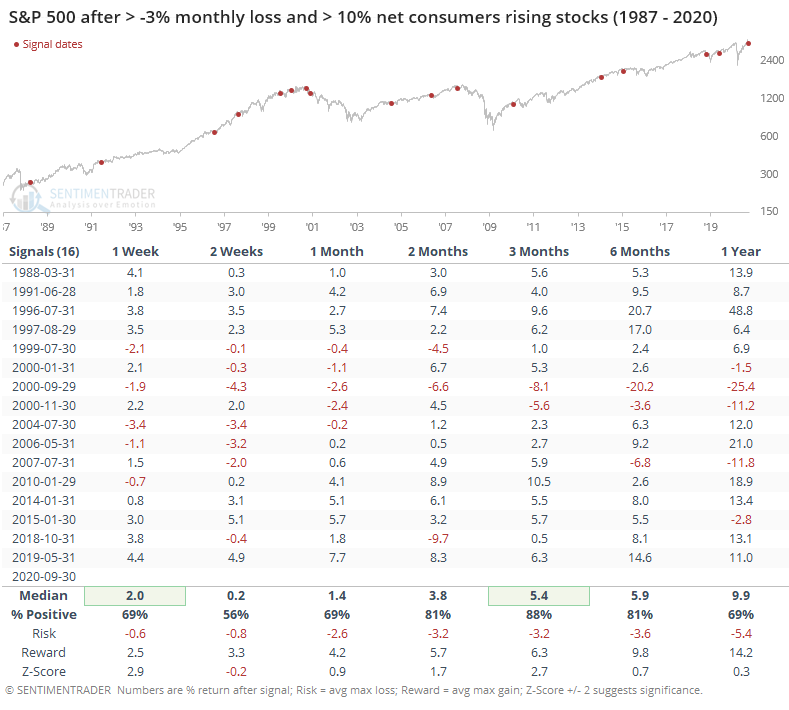

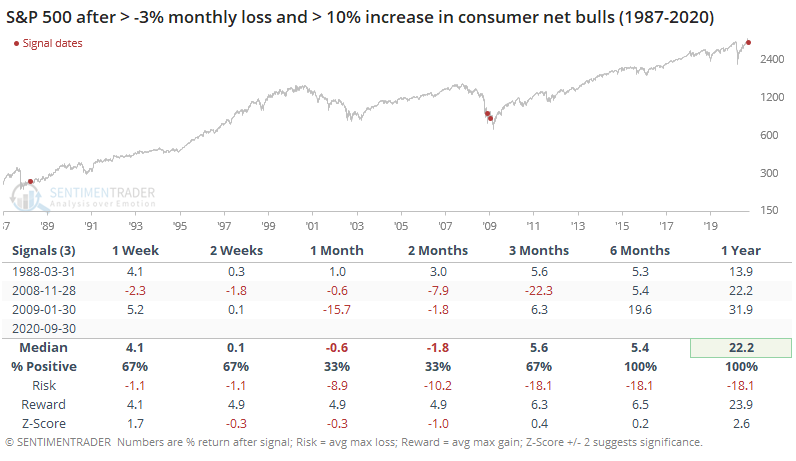

The only times when stocks lost this much and there was more than a 10% jump in consumers expecting stocks to rise were during/after the crashes in 1987 and 2008.

The sample size is essentially two, so we have to take the results with a grain of salt, but the S&P whipsawed in the months ahead, ultimately leading to substantially higher prices over the next 6-12 months.

There is a tendency to think everything is a contrary indicator, especially when it comes to surveys of laypersons. That's not always the case, however, and knee-jerk contrarianism can be a deleterious habit. This seems to be one of those cases. While on the surface we may want to become more defensive because consumers are buying the dip, historically there isn't a strong case to do so.