Consumers are back and counting on rising stocks

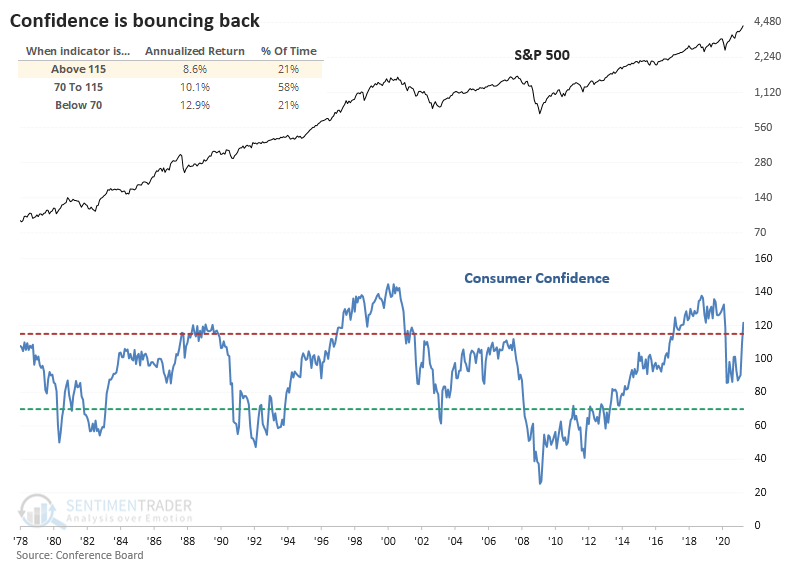

The latest survey of U.S. consumers by the Conference Board showed another massive spike in confidence. That continues a pattern; the past two months have seen confidence rise by more than 30% - this is the biggest jump in history.

Over the past 45 years, a reading above 115 has preceded an annualized return of +8.6% in the S&P 500. That's not bad, though it modestly trails when confidence was low or even neutral.

RISING STOCKS ARE A BIG REASON

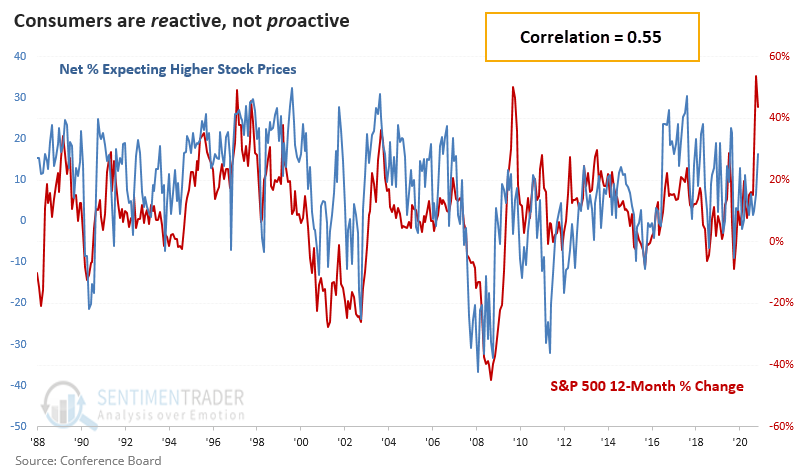

Recent decades show that stocks are an increasingly important influence on confidence. So, a big part of rising confidence lately is due to a stock market that can't seem to go down.

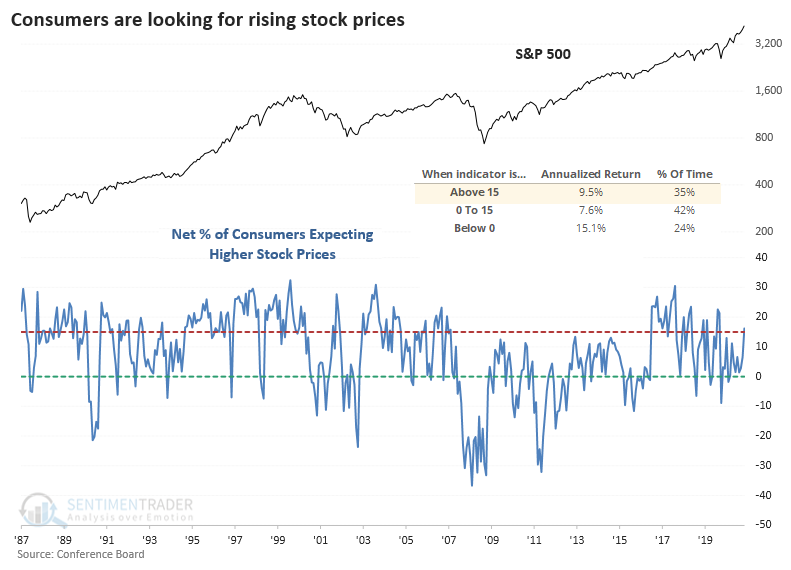

Not only has overall confidence increased, but there has been an increase in the percentage of consumers looking for even higher stock prices relative to those who think they might actually suffer the horror of declining.

This particular survey hasn't been very effective at highlighting extremes in market sentiment, except for the downside when there is a sudden spike in those expecting stocks to drop even further. That's been a good signal to fade consumers and add to long positions.

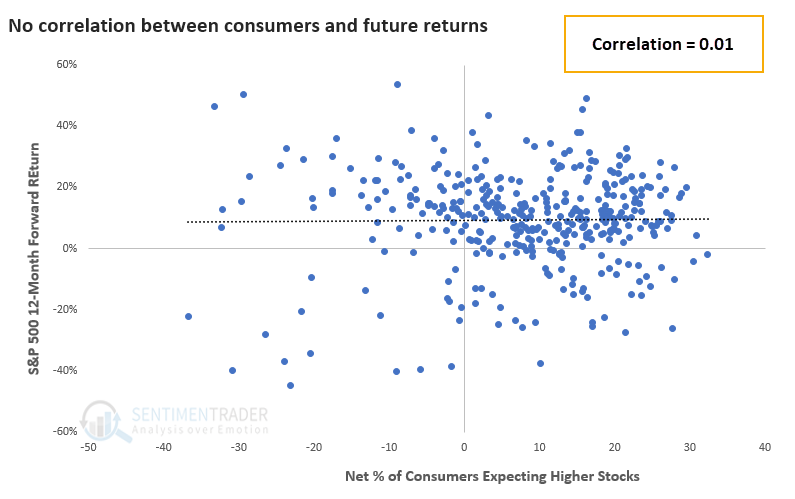

We can also see that in the scatter plot showing the net percentage of consumers expecting higher stock prices versus the S&P 500's actual 12-month forward return. There was essentially no correlation.

ANOTHER SURVEY SHOWS EVEN HIGHER CONFIDENCE

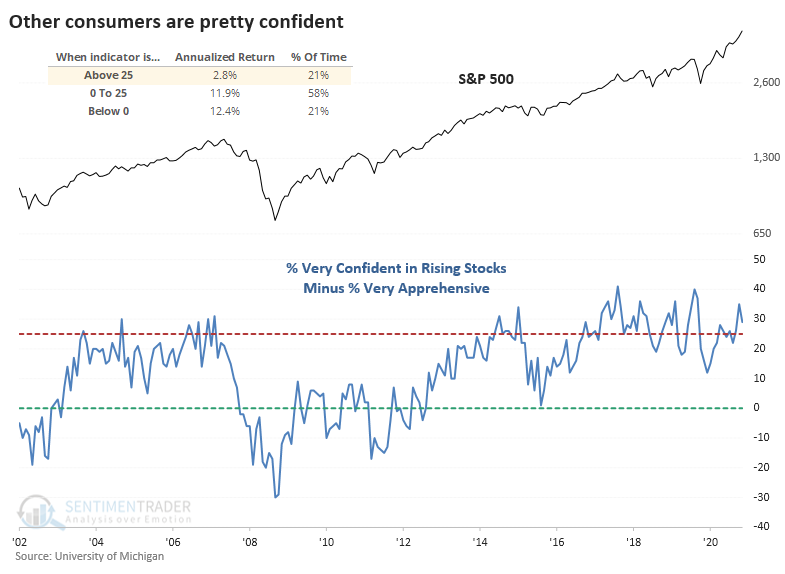

The University of Michigan does a similar survey with more granularity.

It takes some major chutzpah to be 100% confident that stocks will rally, and yet for the past two months, 13% of consumers were exactly that confident. That's just off the record of 14% of respondents who did not doubt stocks in 2019.

Over the past couple of months, a very high percentage of consumers are at least 75% confident that stocks will rally, versus a tiny percentage who are only 25% or less confident.

While there are only 20 years of history for this survey, the S&P's annualized return following extremes shows a solid contrary bias. When the net percentage of very confident versus very apprehensive consumers was above 25%, as it is now, the S&P showed a return of only 2.8%, versus +12.4% when there were more apprehensive than confident folks.

There isn't a strong edge in the latest consumer surveys related to the broad markets. Stocks tended to do okay after the high confidence that consumers have now, but those returns have been muted relative to other times.