Consumer Staples vs. Consumer Discretionary and the Inflation Factor

One of the never ending "tug of war" battles in the market is that between the consumer staples sector and the consumer discretionary sector. The theory is that in stable times consumers will splurge on "wants" which should pump up discretionary stocks. On the other hand, during more troubled times consumers will focus on "needs" which should be a boost for staples stocks.

One factor that few investors take into consideration when allocating between staples and discretionary is inflation. As it turns out, such analysis may offer an edge. To illustrate this point let's focus on a strategy that looks solely at inflation to decide whether to be in the staples or discretionary sectors.

The Strategy

- We will measure inflation using the 12-month rate-of-change in the Consumer Price Index

- Regardless of when CPI data is reported we will analyze the latest available data only at the end of each month

- We will use the month-end reading to decide what to hold during the following month

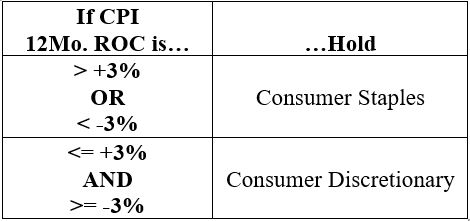

In a nutshell:

- if inflation is relatively high (greater than or equal to +3%) OR relatively low (less than or equal to -3%, i.e., deflation) we will favor consumer staples

- if inflation is within a range of relatively mild readings (greater than -3% to less than +3%) we will favor consumer discretionary

We will use S&P Industry Group data from Bloomberg dating from January 1st, 1927 through December 31st, 2020.

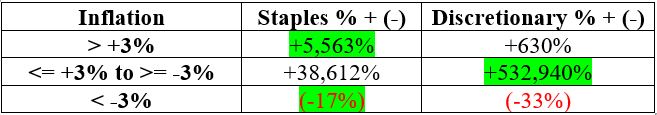

To spell it out:

- When inflation has been greater than +3% staples outperformed discretionary by a factor of roughly 8-to-1

- When inflation has been between +3% and -3% discretionary outperformed staples by a factor of roughly 14-to-1

- When inflation has been less than -3% staples lost half as much as discretionary

Let's take a closer look.

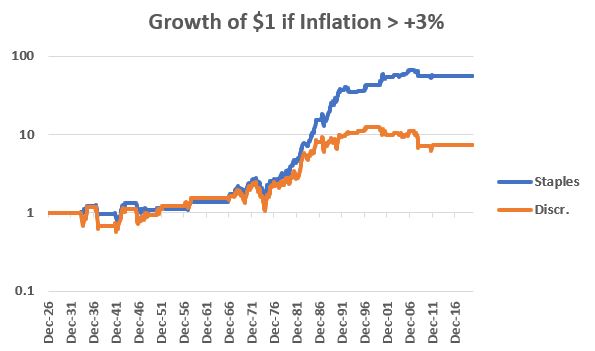

Inflation > +3%

The chart below is a logarithmic chart displaying the growth of $1 invested in staples and discretionary ONLY when inflation was greater than +3%.

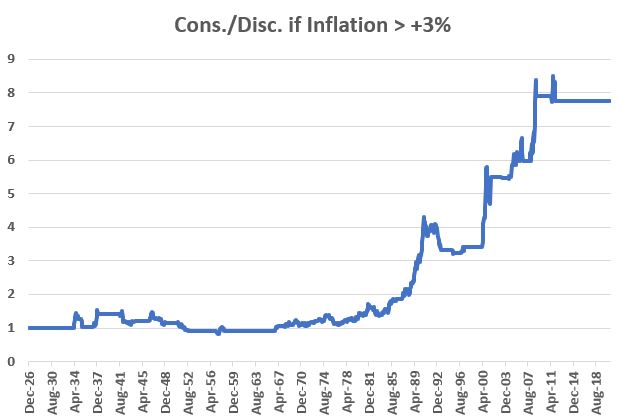

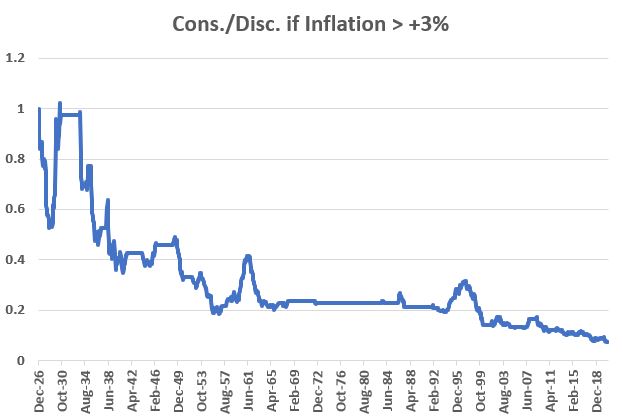

The chart below shows the relative performance of staples versus discretionary ONLY when inflation was greater than 3% (i.e., blue line in previous chart divided by orange line in previous chart).

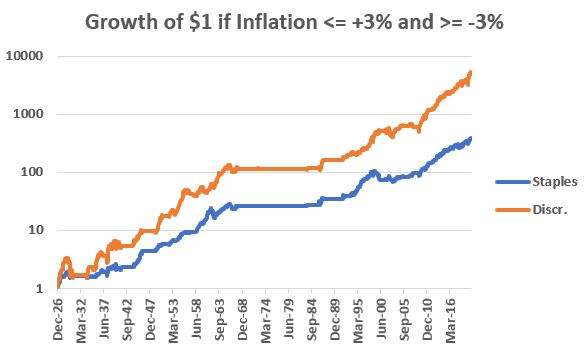

Inflation >= -3% to <= +3%

The chart below is a logarithmic chart displaying the growth of $1 invested in staples and discretionary ONLY when inflation was greater or equal to -3% AND less than or equal to +3%.

The chart below shows the relative performance of staples versus discretionary ONLY when inflation was greater or equal to -3% AND less or equal to +3%. (i.e., blue line in previous chart divided by orange line in previous chart).

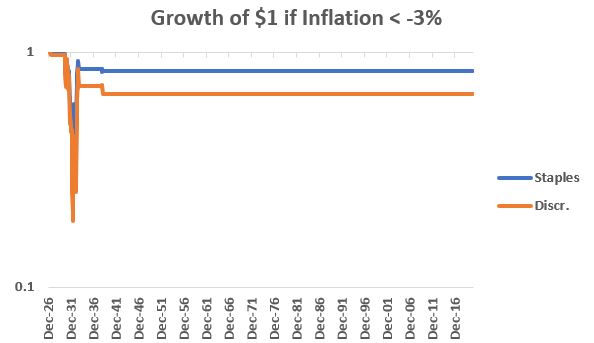

Inflation < -3%

This happened only a few times during the deflation of the 1930's. The chart below is a logarithmic chart displaying the growth of $1 invested in staples and discretionary ONLY when inflation was less than -3%.

Putting it All Together

So now we will employ the following strategy:

- If inflation is > +3% OR < -3% we will hold Consumer Staples

- If inflation is >= -3% AND <= +3% we will hold Consumer Discretionary

As a benchmark we will also compare the strategy above to the following "Split-and-Rebalance" approach:

- At the start of each year 50% of the portfolio is allocated to Consumer Staples and 50% to Consumer Discretionary

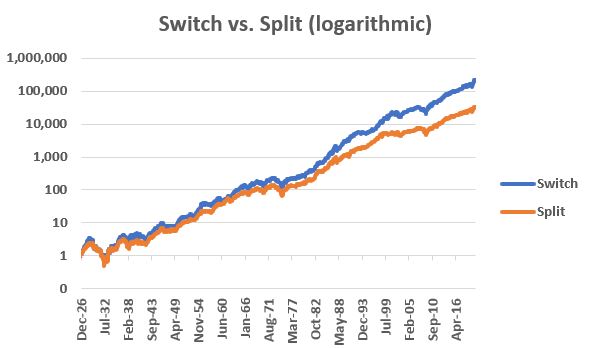

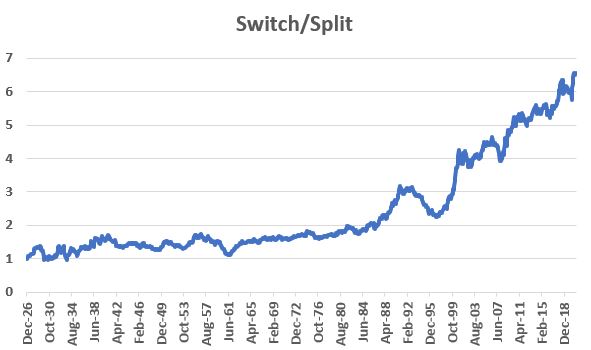

The chart below is a logarithmic chart displaying the growth of $1 using both the "Switch" strategy and the "Split" strategy

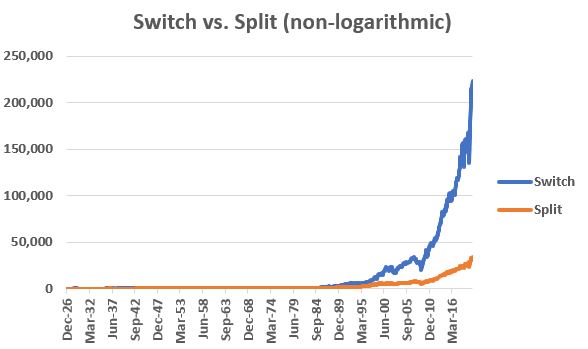

To put it all in a slightly clearer perspective, the chart below shows the same data in non-logarithmic format.

To illustrate the relative consistency of this "inflation dependent only" approach, the chart below divides the cumulative growth for the "Switch" strategy by the cumulative growth for the "Split and Rebalance once a Year" strategy.

Summary

There are many factors that can influence the relationship between consumer staples or consumer discretionary sectors. Still, it appears that factoring inflation into the equation may offer investors an important - and little recognized - potential "edge.".