Consumer Staples Have Been Historically Unstable

This is an abridged version of our Daily Report.

So much for being a Staple

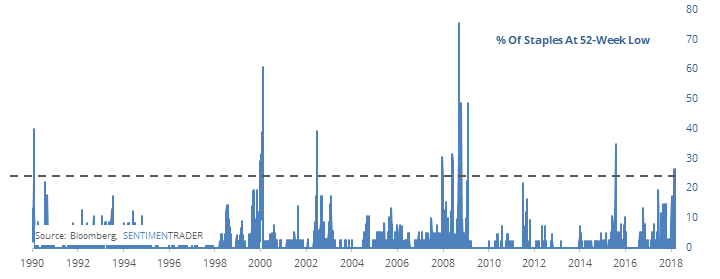

Consumer Staples stocks have taken a big hit over the past couple of days (and weeks). Many of what had been considered safe stocks are down more than 5% in just two days. More than 25% of them are now trading at their lowest level in a year.

Not much of an impact

Even while the Staples sector collapses, the S&P 500 is holding well above its own 52-week low. Going back to 1928, there have only been two other time periods that saw Staples diverge as negatively as they have lately, in 1993 and 1999-00.

Other Staples are holding up

Even while a quarter of Staples stocks are at new lows, more than that are still trading above their 10-, 50-, and 200-day averages. Unlike other times where there were a lot of new lows, this time around we’re also seeing many stocks holding above their moving averages No other date even came close to what we’re seeing now.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Max/Min Screen shows a few contracts where “smart money” hedgers have reached their most extreme position in several years. They added a large number of longs in coffee. Their net long position is now more than 15% of total open interest.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |