Consumer sentiment drop favors Small Caps and Value

Key points:

- A major survey of U.S. consumer confidence showed a shocking decline this month

- Other times it dropped to this low of a level, stocks soared twice, crashed once

- Among sectors and factors, Small-Cap and Value stocks fared best

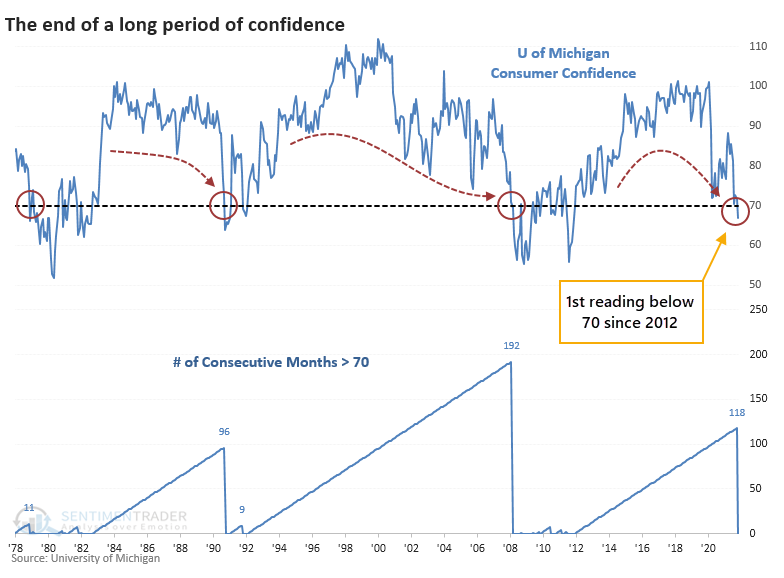

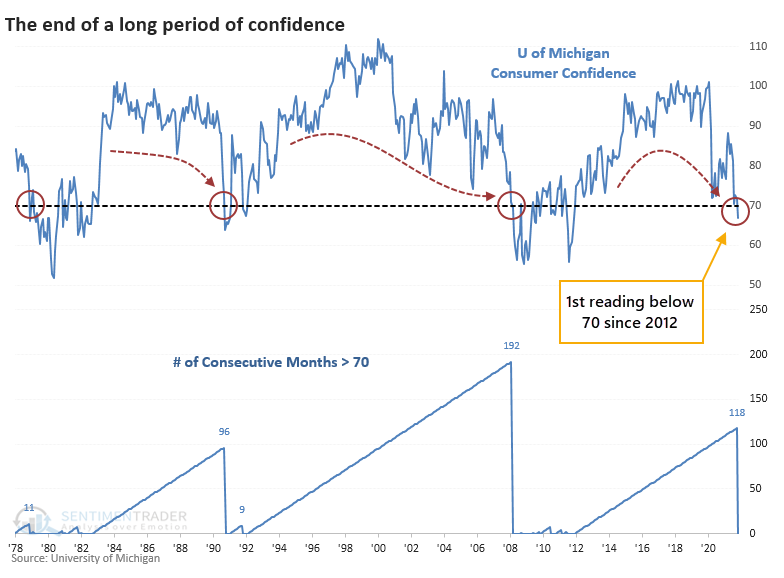

First real pessimism in almost a decade

The latest survey results from the University of Michigan shocked economists.

For the first time since 2012, the overall level of consumer confidence was below 70, well below even the most negative economist on Wall Street. If it holds up, it would be the worst miss versus expectations in 22 years.

This ended the 2nd-longest stretch of readings above 70 since 1978, assuming the figures don't change appreciably when they are finalized at the end of the month.

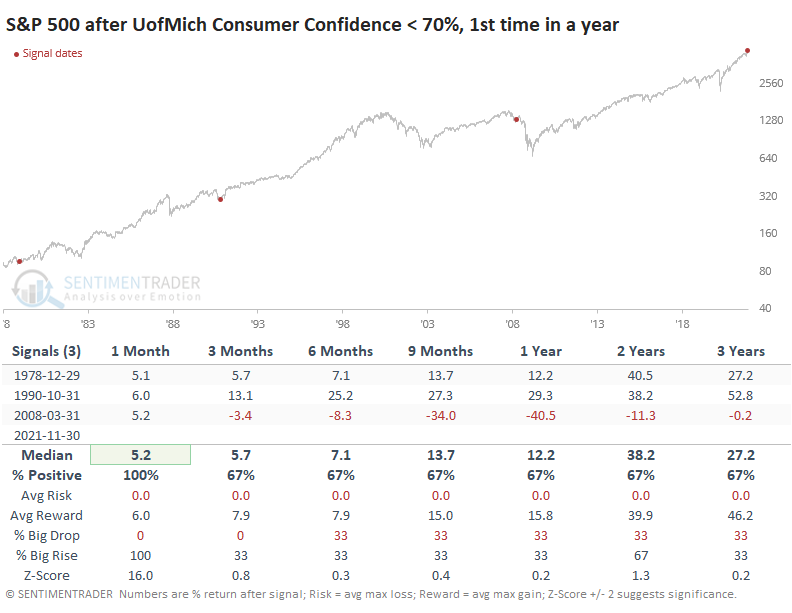

We all know the difficulty of relying on a sample size of 3, so the caveats are huge. It doesn't help that there was no real consensus on future market returns after the other instances, with a couple of big gains and one big loss. The 1978 and 1990 drops in sentiment preceded gains of more than 35% in the S&P 500 over the next couple of years. The 2008 signal was near the beginning of the Global Financial Crisis (GFC) and major losses.

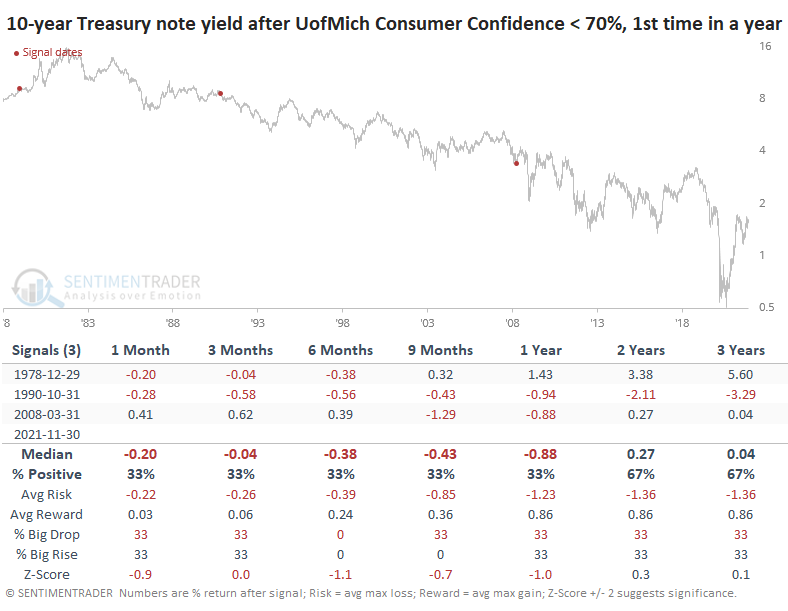

Bonds rose, along with Small-Caps and Value

For Treasury yields, these drops in sentiment were also mixed but at least we could note that yields were negative sometime between 6-12 months later each time, so some consistency there. The returns in the table below are in basis points.

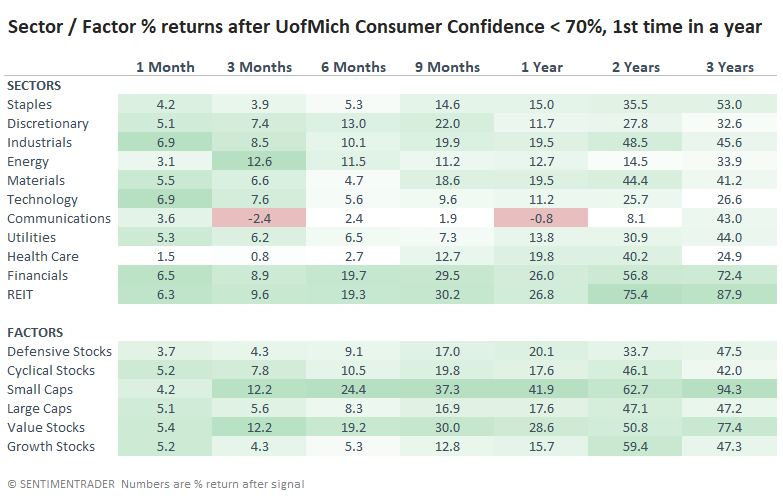

Among sectors and factors, the bear market of 2008 knocked everything for a loop. The strongest returns (darkest green shading) favored Small-Cap and Value stocks across most time frames.

What the research tells us...

There is sometimes a big difference between investors and consumers. We're seeing that now, with extreme optimism among the former and apathy or even pessimism among the latter. Much of this is based on politics and inflationary pressures and less on direct economic prospects. The tiny sample size and inconsistent results make this a tough one to rely on, but it's perhaps a modest point favoring Small-Cap and Value shares.