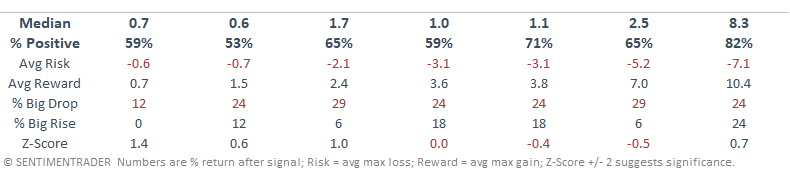

Consumer Discretionary vs. Consumer Staples Relative Ratio

Market participants often reference the consumer discretionary versus consumer staples relative ratio indicator as a relationship that one should monitor to assess the current market outlook. The premise is that when the things that we want are outperforming the things that we need, the market and the economy are in good shape, and when the things that we need are outperforming, the opposite is true.

Unfortunately, when market participants mention the relative ratio indicator in a chart or note, one rarely sees a systematic approach to determine whether the method is valid for assessing the broad market outlook.

Given the deterioration in the relative ratio indicator on an equal and cap-weighted basis of late, let's assess if we can create a valid risk-off signal for the broad market.

The following optimization process was conducted as a short signal on the S&P 500 Index.

COMPONENTS

- S&P 500 equal-weight consumer discretionary sector

- S&P 500 equal-weight consumer staples sector

The equal-weight sectors are utilized in the analysis to avoid any cap-weighted bias and assess a more true relationship between the two groups.

RELATIVE RATIO METHODOLOGY

A range rank calculation was applied to the relative ratio indicator to assess how the current ratio level compared all other values over the previous N days. The range rank methodology allows us to test threshold levels between 0 and 100% for signals in an optimization process.

OPTIMIZATION PROCESS

- Optimized range rank between 63 and 105 days using an increment increase of 21 days. i.e., I assessed a lookback range of 3 to 5 months

- Optimized when the range rank indicator crossed below a threshold level between 20% and 60% using a 1% increment

- Optimized days-in-trade exit

STATIC OPTIMIZATION PARAMETERS

- A reset condition of 90% and 5% were applied to optimization to identify the first cross below the optimized threshold level. i.e., I wanted the relative ratio range indicator to be falling from a high level. The 5% reset condition seeks to avoid signals whereby the range had dropped to a low level and subsequently rose and then had a cross below the threshold level.

- S&P 500 Index must be within 3% of 252-Day High

THE OPTIMIZATION PROCESS RETURNED THE FOLLOWING PARAMETERS

- Range Rank = 105 Days

- Risk-off Threshold Level = 20%

- Days-In-Trade Exit = 30

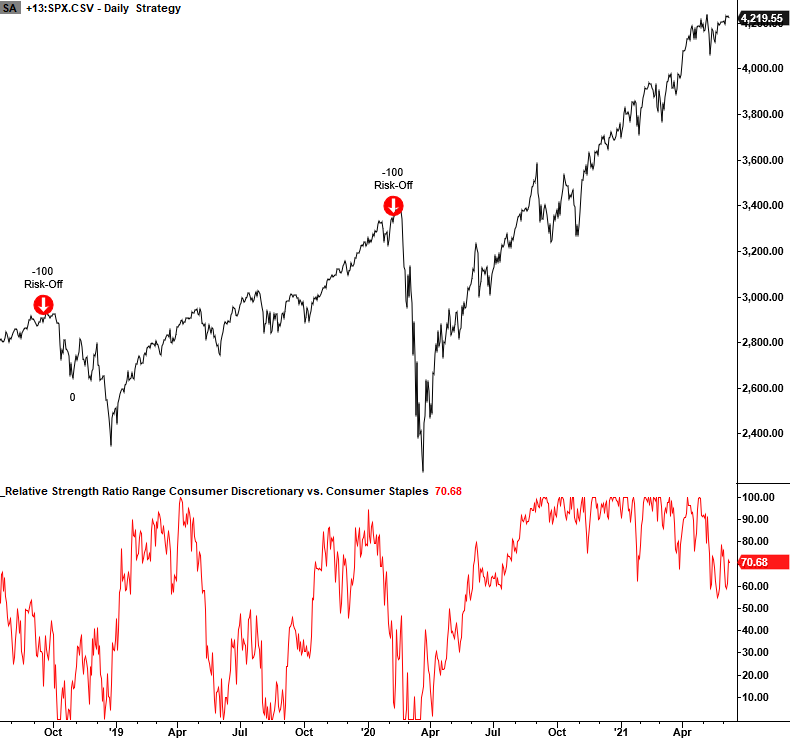

CURRENT DAY CHART

The signals on the current day chart would suggest a valid methodology. Let's review performance for all instances.

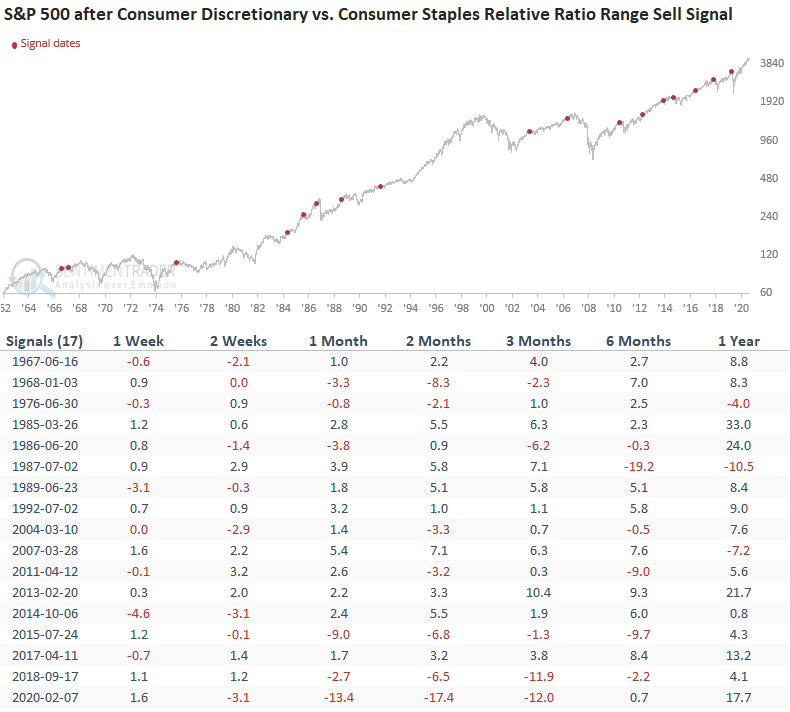

HOW THE SIGNALS PERFORMED

The signal performance suggests that the relative ratio relationship is not a robust methodology for identifying broad market risk-off signals.

Conventional wisdom isn't always what it seems.

Note Edit: The optimization process is based on a short signal, whereas the table below indicates a purchase of the S&P 500.