Consecutive 1% Losses In Back Half Of December

This has been a tough December for stocks. There have been unusually large gap down opens, and now we're on track for back-to-back 1% losses (it's still early, so surely we could reverse before the close).

Assuming stocks don't recover this afternoon, this would be the first time since 2007 that the S&P 500 has lost 1% on back-to-back days in the latter half of December, meaning any time after the 15th of the month. The time before that was in the year 2000.

Going back to 1928, this has only happened at the beginning or in the midst of bear markets. Not sure we can extrapolate anything from that other than what we're seeing is highly unusual for a healthy bull market.

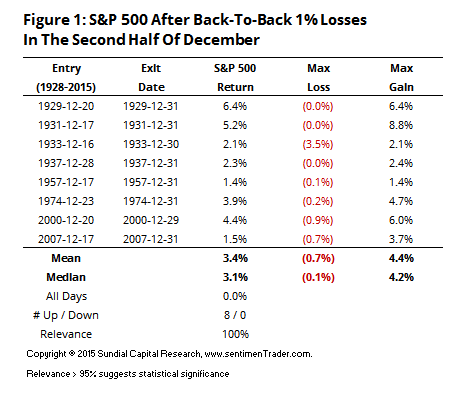

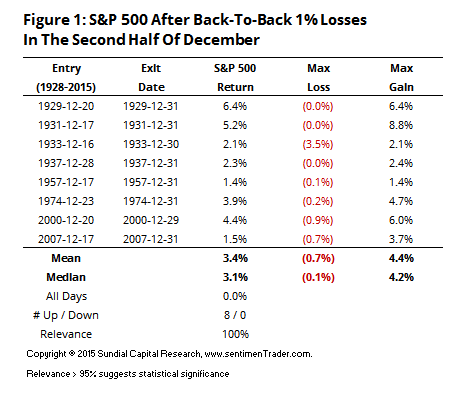

Regardless, even during those horrid market environments, positive seasonality took hold. Buying the S&P after the 2nd down day and holding until the last day of the year (or even the first day of the New Year) resulted in a winning trade every time, with a heavily positive risk-to-reward ratio (Figure 1).

The max loss column shows the most that the S&P lost during the hold time, using closing prices prior to 1962 and intraday after.