Confidence returns to pre-crisis levels

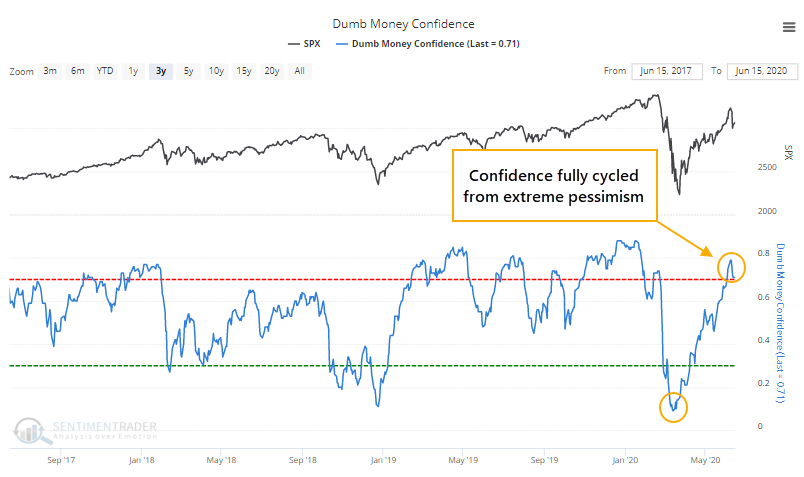

Along with prices, confidence has stormed back from the depths of pessimism, especially among those who have a tendency to be most bearish near price lows and most bullish near price highs. From a record low reading in March, sentiment has cycled well into extreme optimism, where it has since settled a bit.

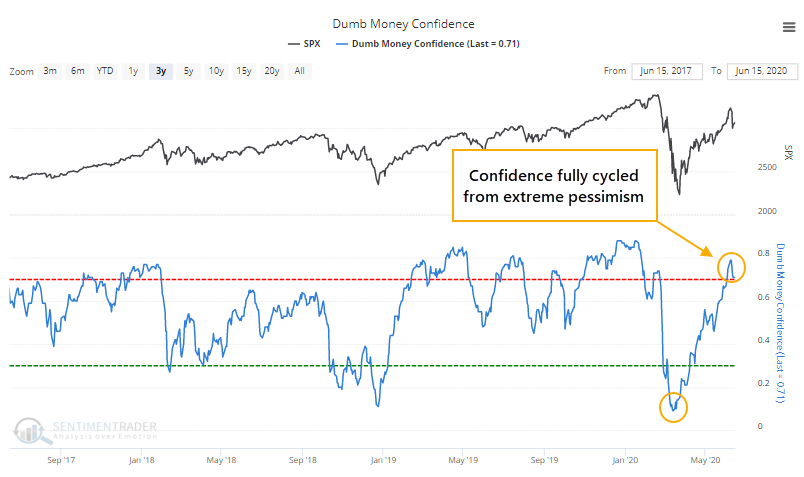

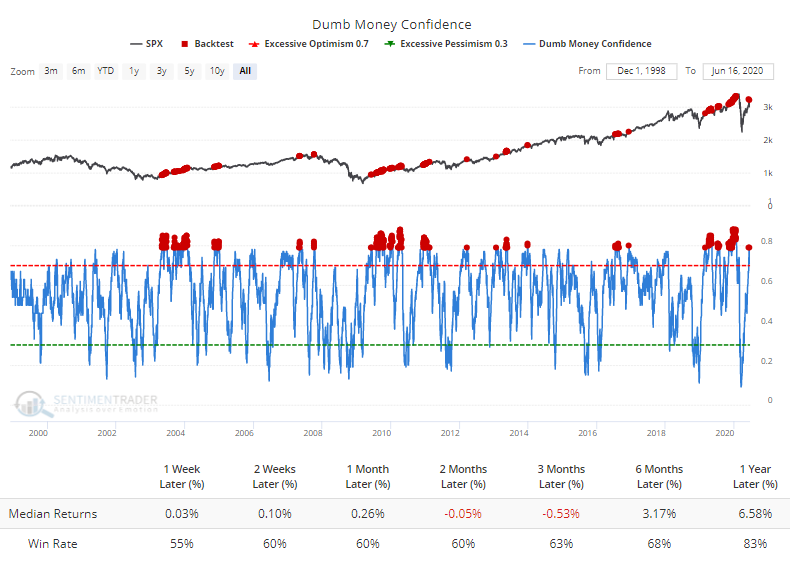

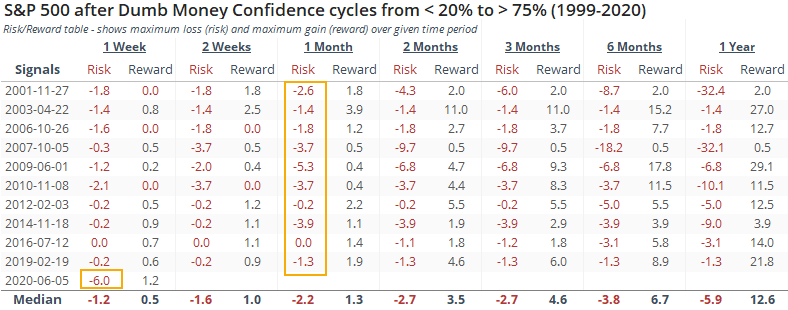

When Dumb Money Confidence has been 79% or above since 1999, the S&P 500's returns in the months ahead have tended to be subdued. Even though median returns were negative over the next 2-3 months, the S&P was still positive most of the time, thanks mostly to the initial readings following the 2002 and 2008 bear markets.

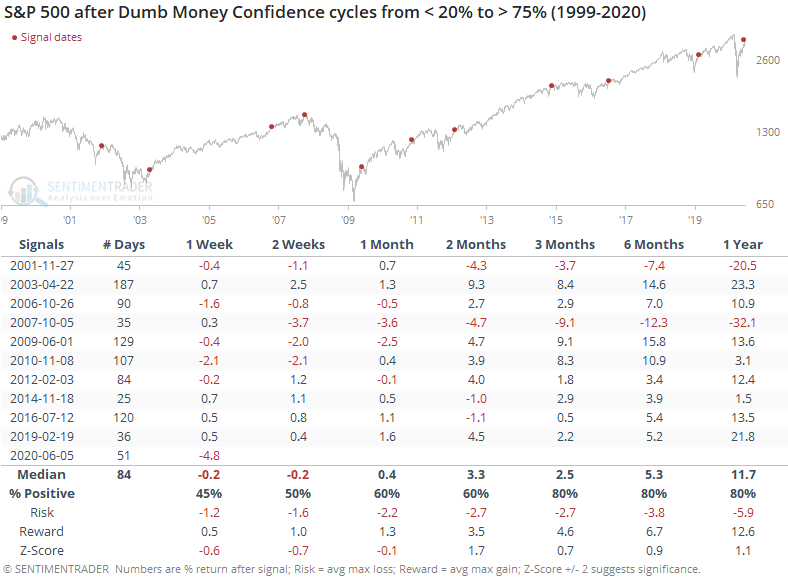

When Confidence goes from deep pessimism to high optimism, negative returns had a stronger tendency to be focused on the shorter-term. On average, it took 84 trading days for Confidence to go from below 20% to above 75%. This time, it took only 51 sessions.

That was evident this time, with a 6% drawdown in the week after Dumb Money Confidence first surged above 75%. That's larger than every other signal's drawdown even up to a month later.

It's hard to know whether this is a good thing (the selling pressure has already been alleviated) or a bad thing (this signal is different from all the others). In a very general sense, when we see behavior like this, it's usually the former as opposed to the latter.

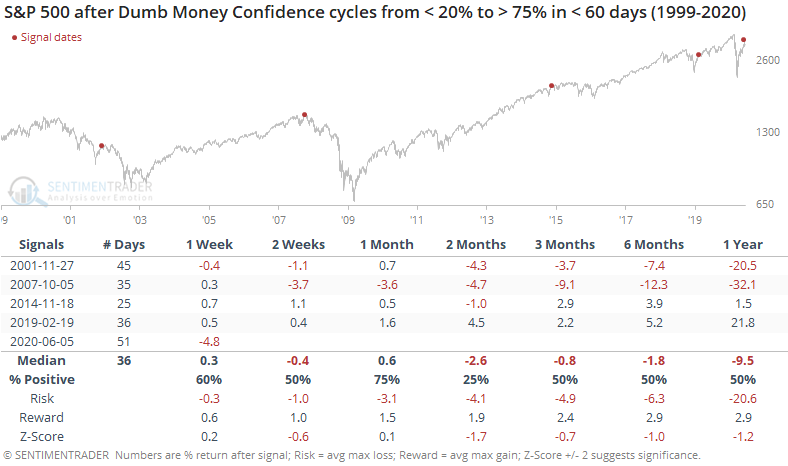

One concern is just how fast Confidence returned. There have been only a handful of times when it made a round trip from pessimism to optimism within three months.

After these, prices ultimately gave back any further gains. It happened immediately after signals in 2001 and 2007, but took a long while after the ones in 2014 and 2019.

The most compelling aspects about stocks since late March, and which have continued recently, are the breadth thrusts and recoveries have an almost unblemished record at preceding higher prices over a 6-12 month time frame. Shorter-term, there have been an increasing number of warning signs, and we'd rate the return of Dumb Money Confidence among them.