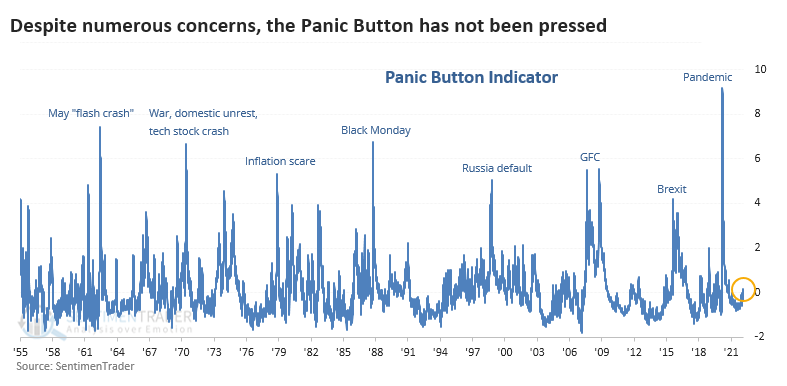

Concerns aplenty, but investors haven't pushed the Panic Button

Despite concerns, investors aren't panicking

If ever there was a time for investors to panic, now is about as good a time as any. After all, we're dealing with:

- The harshest geopolitical climate in decades

- The potential end to a decade-long boom

- Rapidly rising interest rates with an unfriendly Fed

- Recent record valuations

- The pricking of a speculative bubble

- 40-year high in inflation

- Domestic unrest

- Record-low confidence in politicians and media

The one-two combination of skyrocketing inflation and a potential multi-country war should have been the last straw. Curiously, however, investors haven't panicked.

Sure, some readings show pessimism. But the Panic Button has not been pressed.

The Panic Button incorporates volatility, interest rates, liquidity, bond spreads, and default protection costs to highlight those periods of outright terror when markets tank. When there is a crisis that spreads across markets and geographies, these measures tend to rise in tandem.

We discussed the Panic Button after it was triggered in January 2016 and March 2020, but it has been curiously flaccid lately. It's still sitting at zero.

Typically, we look to fade extremes. When investors panic in both directions, markets have a high probability of going the other direction. So, when we've looked at the Panic Button in the past, it was related to a high reading.

We took a look at times when the S&P 500 fell into a correction but investors weren't panicking to see if that was a good sign...or not.

| Stat box The Optimism Index for the XME metals & mining fund rose above 95% on Wednesday. Per our Backtest Engine, it has been above 95% on 37 other days since the fund's inception, leading to further gains over the next week 10 times. |

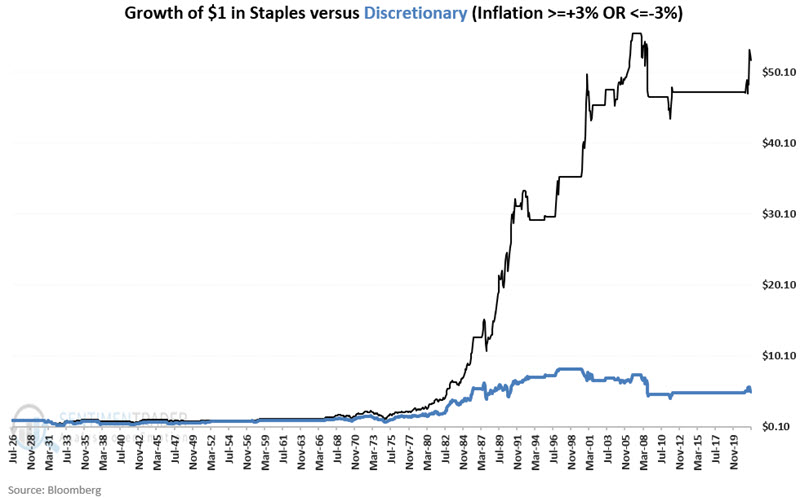

Using inflation to switch between Consumer Staples and Discretionary stocks

Being in the right sector at the right time is one of the lesser appreciated keys to above-average performance. The level of price inflation impacts purchasing power and thus affects different sectors differently.

Jay showed that one factor that few investors consider when allocating between staples and discretionary is inflation. He created a strategy based on the idea that when inflation is relatively high OR relatively low we will favor consumer staples. Within a range of relatively mild readings, we will prefer consumer discretionary.

The chart below displays the growth of $1 invested in staples and discretionary sectors ONLY when inflation is above 3% or below -3%.

In a macro sense, the consumer discretionary sector represents "wants," and the consumer staples sector represents "needs." Because inflation impacts purchasing power, it affects people's buying decisions. When inflation is moderate, individuals are generally more comfortable spending their money on "wants." However, when inflation is abnormally high or low, individuals tend to focus primarily on spending their money on "needs."