Companies and Wall Street are raising outlooks

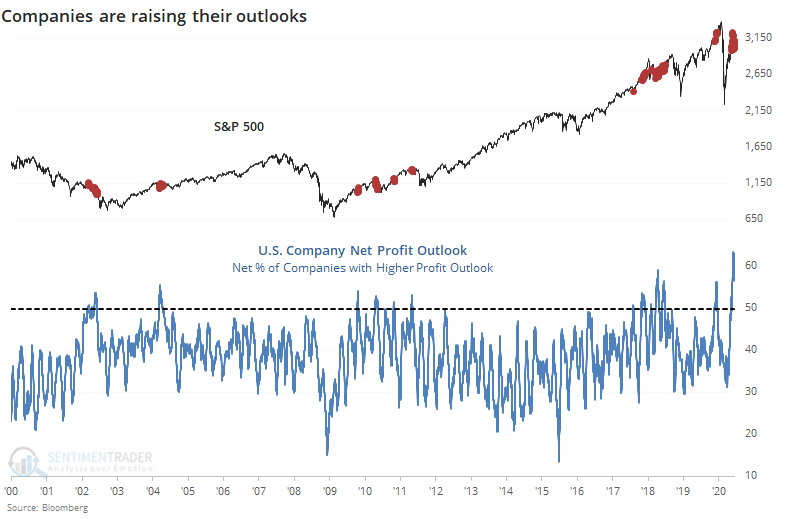

Companies are raising their outlooks.

After the uncertainty of the pandemic earlier this year, the past month+ has seen businesses gingerly re-open, with a little bit more optimism among executives. As a result, a greater percentage of them are thinking that profits will be higher than expected.

As noted by Bloomberg:

"Up, Down, and Neutral ratings are based on a comparison between the company forecast and the consensus analyst estimate. The Profit Outlook Net Index is calculated as the percentage of companies reporting higher profit outlooks and adding one-half of the percentage of companies reporting unchanged profit outlooks, relative to the consensus analyst estimates. A reading above 50 is positive, below 50 is negative, while 50 indicates no change."

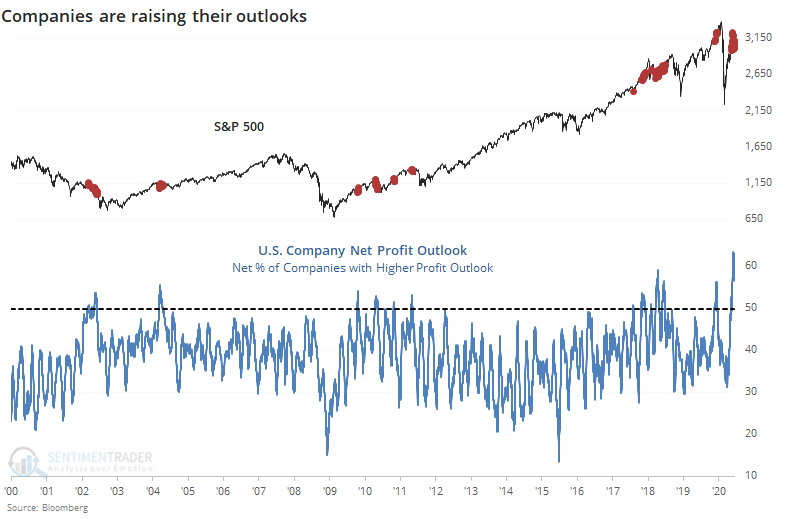

Based on these definitions, companies haven't raised their outlooks to this degree in more than 20 years.

This should be a good sign for future returns but logic isn't always a good guide in markets. By the time companies became this enthused about their future profits, investors had already anticipated much of the gain.

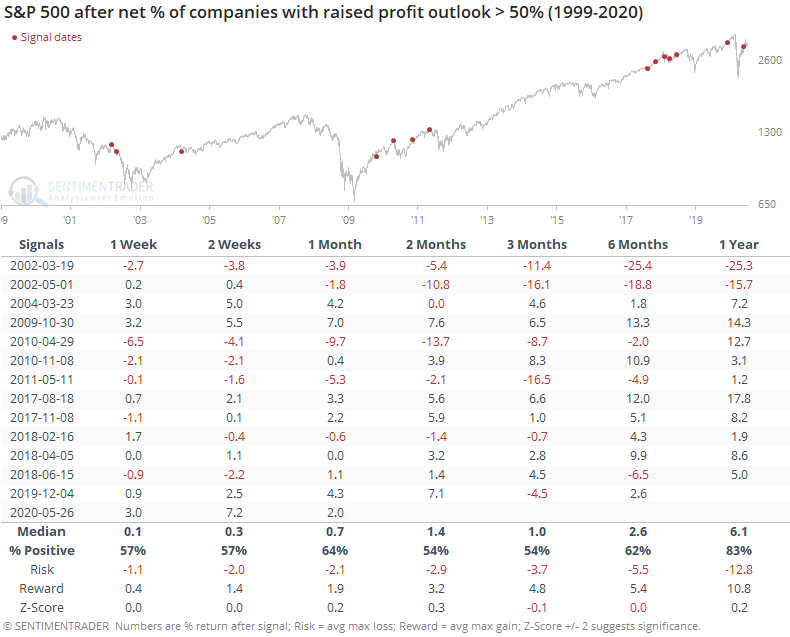

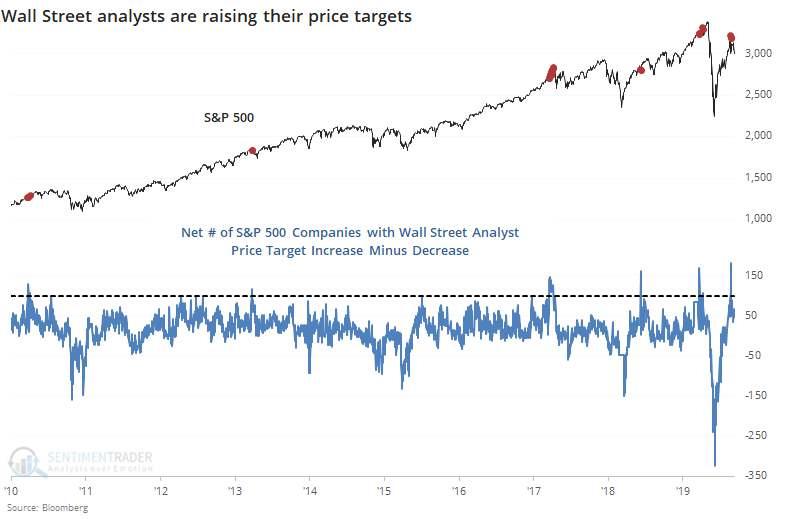

At the same time, even though Wall Street strategists are apprehensive, analysts have been busy upgrading price targets on the stocks in their coverage universe.

If we think about investors' risk being like an iceberg, then strategists would be warning about risks from above while analysts would be looking under the surface.

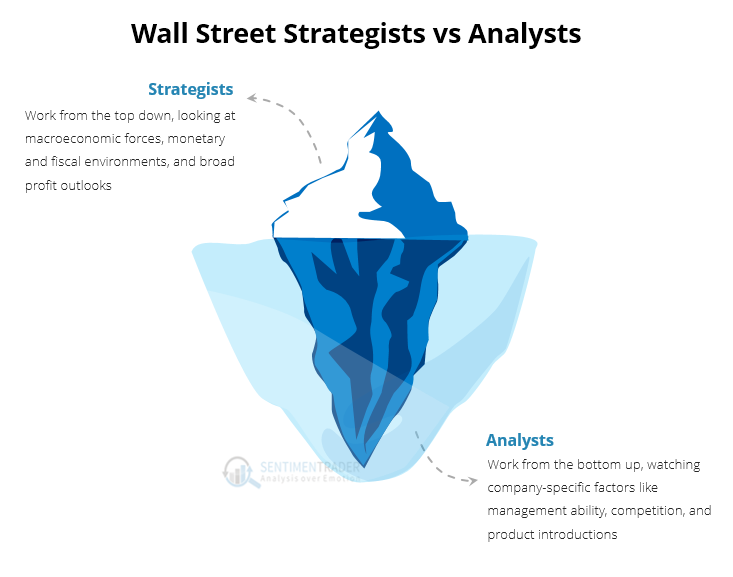

Below, we can see the net number of stocks within the S&P 500 that enjoyed a price target increase minus decrease. These technical upgrades were at a record high on June 10 and have settled down somewhat since then, but still high. This has tended to be a short- to medium-term contrary indicator.

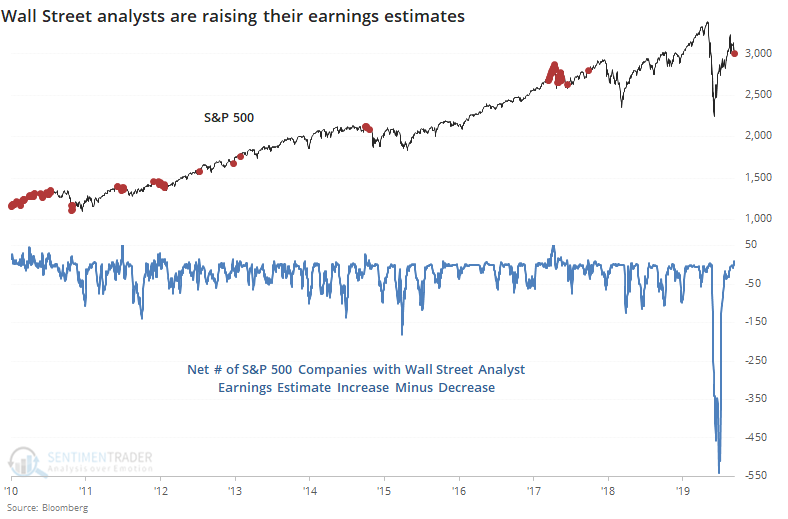

Analysts have been upgrading earnings estimates on the stocks they cover, too, so they're becoming a bit more optimistic about company fundamentals.

This has been less of a contrary indicator than when analysts are just raising price targets. Like we saw in the January 14 report, when analysts are upgrading technicals but not fundamentals, it's a big worry. That's not so much the case now.

Overall, the rise in optimism from both companies and Wall Street seems like it should be a good sign, but the evidence is mixed. When optimism gets to a very high level, it has tended to be more of a contrary than confirming indicator. Because of that, we'd consider the current bout of positivity to be a slight negative, but it's not enough to consider it a sell signal.