Companies, and bankers, satisfy an eager market

Among the most opportunistic groups on Wall Street are investment bankers. If they see an appetite for something, they will work tirelessly to fulfill it. They've been busy over the past year, and there's no letup so far.

As the Wall Street Journal notes:

"There's a tremendous appetite for equity, both U.S. and now increasingly international," said Jerry Braakman, chief investment officer at First American Trust. "When you have such investor demand for equities and continued cash flow into the market, it's a great time to issue—initial offerings as well as obviously secondary and follow-up offerings."

We noted the rise in IPOs, and their performance, in December. We've neared or exceeded the prior bubble peak in most metrics that count. As the Journal notes, it's not just IPOs, but additional offerings like secondaries that are enjoying open arms among investors.

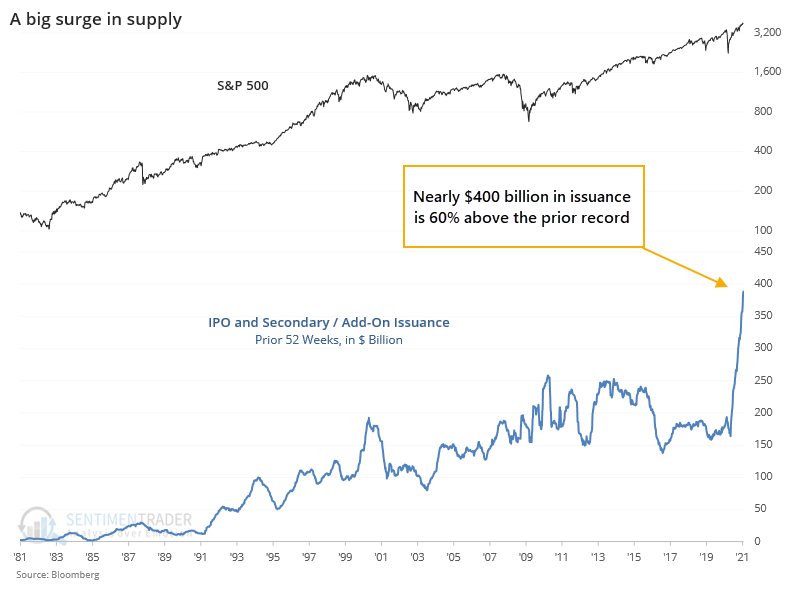

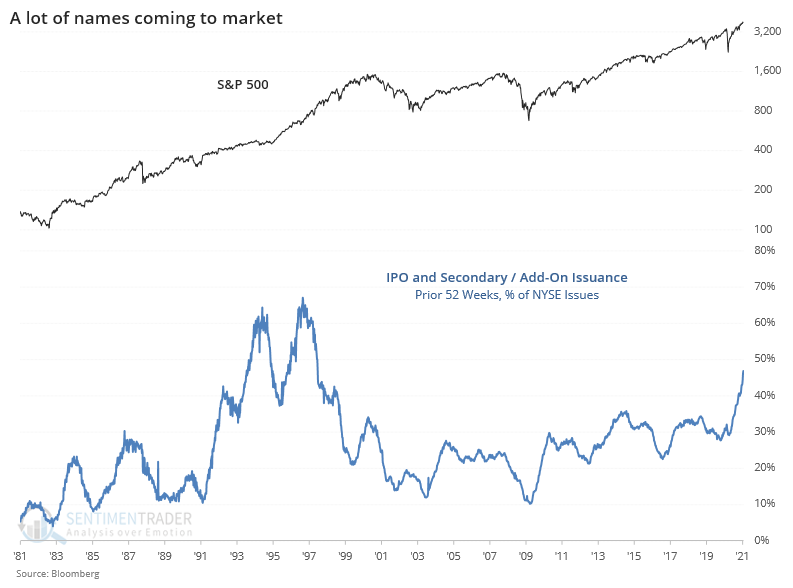

Over the past year, there has been nearly $400 billion in issuance according to Bloomberg data.

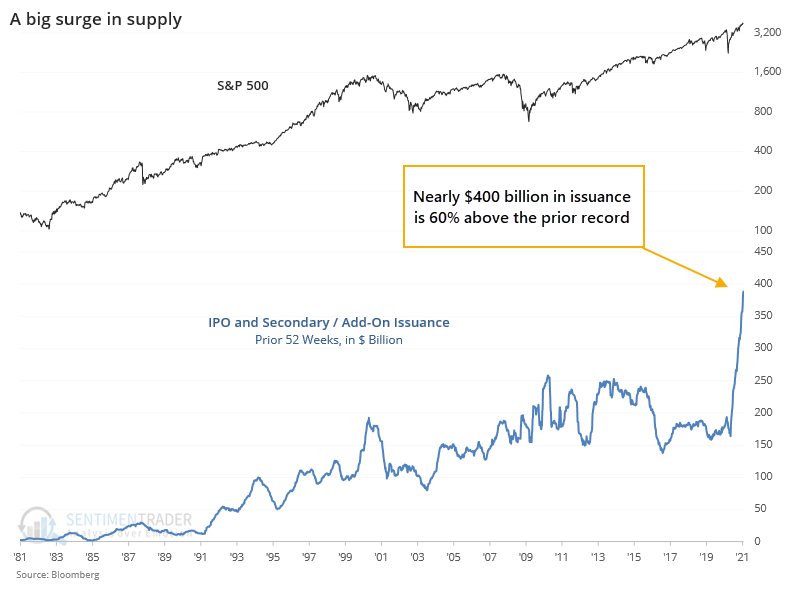

Markets have grown - a lot - so as a percentage of the total market capitalization of U.S. stocks, this issuance is not nearly as extreme.

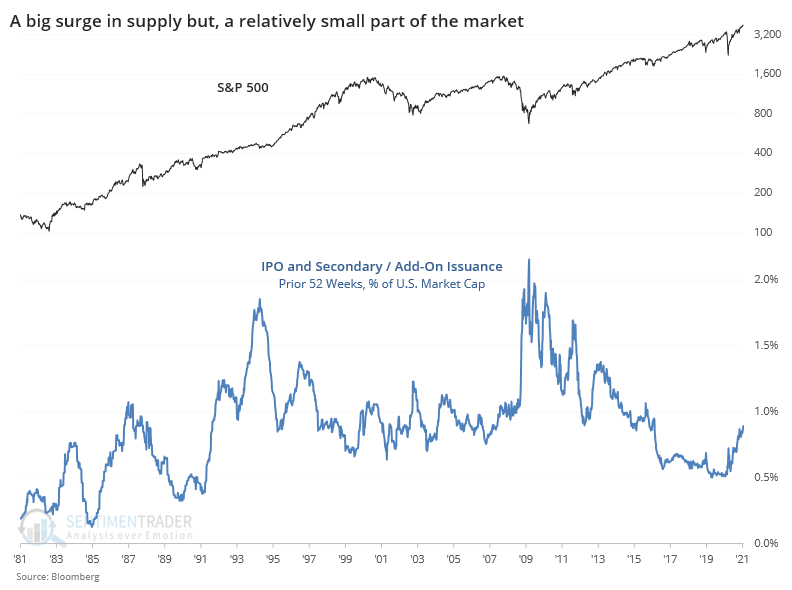

It hasn't just been a few mega stocks issuing shares that caused the rise in issuance; the number of issues has also skyrocketed.

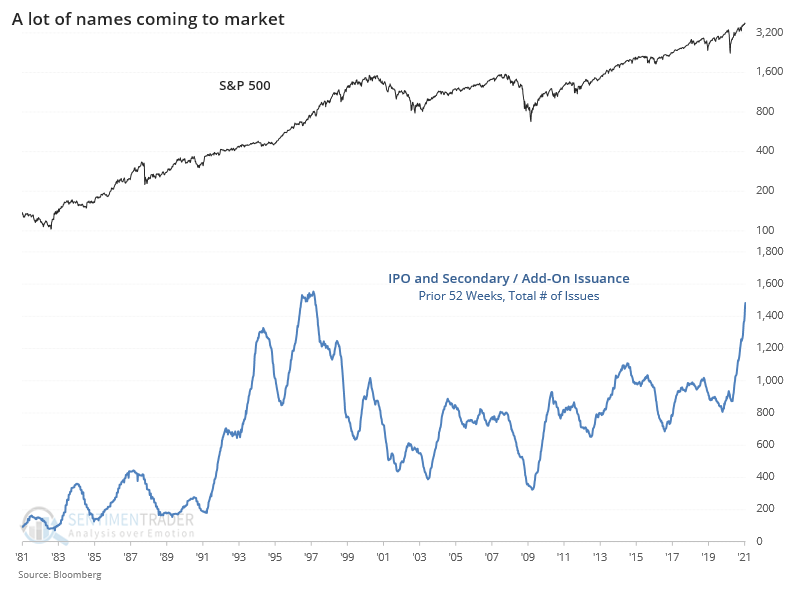

As a percentage of total issues, it's less extreme but still up there.

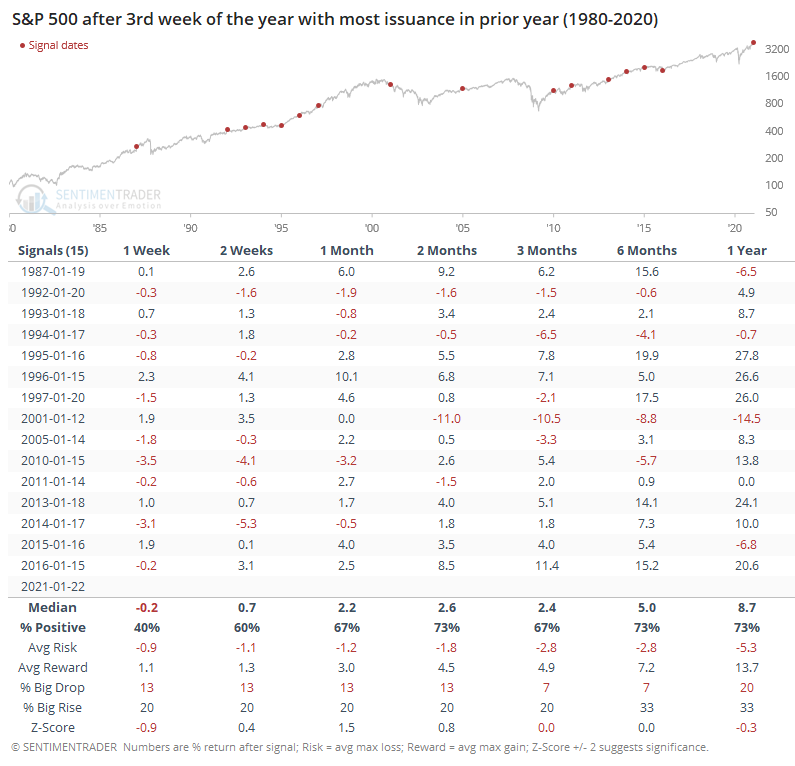

Looking at comparable times of the year with the most combined issuance (dollars and number of issues), forward returns were about in line with random. The jump in supply didn't seem to be a major limiting factor. The S&P 500 didn't go gangbusters to the upside in the months following most of these signals, but neither did it tend to collapse from the overhang of supply.

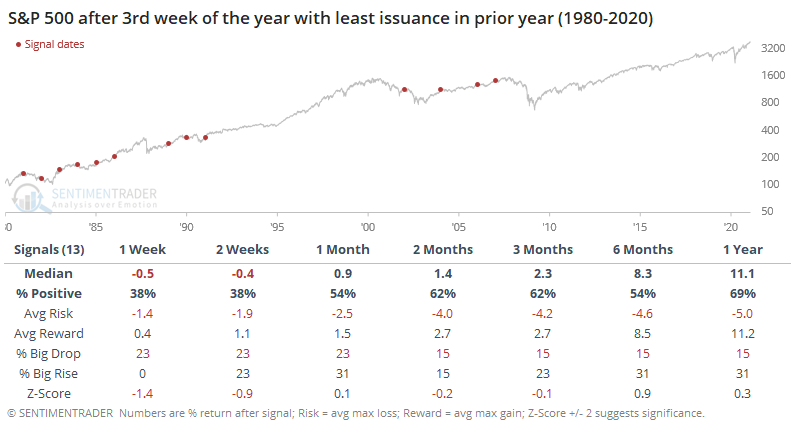

Following years with the lowest issuance, returns were worse shorter-term but a bit better longer-term, if less consistent.

There are a whole host of things we should be worried about right now, including record valuations and poor seasonality coupled with a historic bout of speculation. In recent days, there have also been a few cracks in what had been the steel-plated armor of this market - broad-based and thrusty participation among stocks and high-yield bonds. We're not yet seeing consistent sell signals in those metrics, but if we continue to see signs of deterioration, it will be time to become fully defensive. We just shouldn't use the jump in issuance as a potential crutch for sell orders.