Commodity Traders Need to Watch This Market Closely

The corn market has been one of the top-performing commodities markets so far in 2021.

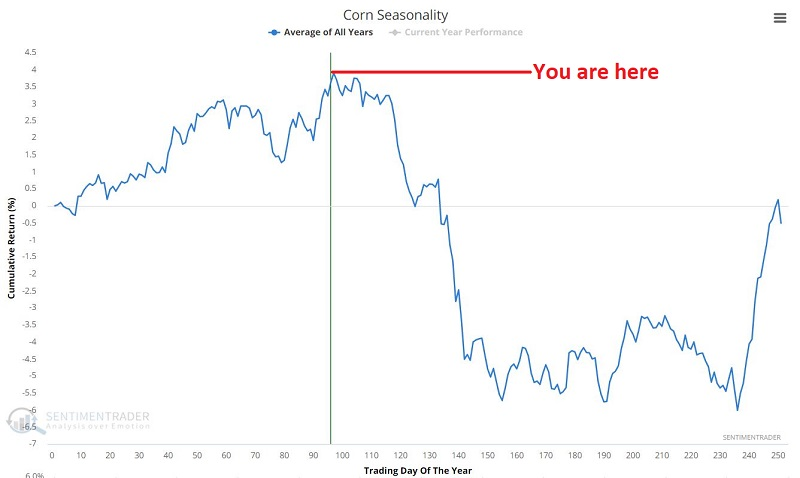

Will this rip-roaring bull market continue? It is certainly possible. Still, history suggests that the next several months could offer some strong seasonal headwinds. To wit, the chart below displays the annual seasonality trend for corn. We are about to enter a seasonally unfavorable period that typically lasts into mid-August.

It is important to remember that seasonality charts display previous tendencies and DO NOT serve as a roadmap.

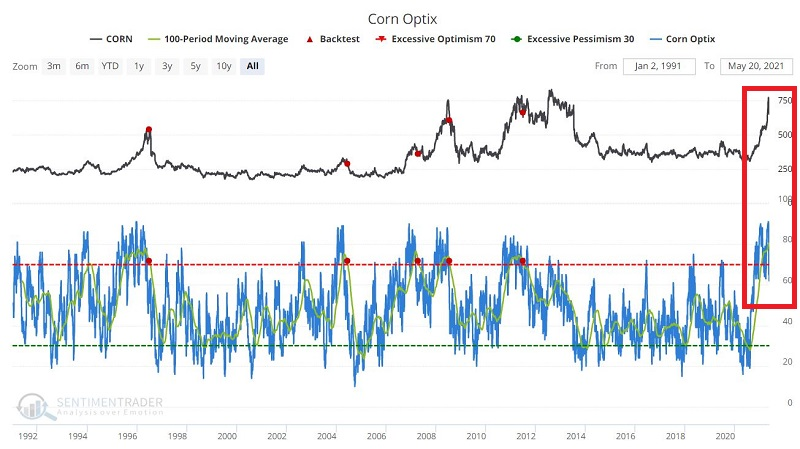

At the same time, optimism is through the roof and starting to slide back. The chart below displays those rare occasions when the 100-day average of our Corn Optimism Index dropped from above to below 72%.

None of the information above guarantees weakness for corn in the months immediately ahead. There are never any sure things, only potential opportunities.

The real point is that traders who wish to play:

- The long side of the corn market need to pay careful attention to risk in the months ahead

- The short side of the corn market need to decide what will trigger them to enter a short position and how much risk they are willing to assume

| Stat Box On Thursday, the Citi Economic Surprise Index turned negative. That's the first time in 248 sessions, ending the longest streak of positive surprises in 20 years. After the ends of other long positive streaks, gold was the market that struggled the most. |

What else we're looking at

- Full details on forward returns after high and ebbing optimism on corn

- A mean-reversion tendency based on a volatility spike for stocks in Taiwan

- What happens after small speculators hold a massive amount of equity index futures

- "Smart money" hedgers have established large positions in the Canadian dollar