Commodity at the Crossroads - The Cotton Edition

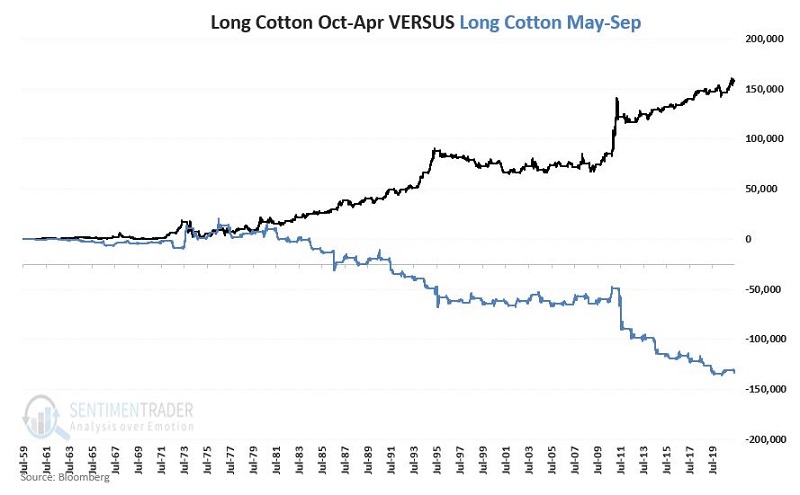

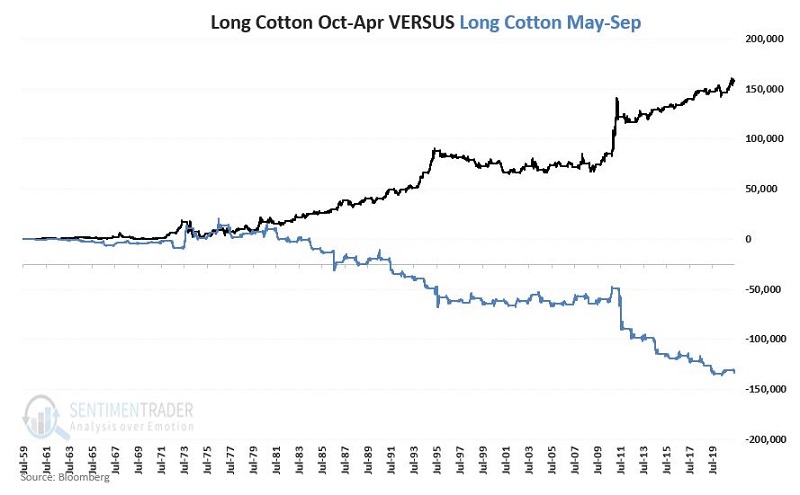

Few markets are as cyclical as the cotton market. To wit, in the chart below:

- The black line displays the hypothetical $ + (-) achieved by holding long a cotton futures contract ONLY during October through April

- The blue line displays the hypothetical $ + (-) achieved by holding long a cotton futures contract ONLY during May through September

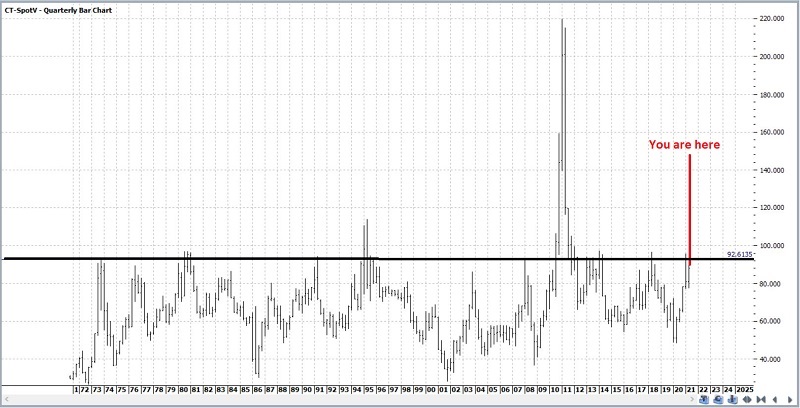

WARNING SIGN #1: RESISTANCE

The chart below (courtesy of ProfitSource by HUBB) shows that the 92 to 97 range has long been a tough level for cotton to cross above. It did so briefly in 1994 and 1995 and again (in a huge, blowoff kind of way) in 2010 and 2011.

Is another 2010-2011 type explosion possible? Of course. Is it likely? History suggests not.

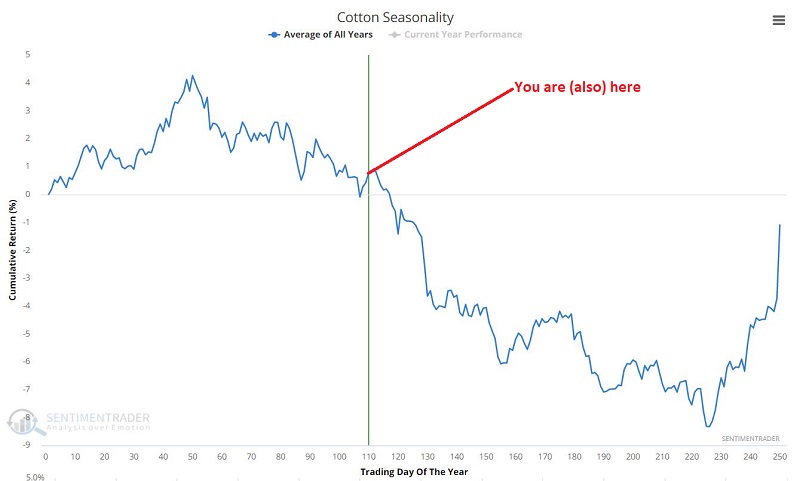

WARNING SIGN #2: SEASONALITY

As alluded to above, the May-Sep time of year is the period most likely to witness weakness in cotton. The seasonality chart below tells the tale pretty clearly.

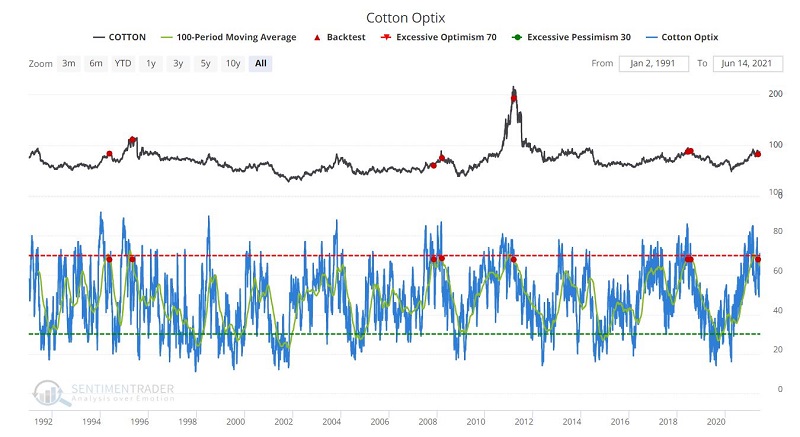

WARNING SIGN #3: SENTIMENT

In mid-May, the 100-day moving average for cotton Optix dropped below 68. Since 1994 there have been only 7 previous occasions when the 100-day moving average of the Optimism Index on cotton dropped from above to below 68. Those signals are displayed in the chart below.

As you can see in the table below, the average and median returns across all time frames have been negative, and the Win Rate well below 50% for every period except 1-month.

TRADING

The most straightforward approach to trading cotton is via the futures market. The December 2021 contract is currently the most active.

There is ticker BAL (iPath Series B Bloomberg Cotton Subindex Total Return ETN) in the ETF market, which tracks the price movement of cotton futures contracts. Volume on ticker BAL is presently very light, and selling short shares may be difficult. There are options on BAL. However, they are presently extremely illiquid and have prohibitively wide bid/ask spreads.

For non-futures traders, the best avenue might be buying a put option on ticker DBA (Invesco DB Agriculture Fund). As you can see in the table below, DBA has the highest correlation to cotton futures among ETFs.

As this is written, the Oct2021 DBA 19 strike price put is trading at $1.00 bid/$1.20 ask.

As always, this should not be considered a recommendation. Instead, we are merely pointing out a potential low-dollar risk way to play a market that could be on the verge of trouble.

SUMMARY

On a trend-following basis, Cotton remains in an uptrend. As you can see in the chart below (courtesy of www.BarChart.com), cotton is still trading above its 50-day average. However, it recently hit resistance and is threatening to reverse to the downside.

The warning signs above suggest that any drop below the 50-day average could be a sign of potential trouble and that traders should pay close attention.