Commodities reverse lower on recession fears

Key points:

- The Bloomberg Spot Commodity Index registered a new 63-day low on 6/21/22

- The new low occurred in 25 trading sessions or fewer from a 252-day high

- After similar signals, commodities struggled in the next few months

What's the market message from the reversal in commodities

I've had a bullish outlook on commodities since the fall of 2021, when I wrote a note titled Did We Just Start a New Secular Commodity Bull Market. Since the publish date, the Bloomberg Spot Commodity Index is up 17.3%. At the same time, the S&P 500 is down 13.5%. As an investor, it's always important to remain flexible and keep an open mind to all outcomes as new data emerges.

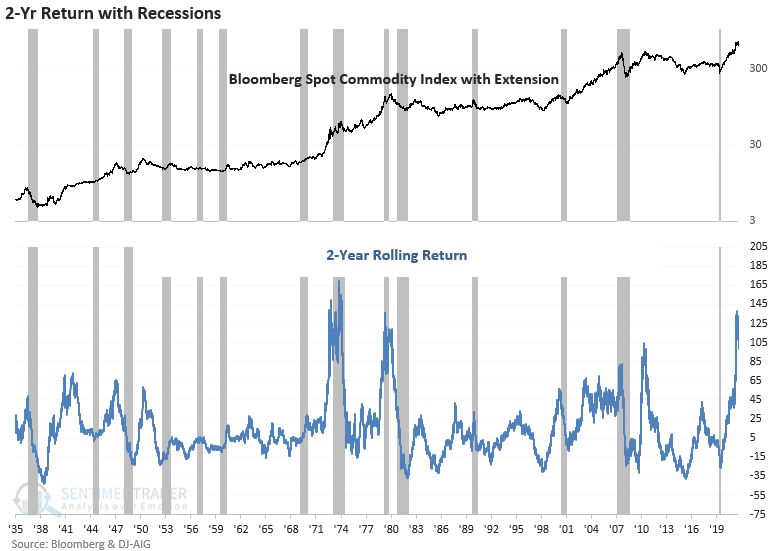

So, with commodities crumbling on recession fears, let's assess the outlook for the Bloomberg Spot Commodity index when the index reverses from a 252-day high to a 63-day low in 25 trading sessions or fewer. I used closing prices for the study.

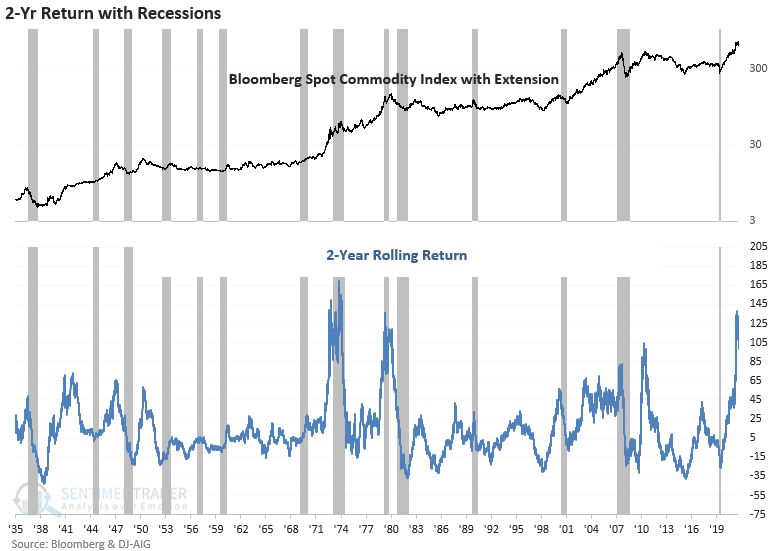

Commodity momentum since the pandemic low has been historic, registering the 2nd highest 2-year rolling return in history. The two previous momentum surges preceded or coincided with recessions in 1973-75 and 1980. While the sample size is small, potential recession fears are not unfounded. Interestingly, commodities suffered several sharp setbacks in the 1973-75 recession while maintaining a bullish secular trend.

Similar signals preceded negative returns for commodities

This study generated a signal 17 other times over the past 88 years. After the others, commodity returns, win rates, and z-scores look unfavorable across short and medium-term time frames. The 1-4 week window shows a loss at some point in 14 out of 17 cases.

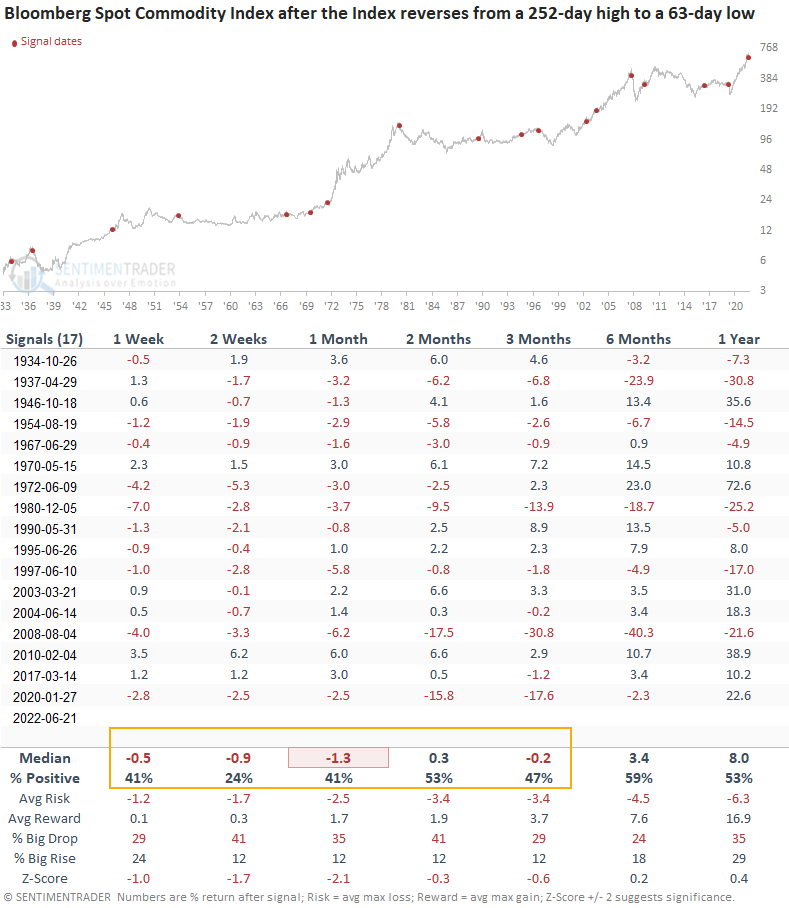

What happens to copper after commodity reversal signals

Given the reversal in copper that I shared in a note on Wednesday, let's apply the commodity signal dates to copper to see if the momentum shift impacts the economically sensitive metal. As with the commodity index, copper returns and win rates look unfavorable across short and medium-term time frames.

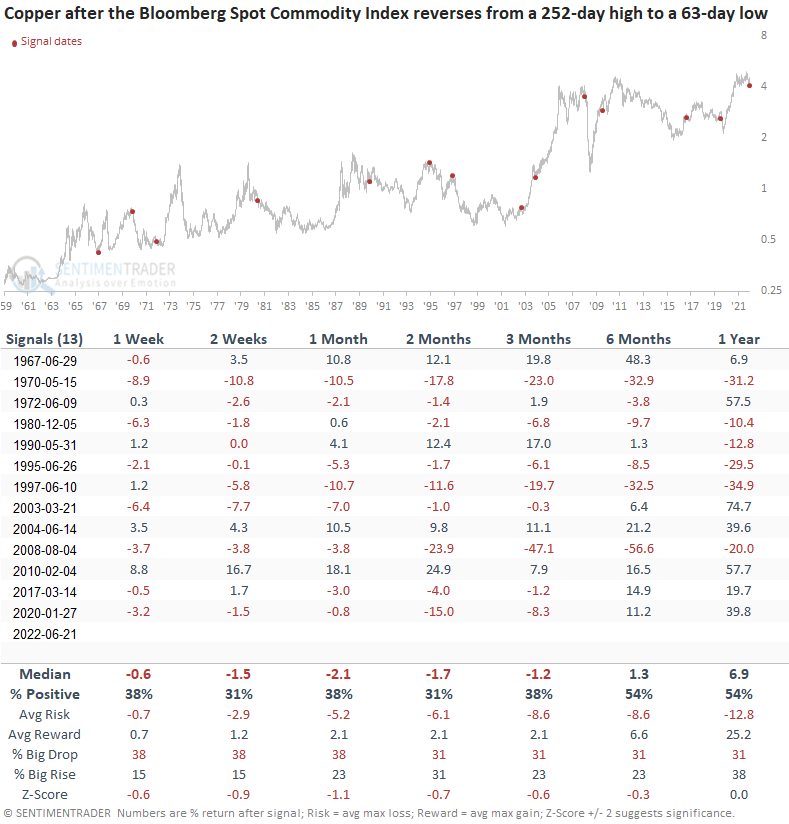

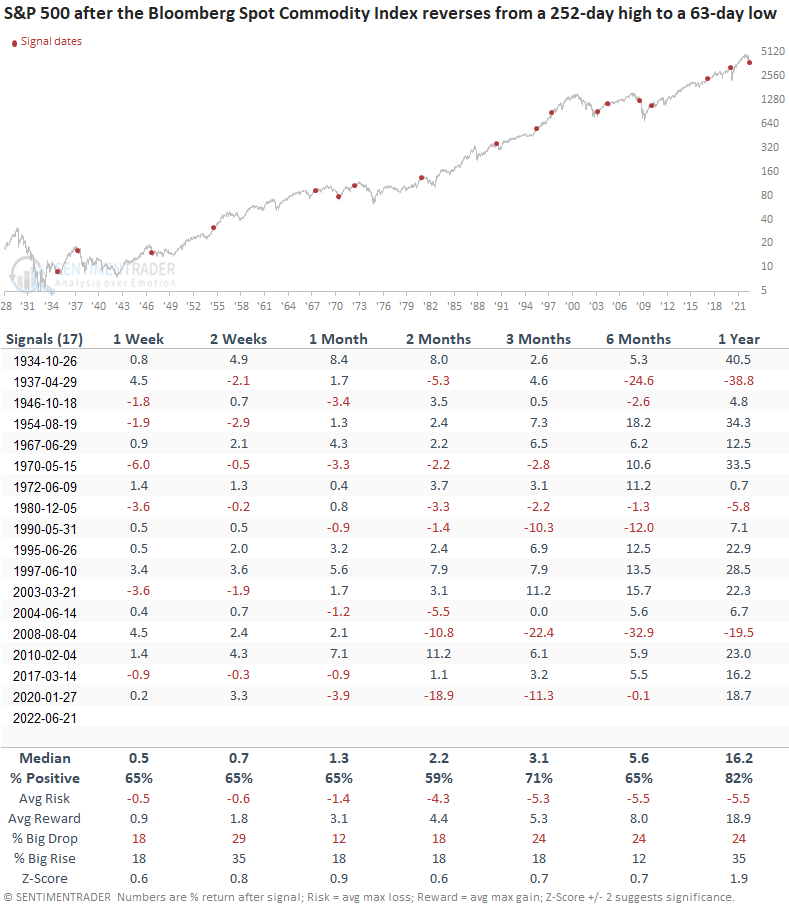

What happens to stocks after commodity reversal signals

Stocks show a positive return across all time frames, with the 1-year window looking solid except for the recessionary bear markets in 1937, 1980, and 2008.

What the research tells us...

When the Bloomberg Spot Commodity Index reverses from a 252-day high to a 63-day low in 25 trading sessions or fewer, the shift in momentum typically leads to more adverse price action for commodities. Similar setups to what we're seeing now have preceded unfriendly commodity returns, win rates and z-scores across short and medium-term time frames. When I apply the signals to copper, forward returns look unfavorable in the next few months. An assessment of stocks looks constructive, especially on a 1-year time frame, as long as we avoid a recession.