Commodities haven't done this since November 2007

Key points:

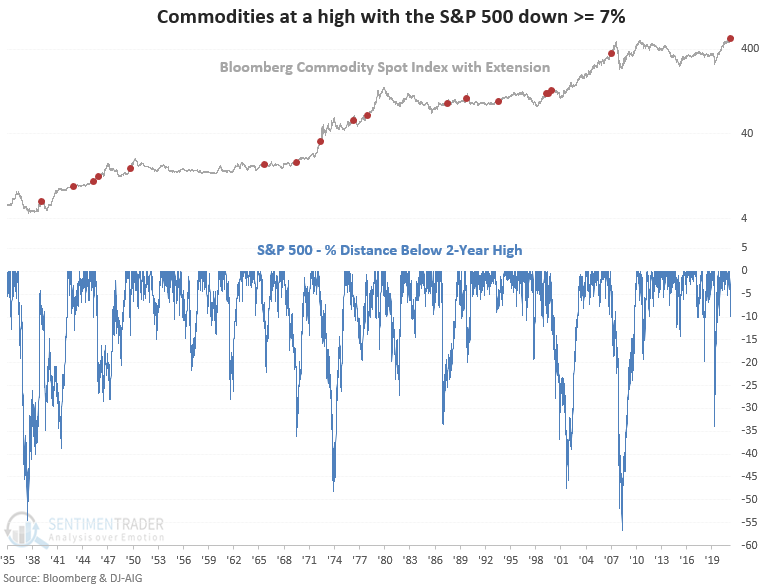

- The Bloomberg commodity spot index closed at a new 2-year high last week

- At the same time, the S&P 500 closed more than 7% below its 2-year high

- Commodities show a tendency to outperform stocks after other signals

What's the market message when commodities and stocks diverge

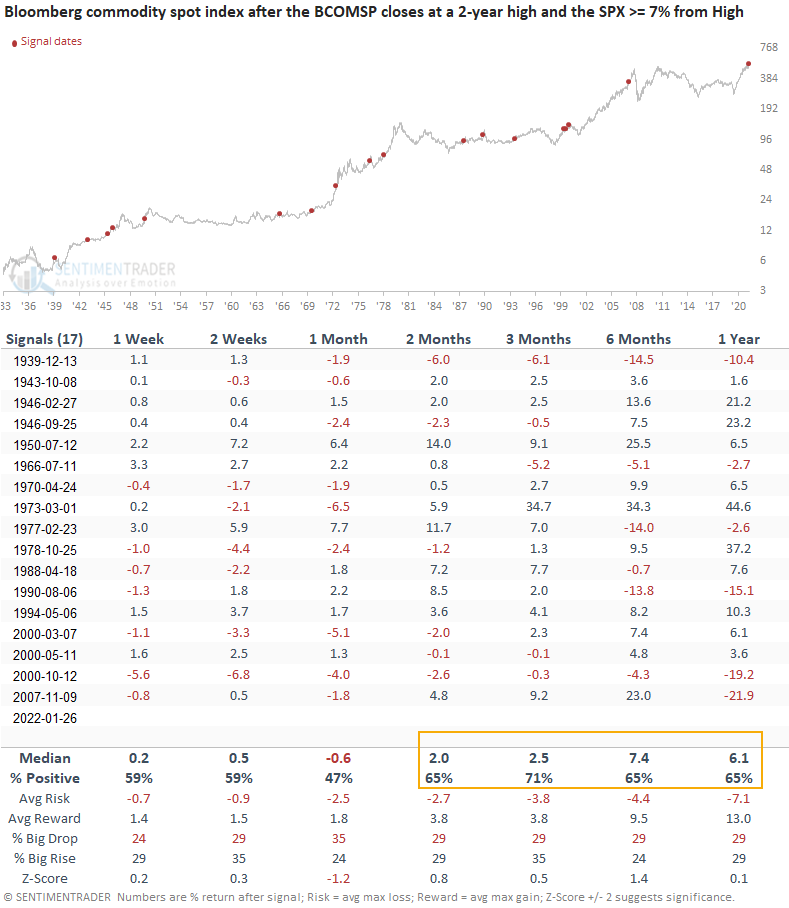

Let's conduct a study to assess the outlook for stocks and commodities when the Bloomberg commodity spot index (BCOMSP) closes at a 2-year high. At the same time, the S&P 500 index is down 7% or more from its 2-year high. I required the S&P 500 to close within 1% of its high to screen out repeats.

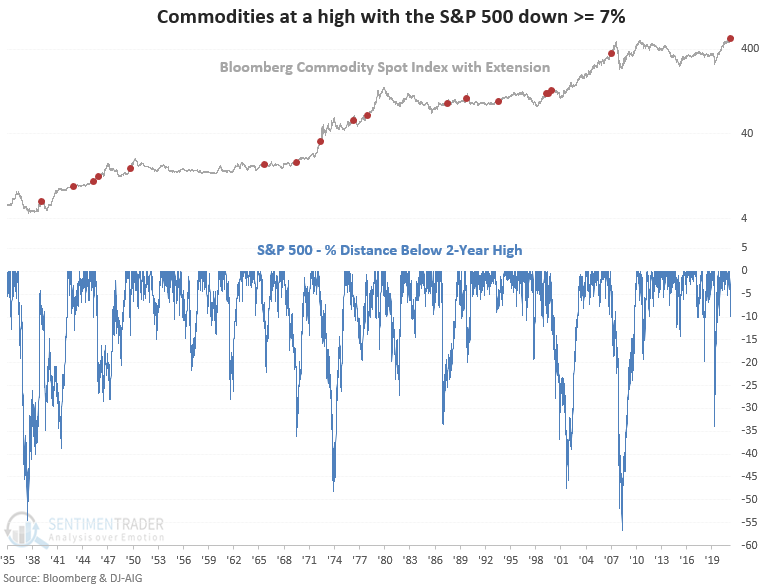

The S&P 500 chart version shows some noteworthy signal dates

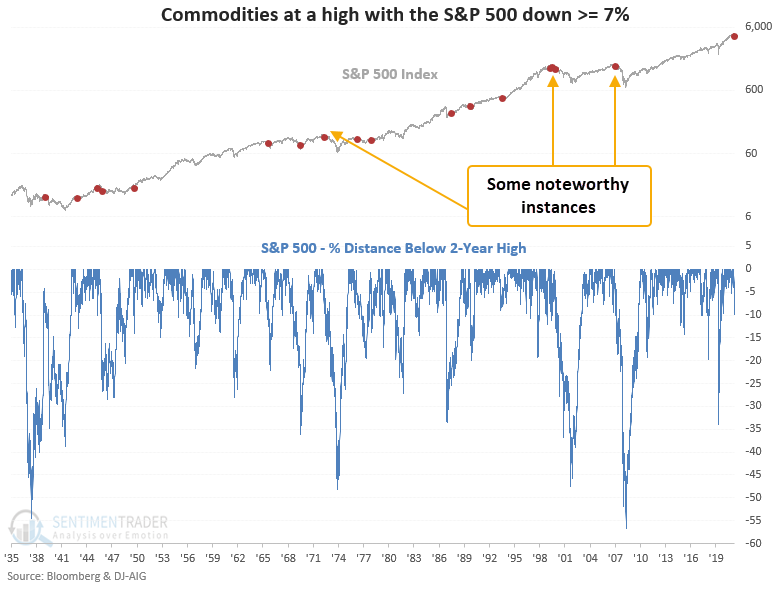

Similar signals have preceded flat returns

This signal has triggered 17 other times over the past 83 years. After the others, S&P 500 returns were flat across all time frames. The signals in 1950 and 1994 were the only two instances where you had positive returns across almost all points in time. The one exception was the 1-week forward return in 1994.

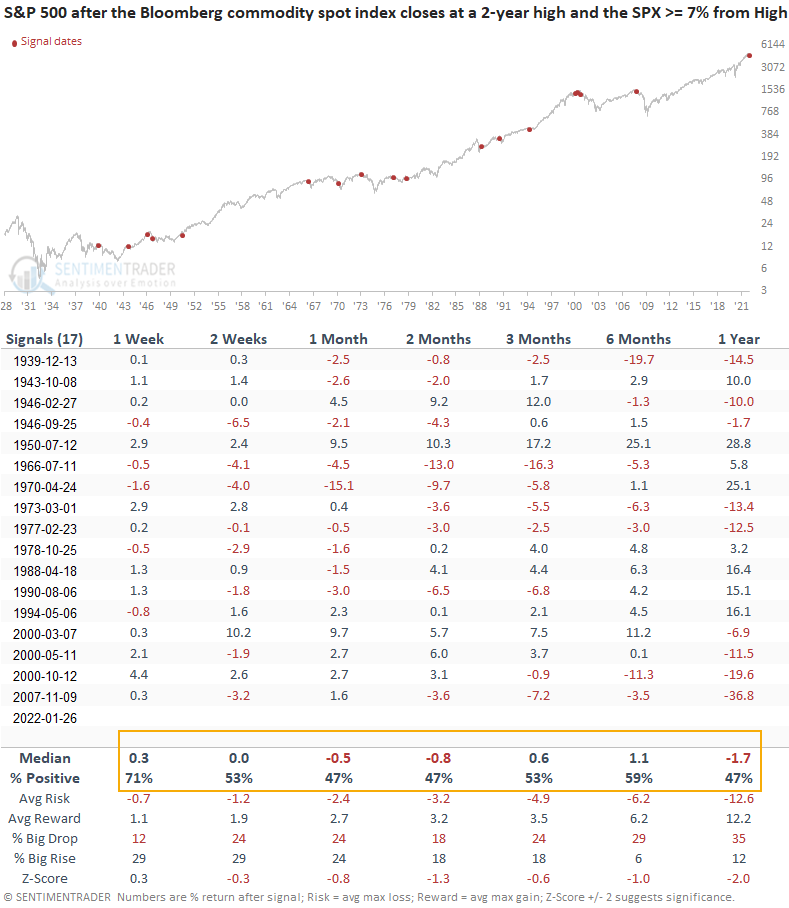

Let's apply the signals to the Bloomberg commodity spot index

Commodities show better returns and win rates when compared to the S&P 500. Interestingly, the 1-month time frame was negative for both assets with an almost identical return. If I compare commodities to the historical study period, returns and win rates look better on a medium to long-term basis. Let's assume the stock market has peaked, which is a big assumption. In that scenario, commodities can continue to rally, as they showed in 1973, 2000, and 2007.

What the research tells us...

Investors should be mindful that commodities could outperform stocks when the Bloomberg commodity spot index and the S&P 500 diverge around multi-year highs. Similar setups to what we're seeing now have preceded flat stock returns. Commodities look better compared to stocks and show absolute returns that exceed historical averages on a medium to long-term basis.