Commodities have lost their long-term uptrends

Key points:

- Commodities above their 200-day average reversed from > 80% to < 20%

- After similar reversals, general commodity prices showed negative returns across all time frames

- Commodity-based sectors showed somewhat weak returns in the near term

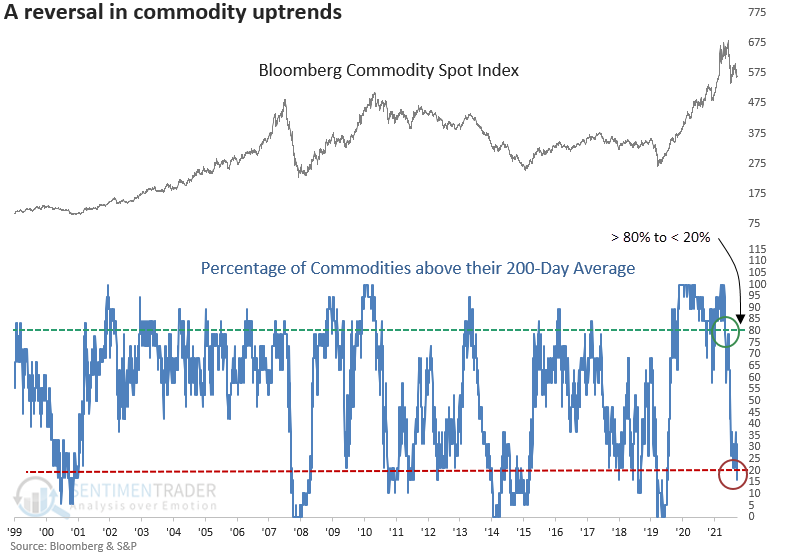

A bullish to a bearish reversal in long-term commodity uptrends

After a multi-year bull market with solid participation, most commodities have given up their long-term uptrends.

Last week, a significant reversal in uptrends occurred when fewer than 20% of commodities closed above their 200-day average. The shift happened after more than 80% of commodities traded above their 200-day average as recently as May.

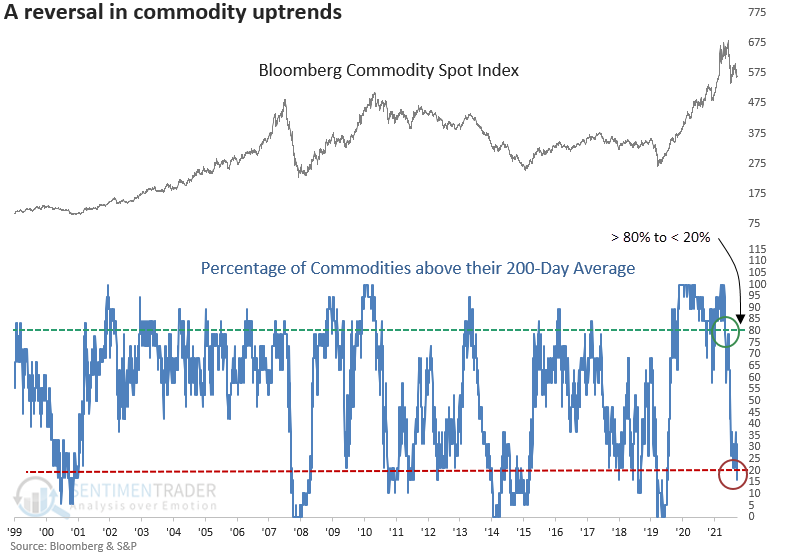

Similar reversals preceded negative returns for commodities

The u-turn in long-term uptrends for commodities does not bode well for the Bloomberg Commodity Spot Index. After similar signals, returns, win rates, and z-scores were unfavorable across all time frames. The index was lower a month after 9 out of the last 10 signals.

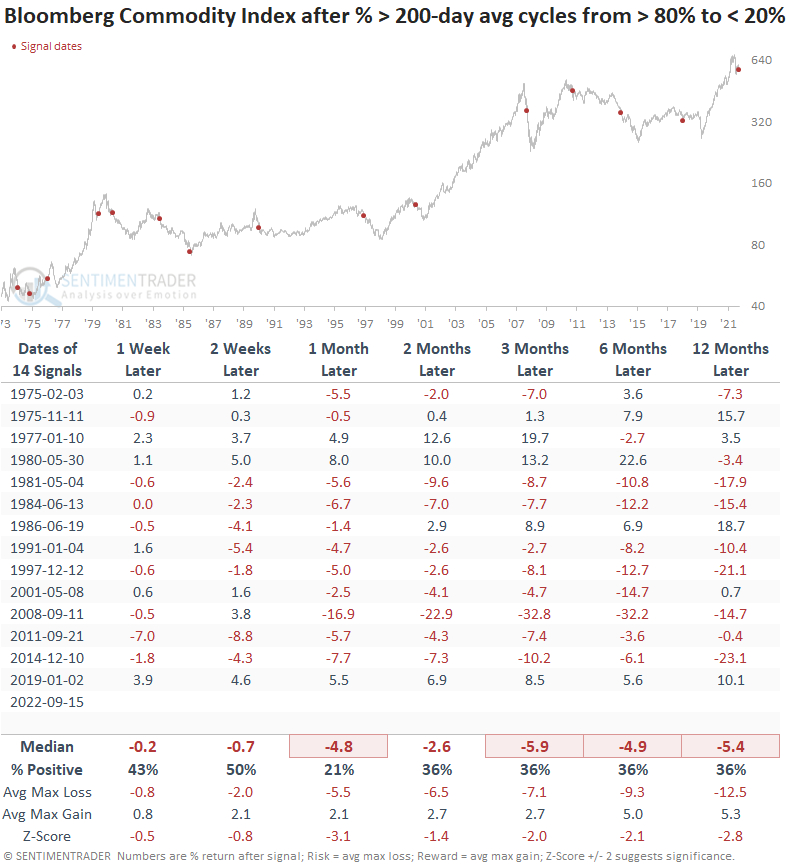

The S&P GSCI Equal Weight Commodity Index shows negative returns and unfavorable win rates across all time frames. So, the equal weight index confirms the adverse environment from the Bloomberg index, which is weighted more toward the underlying commodities' economic significance.

Commodity-based stocks tended to suffer as well

If we look at sectors that may be heavily influenced by commodity prices, two stand out.

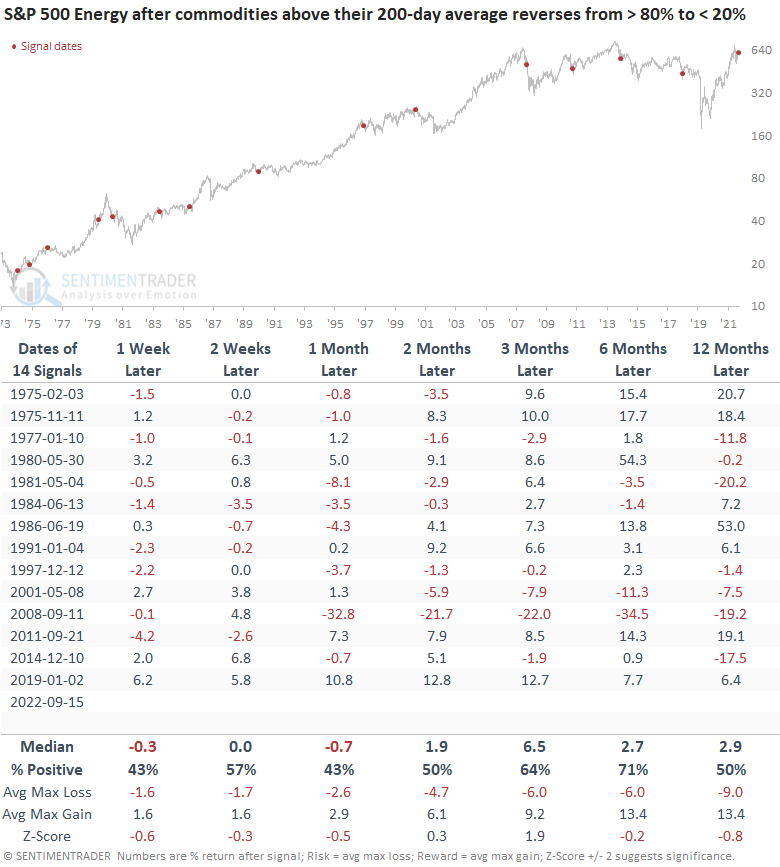

Energy stocks look weak in the near term, with a more favorable outlook 3-months later. After that, returns start to fade with a coin toss win rate a year later. The 1981 and 2008 signals are interesting analogs as they occurred after significant energy-driven bull markets.

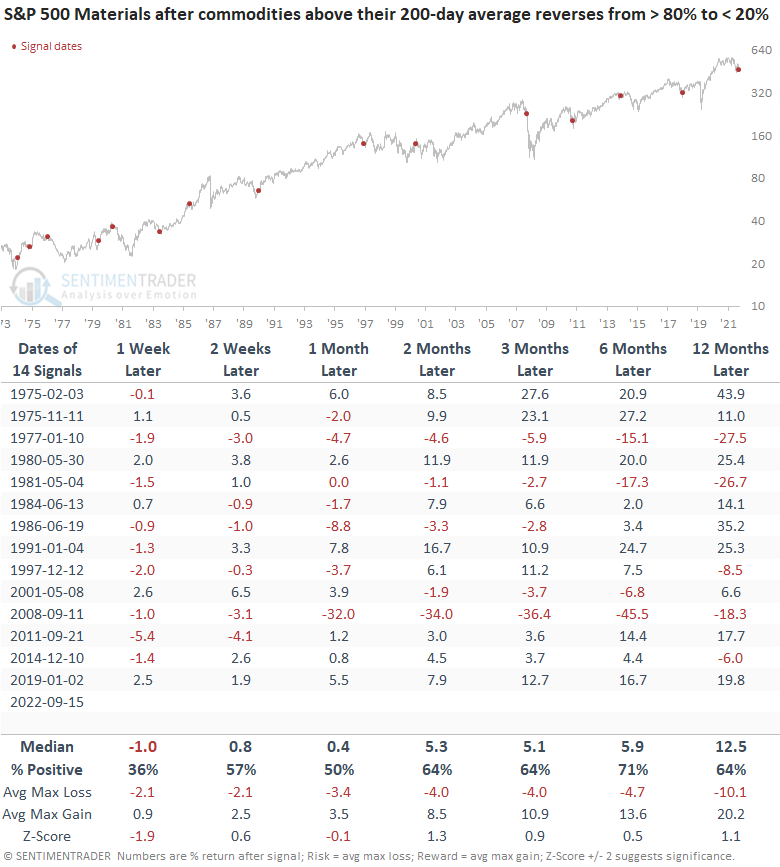

The materials sector looks better than the energy group, with positive returns across almost all time frames. Like energy, materials showed meaningful drawdowns after the commodity bull markets rolled over in 1981 and 2008.

What the research tells us...

Like most risk assets, commodities have finally succumbed to a softening economic environment brought on by the relentless rise in interest rates. The reversal in long-term uptrends looks unfavorable for a broad-based allocation to commodities. While energy and basic material stocks perform better over longer time horizons, one should be mindful of adverse conditions in the near term.