Commodities Have Done This 9 Other Times Since 1933

On Tuesday, we saw that the 4-month start to stocks this year has had some impressive precedents. While most of the similar years witnessed some consolidation during the summer months, the long-term implications were positive.

Commodities have arguably had an even more impressive start. The long-term trend in stocks is well-documented to be higher as companies innovate and produce profits, but commodities are much more cyclical. As prices rise, farmers plant more crops, or miners dig more stuff out of the ground, and prices go down. It's hard to sustain uptrends except when there is a massive supply/demand imbalance.

Using the same methodology we used for stocks, we see that 9 other years since 1933 had a correlation greater than +0.7 (on a scale of -1.0 to +1.0) through the first 4 months of the year.

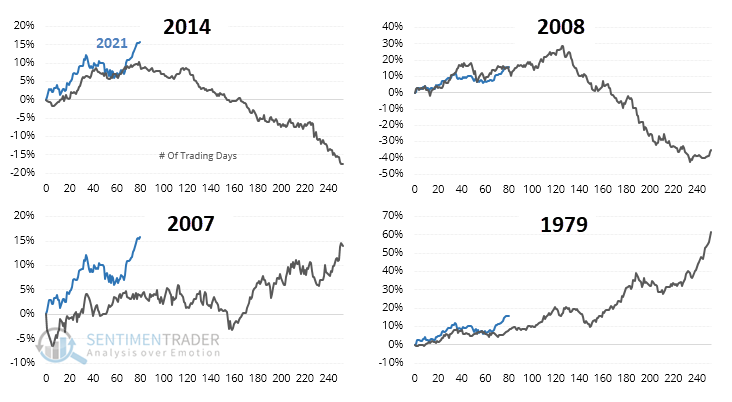

We can see the last 4 analogs in the chart below.

The years all showed gains through April and enjoyed a roughly similar path to get there, but the only year with a better 4-month beginning was 1973. Commodity bulls would love to see a repeat, as it preceded massive additional gains.

| Stat Box On the Nasdaq exchange, a Hindenburg Omen has triggered. This technical warning sign was flared up 45 times in the past 10 years. According to our Backtest Engine, the Nasdaq 100 rallied over the next month after only 14 of those sessions. |

What else we're looking at

- Full details on the years with the highest correlation in commodities to 2021

- Future returns for the Bloomberg Commodity Index from April for those years

- A signal that's suggesting caution for tech stocks

- What happens when 80% of stocks in the Germany DAX trade below their 200-day moving averages