Commodities Continue Rallying Despite Rising Dollar

Among all the breakdowns in historical relationships during 2021, one of the most unusual is that commodities continue to scream higher despite a rising U.S. dollar.

That's not the usual relationship between the two assets. Over the past decade, the two have roughly traveled in opposite directions during big trend swings. A rising dollar has typically meant falling commodities, and vice-versa. At least, that was the case until 2021.

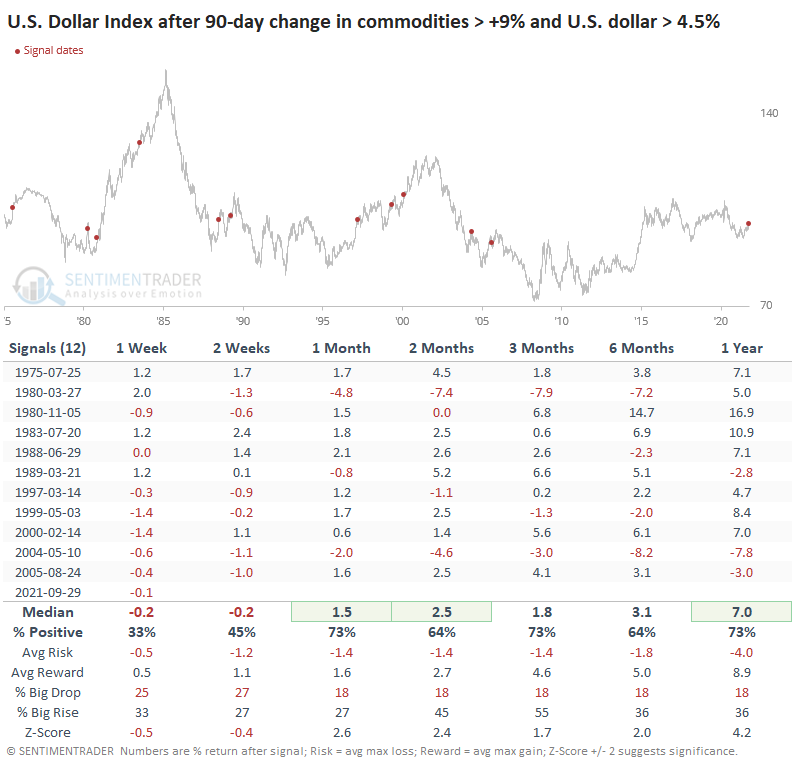

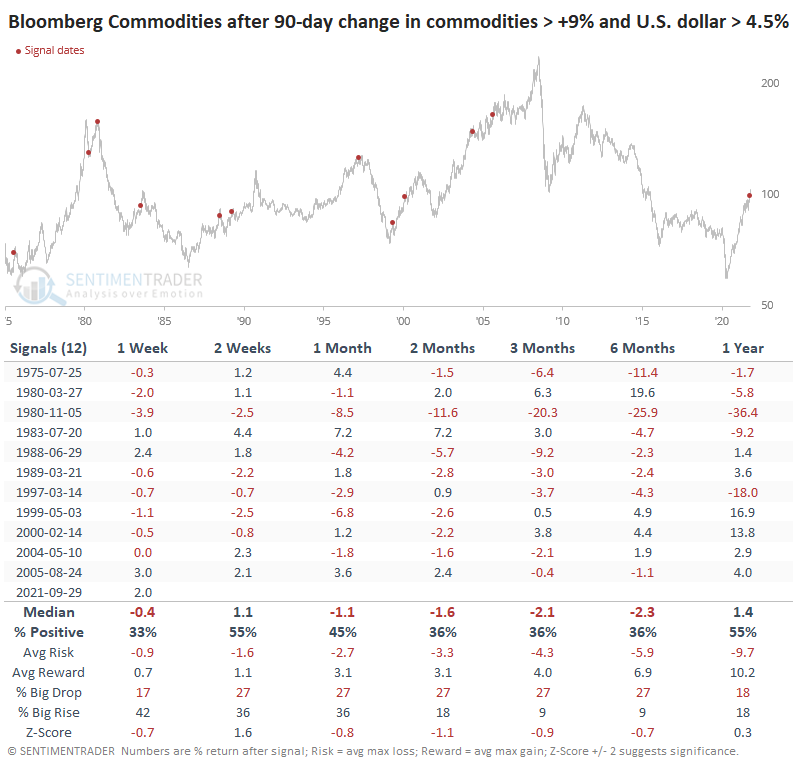

Going back to 1975, there have been a dozen instances when the dollar rallied at least 4.5% over a 90-day window and the Bloomberg Commodity Index more than doubled that return, rallying at least 9%.

Despite a trend that mostly points down over the decades, the dollar tended to rise after these periods, with well-above-average returns.

It was a different sign for commodities. They had a much more difficult time continuing to buck the headwind of a rising dollar.

Dean noted earlier this week that commodities have accomplished something they have never done during a bear market, which is to rise more than 50% over a rolling 2-year period. So, there are some signs that this time is different in terms of the commodity environment and if that continues then they should be able to shrug off the rising dollar headwind.

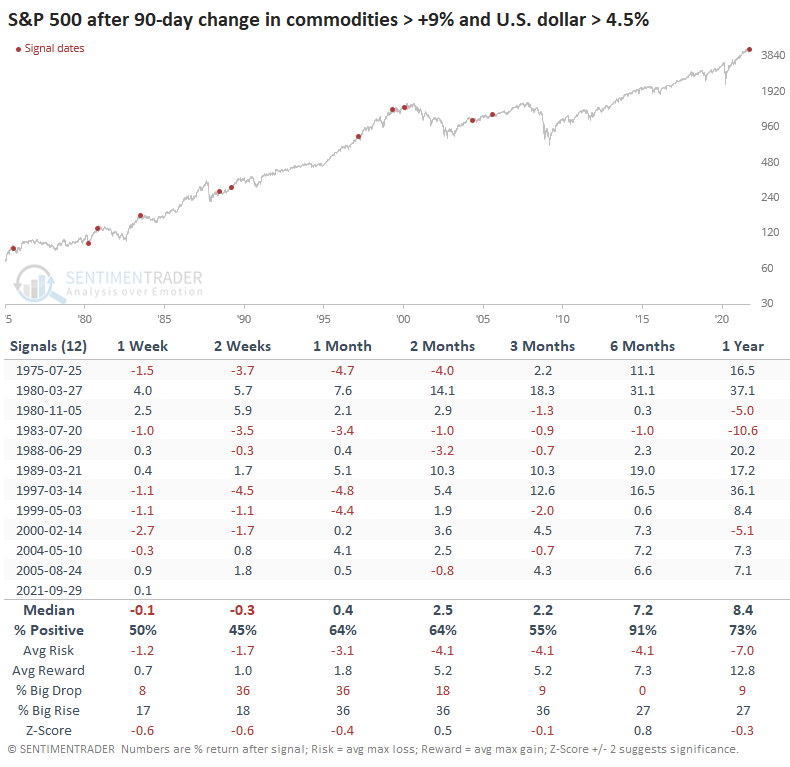

For what it's worth, stocks held up fine after these joint dollar-and-commodity rallies, with the S&P 500 rising over the next six months 91% of the time.

The next couple of weeks should tell us a lot about the trends in the dollar and commodities. Usually, when both have rallied as much as they have lately, how investors behave in the weeks ahead says quite a bit about their appetite for the long-term trends in each. If they keep pushing into the dollar, it will likely mean a much tougher row to hoe for commodities in the months ahead.