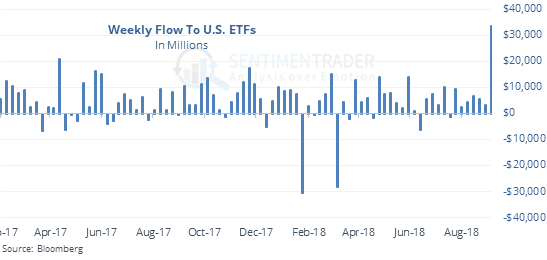

Comfort Nears Record High As ETF Inflows Surge

This is an abridged version of our Daily Report.

A comfortable time

Consumers are about as comfortable as they’ve been at any time in 30 years according to the latest survey from Bloomberg. Other periods of exceptionally high comfort led to trouble in stocks, but years later, while gold did well.

Everybody in

A massive $33 billion flowed into U.S. ETFs this week, likely a weekly record. That’s partly due to sector rebalancing and may be a minor negative at most.

Expiration hangover

The week after September options expiration (next week) has been positive only 11 out of the past 36 years, since the inception of S&P 500 futures.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Max/Min Screen shows that “smart money” hedgers established new multi-year long exposure to the Aussie dollar, coffee, the Nikkei, and 30-year Treasuries.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |