Combining Seasonality With Sentiment

As we near the middle of the month, it's interesting to note that several markets are bucking their typical seasonal patterns.

Seasonality is a minor consideration, especially in stocks, but it's worth checking to see if there are any especially consistent patterns or months that tend to generate outsized returns.

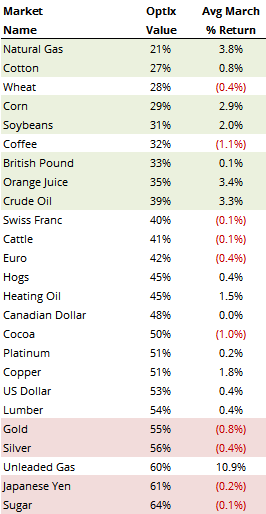

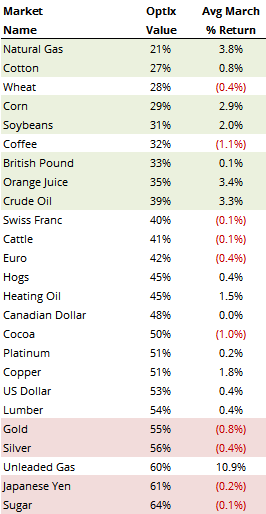

The table below looks at most of the commodities we follow, ranking them by Optimism Index and including their average March return. Markets that are showing pessimism but with positive seasonality are highlighted in green while those that are showing optimism with negative seasonality are in red.

The most notable are natural gas and the grains. They currently have deep pessimism but tend to perform well this time of year. At the opposite end are the precious metals and sugar (which tends to perform poorly in April as well).

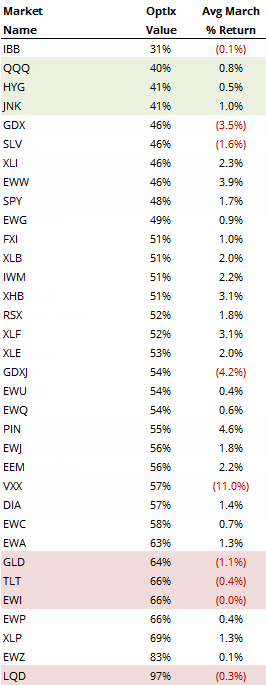

Here is the same screen for ETFs. This is using the raw daily figure, which can be noisy.

The most interesting development here is in bonds, with high-yield funds showing modest pessimism yet with positive seasonality, while investment-grade bonds are showing optimism with moderate negative seasonality. That would hint that high-yield funds would outperform their "safer" cousins in the coming weeks. A caveat there is that fund flows to high-yield funds have been on a tear, which has preceded weakness in the past. Not an ideal setup.