Close 1-Year Analogs, As Confidence Peaks

A year like ‘90

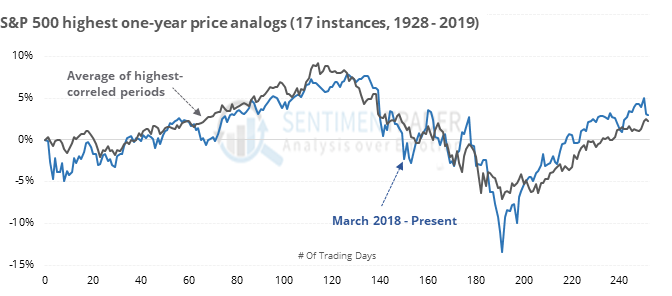

Hand-picked price overlays can show some scary comparisons to the past year, like 1937. But the one-year period with the highest correlation since 1928 was 1990, which led to tremendous gains.

Of the 17 one-year periods with the highest correlation to the past year, the next few months were sketchy, with positive returns less than 45% of the time and more risk than reward.

A little less confident

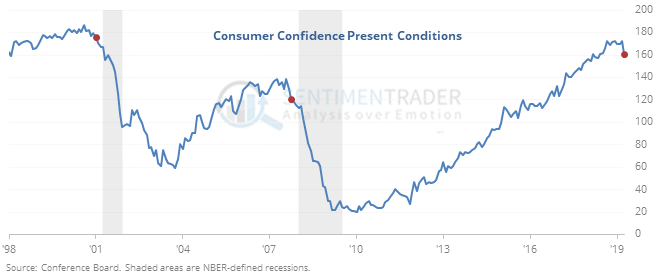

Consumers are becoming less confident about their present conditions. According to the Conference Board, this measure has gone from a multi-year high to the lowest level in nearly a year.

This has indicated the peak of most past cycles since 1970, often leading to recession and poor stock returns.

Lots of extremes

More than 45% of our core indicators are now showing excessive optimism, the most since late January 2018. Over the past 20 years, when there were this many extremes, the S&P’s two-month average return was negative. Most dates showed a negative return somewhere between 1-3 months, with the major exceptions being late 2003 and 2004, and early 2017.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.