Chinese Fear & Greed (mostly greed)

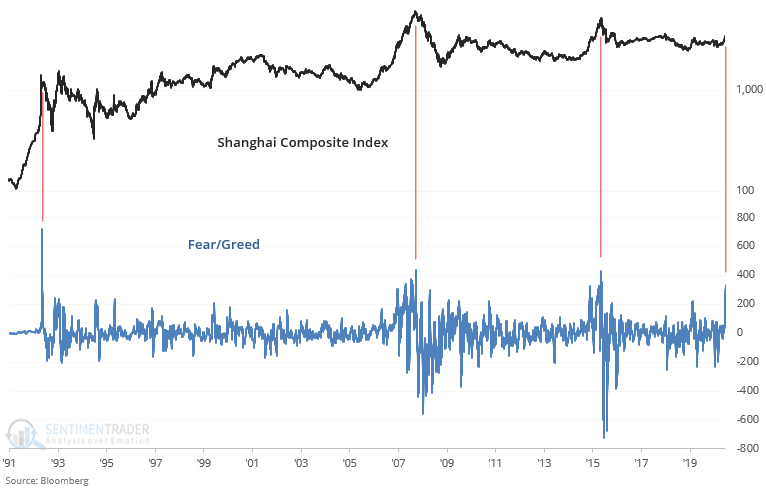

As several media outlets noted (data originally from Bloomberg), the Chinese stock market rally pushed the Shanghai Composite's Fear/Greed indicator to the highest level since 2015's explosive rally. Bulls are firmly in control of this market, and perhaps that's too much of a good thing.

There have only been 3 clusters of cases in which the Shanghai Composite Index's Fear/Greed was this high. All 3 clusters saw Chinese stocks plunge over the next 6-12 months:

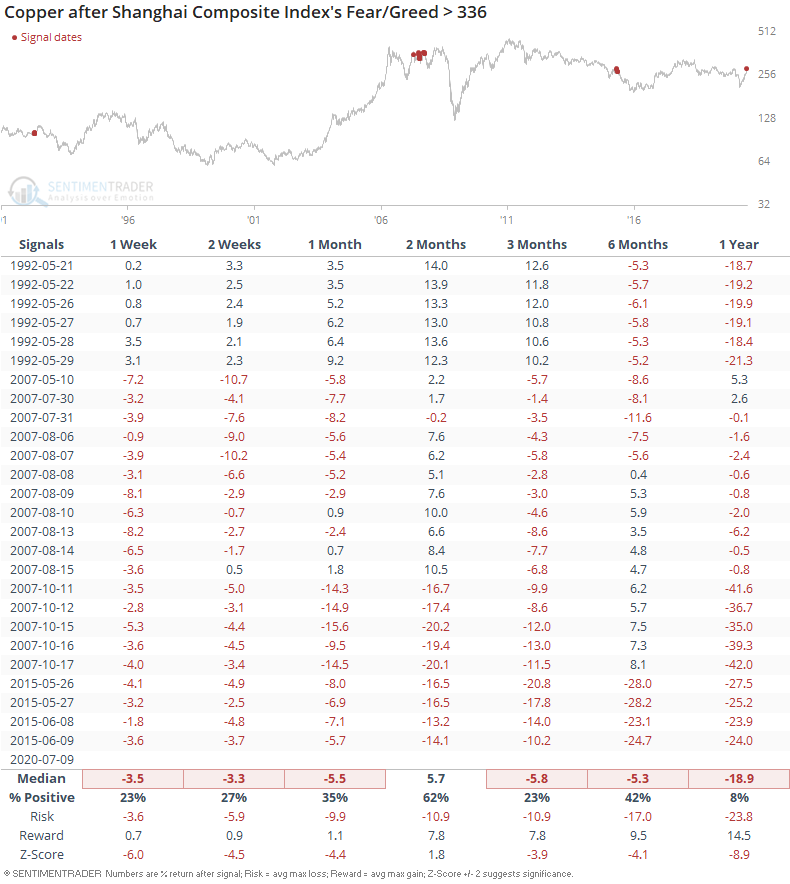

While copper is sometimes seen as a useful economic indicator and is plotted on a chart against the S&P 500, a price chart that overlaps copper with EM indices is probably more meaningful. Such a ramp higher in Chinese equities was bearish for copper over the next year: