CFOs Are Getting More Confident (But Their Bosses...)

Corporate insiders, CEOs and CFOs, are becoming more optimistic as stock market indexes break out.

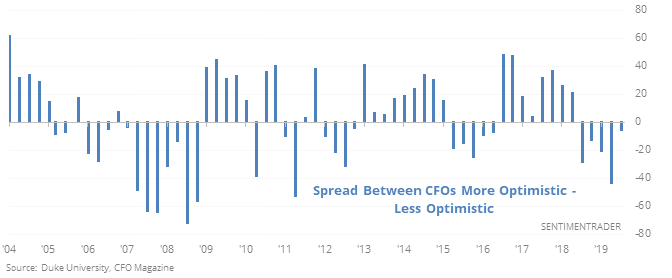

Insiders show diverging sentiment

In recent quarters, corporate CFOs have become more optimistic after a long time expecting declining conditions. At the same time, their bosses (CEOs) have continued to edge further into cautious territory. For CFOs, they're nearing their first quarter of net optimism in years.

When we combine CFO and CEO optimism into a single measure, we can see that overall, they're still more cautious than they usually are. And while there is a strong tendency to consider these insiders to be prescient, there isn’t a lot to conclude from this. Their caution was a great warning ahead of the 2008 meltdown, but other than that, their behavior has been more like Chicken Little than Carnac the Magnificent.

Breakouts Galore

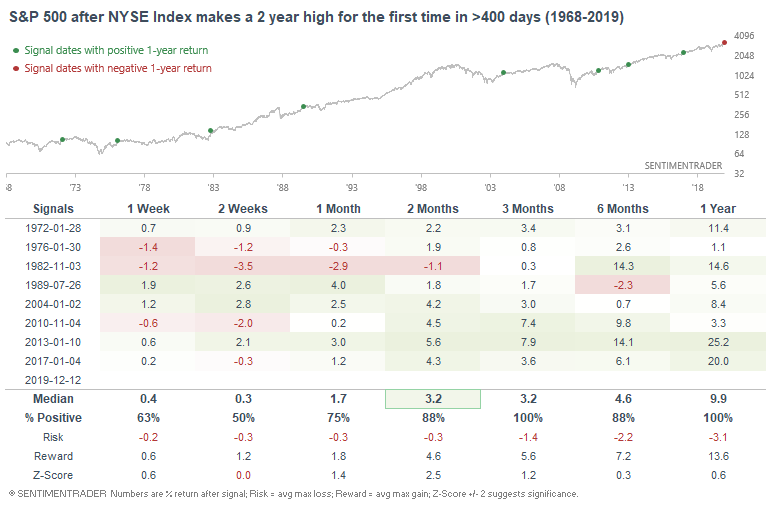

The U.S. stock market was among the first to breakout to new all-time highs this year. And now amidst a stream of positive trade war developments, indices that were more beaten down by the trade war (e.g. emerging markets) are also making new all-time highs. For example, the NYSE Composite Index just broke to a new high.

When it did so in the past, the NYSE Index typically rallied over the next 3 months and 1 year, as did the S&P 500.

While the sample size is small, it's hard to ignore a perfect record.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- SPY volume is one of the lowest in history, relative to its one-year range

- The S&P hasn't had a 1% down day in 45 sessions

- What happens after the MSCI All World Index breaks out

- Net new highs - new lows is surging

- Financials are hitting new highs, too

- The Equity Put/Call Ratio plunged

- Taking a look at other new highs in the British pound