Cash Is Trash As S&P Ends 50-Year Streak

This is an abridged version of our Daily Report.

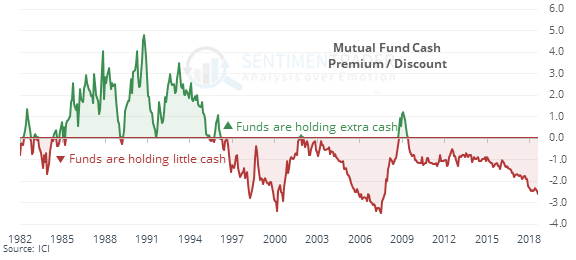

Cash is still trash

Mutual fund managers have refused to raise cash balances, despite rising yields on those balances. The latest monthly data shows that they’re holding only 3% of assets in cash, among the lowest in history.

Adjusting for rising interest rates, their “cash deficit” is now the widest since 2007, and among the most extreme in 60 years.

End of a 50-year reign

The S&P had gone almost 50 sessions without a 0.8% move either up or down, its longest since 1968. Thursday’s drop ended that streak. The ends of other calm stretches, when stocks were recently at a high level, led to further selling pressure).

Lotsa lows

More than 14% of securities on the NYSE sunk to a 52-week low on Thursday. That is – by far – the most when the S&P 500 was still within 1% of its 52-week high.

Bond scare

The TLT bond fund closed at a 3-month low with its volume over the past five days at a 3-month high, showing some panic among holders. That has led to a rebound a little over a month later only 31% of the time.