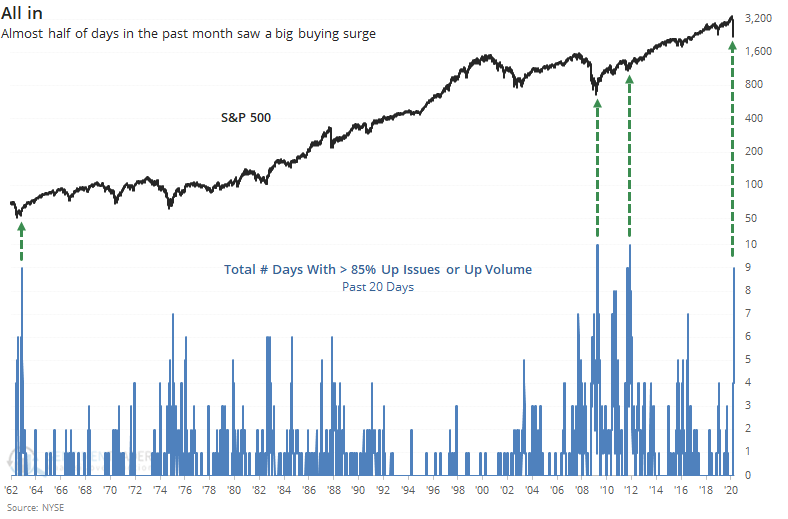

Buying interest has been historic

Over the past month, there have been a large number of sessions that have seen impressive buying pressure. Whether what we've seen constitutes a breadth thrust is open to interpretation, but Monday's session added to the idea that we have.

During the past 20 sessions, almost half of them have seen the NYSE Up Issues or Up Volume ratios surge above 85%. If both occur on the same day, both are counted because that's an especially strong signal.

There haven't been many stretches in the past 60 years with such heavy and concentrated buying pressure. This is being calculated before the close on Tuesday, but it's on track to trigger again and would push the current thrust to at least a tie for the most all-time.

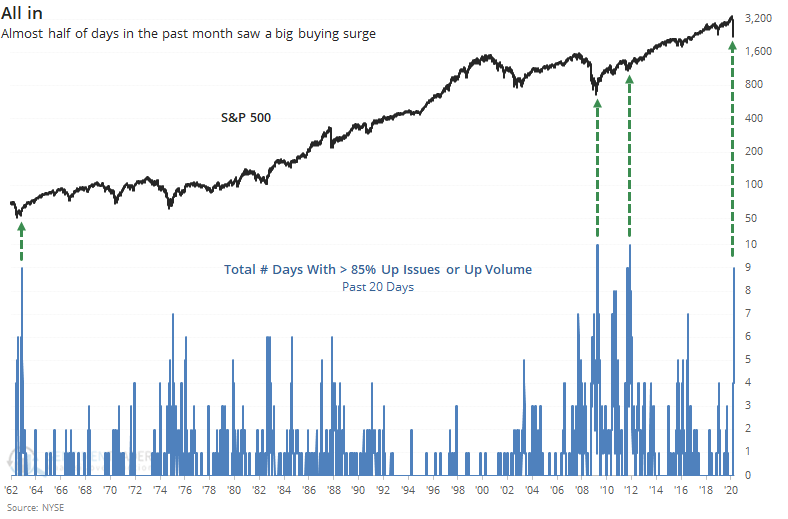

The sample size is tiny, but 3 of the 4 saw some give-back over the next week or so, then resumed the upward surge.

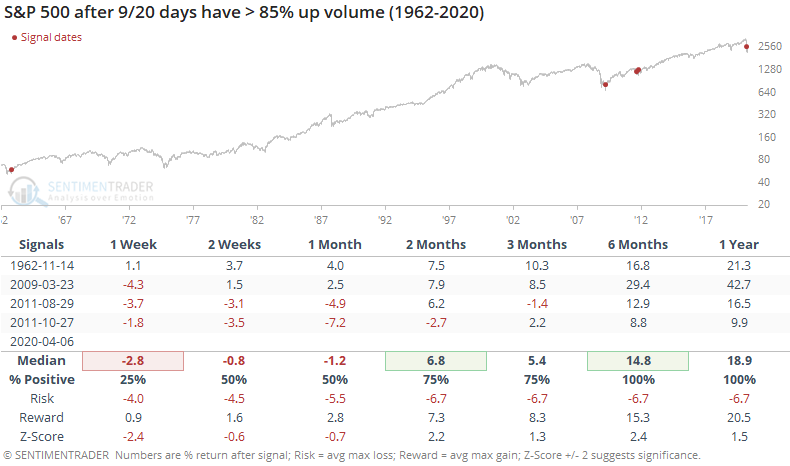

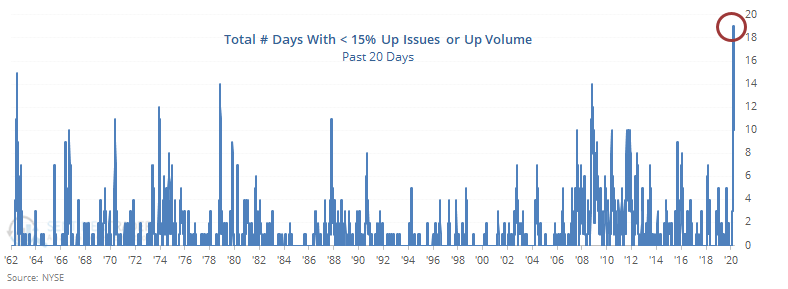

Of course, there have also been a large number of days with extremely heavy selling pressure. A record number, actually.

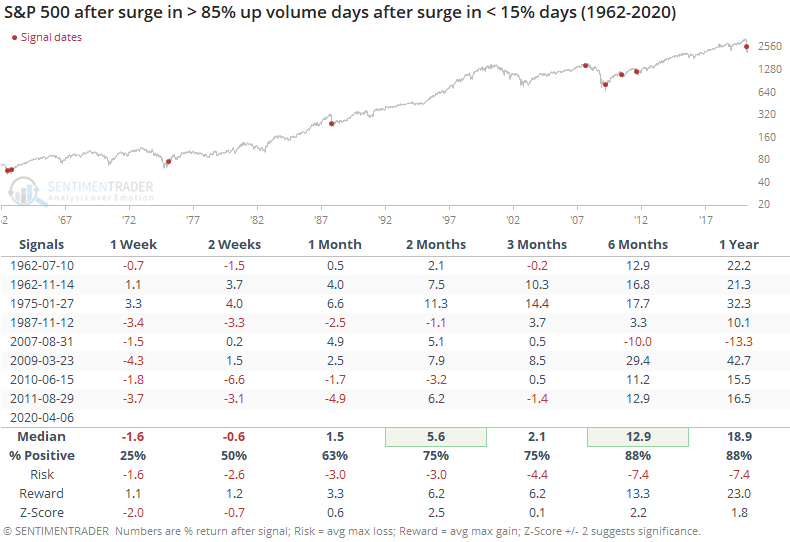

The key is that these heavy buying days have triggered after the surge of heavy selling days already peaked. If we look for times when there were lesser extremes, but with a surge in selling pressure days followed by a surge in buying pressure, then we get the following.

By definition, the table above shows returns after there had already been a surge in buying pressure and a rebound in stocks. Even so, forward returns ere very positive after the first week or two of volatility. The only real failure was in August 2007, which still showed medium-term returns, and that was one of the weaker thrusts in the whole table.

On March 25 and again March 26, we looked at the importance of the historic buying pressure flooding into stocks. It might not meet the definition of a "buying thrust" but those definitions assume that there are rules when it comes to technical or fundamental analysis. There are not. When we consider the implications of what happened, and the context in which it happened, it bodes well for future returns.