Buyers Enjoying A 2nd Gap Up Open

With another largish gap up this morning, we're seeing a type of buying interest from a sell-off that hasn't occurred since February, which, of course, ended up being a good sign.

Opening gaps are signs of emotional trading, and some of the most consistent edges we've discussed over the years occurred on days when there were large gaps, especially at price highs/lows or after big moves higher/lower. Typically, these are short-term edges though when extreme enough, it can spill over into the medium-term.

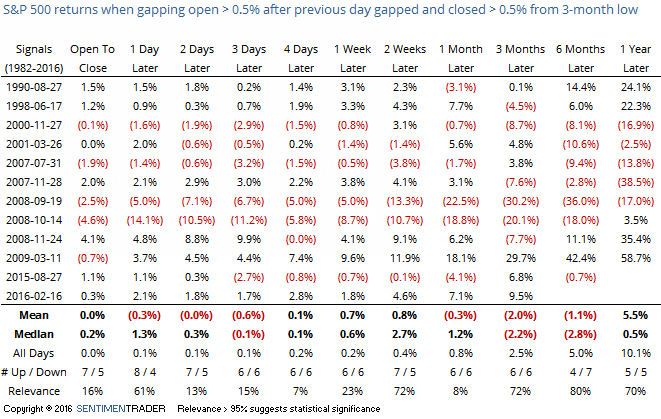

Let's take a look at how the S&P 500 futures (and SPY) have done after it dropped to a 3-month low, gapped up at least 0.5% then next morning, and then gapped up 0.5% gain (as it is on track to do this morning).

The sample size is relatively small but we're starting now to see that the bullish edge noted on Monday and Tuesday is starting to dissipate. By the time we got to the 2nd gap up, buying pressure was starting to show some exhaustion. The formerly consistent positive edge over 3-5 days was now flat.

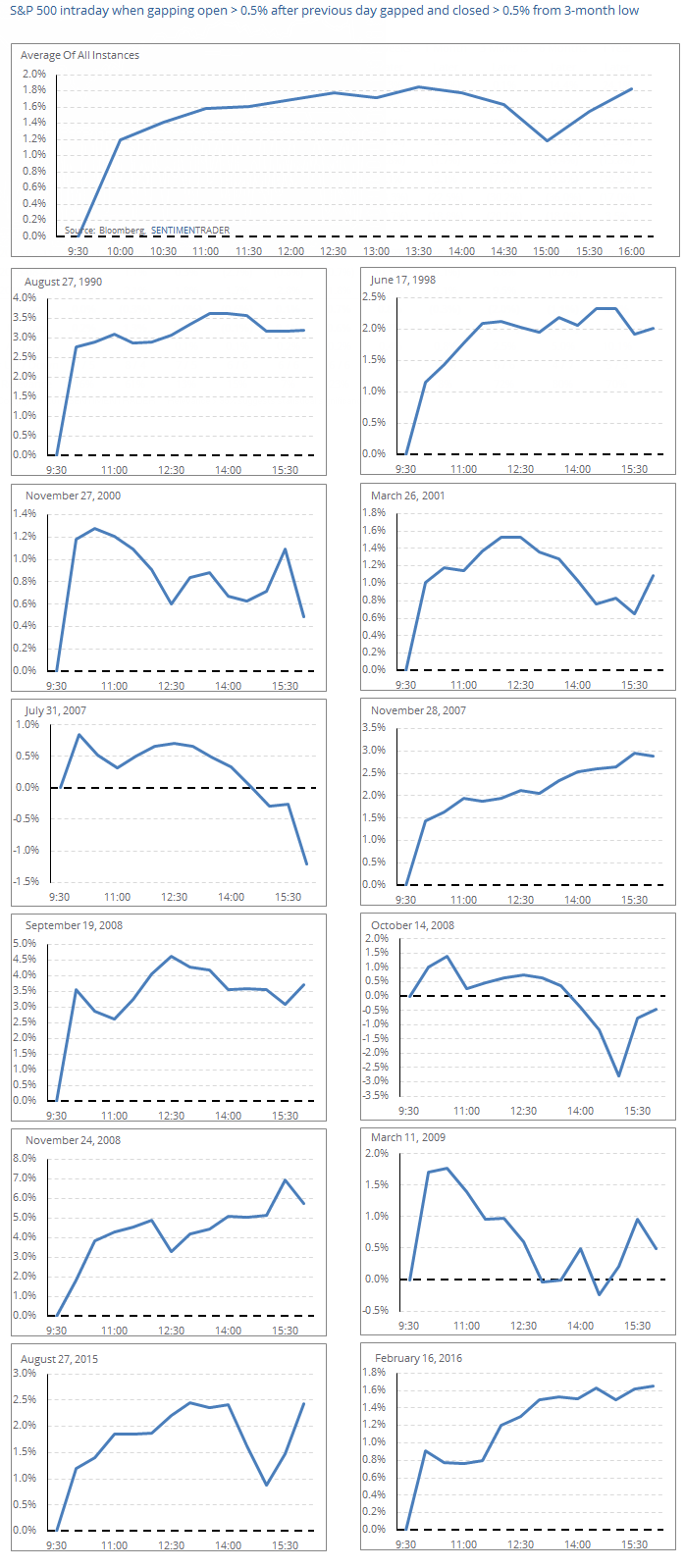

On Tuesday, stocks happened to follow the average intraday pattern almost exactly, so let's take a look at the same thing, except this is intraday performance on the day of the 2nd gap up open. Here we have typically seen a push higher into the afternoon but then fading performance.

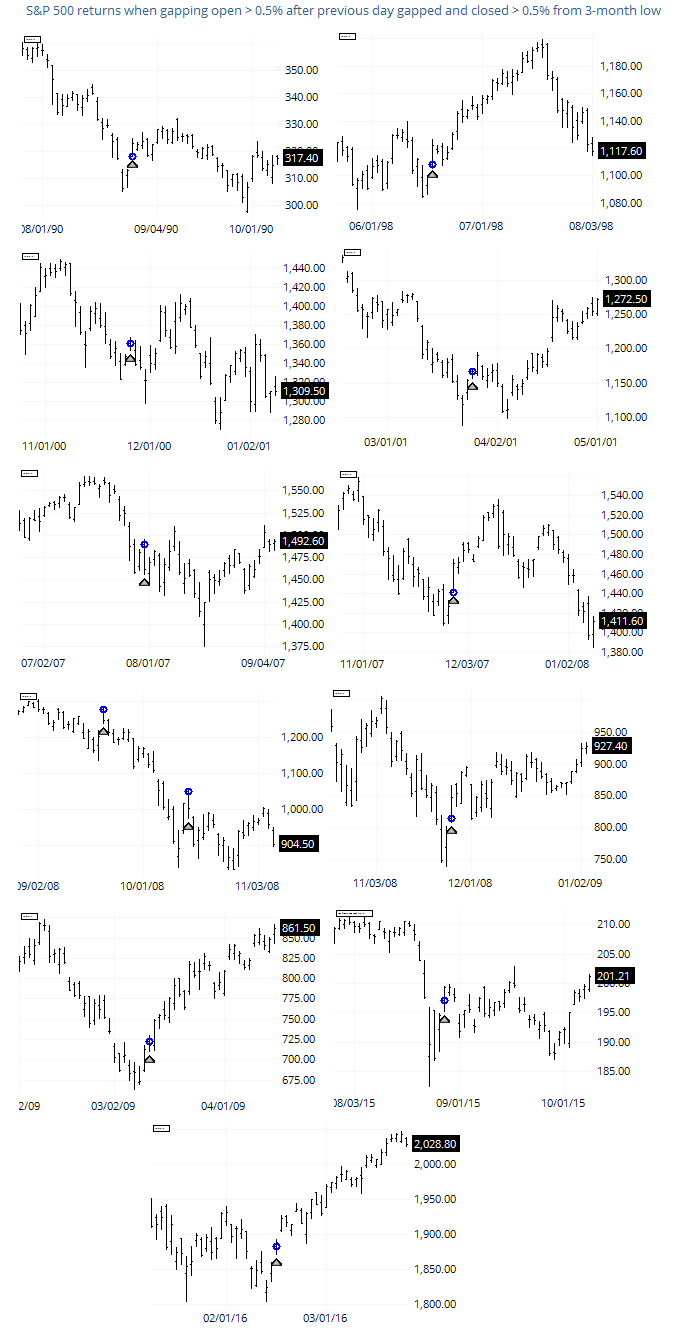

Zooming out a bit, here is how the S&P performed in the few weeks following the 2nd gap. The blue circles highlight the open of the day of the 2nd gap of 0.5% or more following a 3-month low. Three of them resulted in gap-and-go scenarios but generally we see some back-and-forth as the knee-jerk buying pressure subsides.