Buyers come back in force yet again, nearing a record year

NOTE: We have amended this note at the end to include the fact that Up Volume once again surged above 80% after this was published.

The backbone of any positive bias since the spring has been the multitude of thrust and recovery signals. That turned a little iffy in July and August as oddities triggered, thanks to the overwhelming push by large tech stocks.

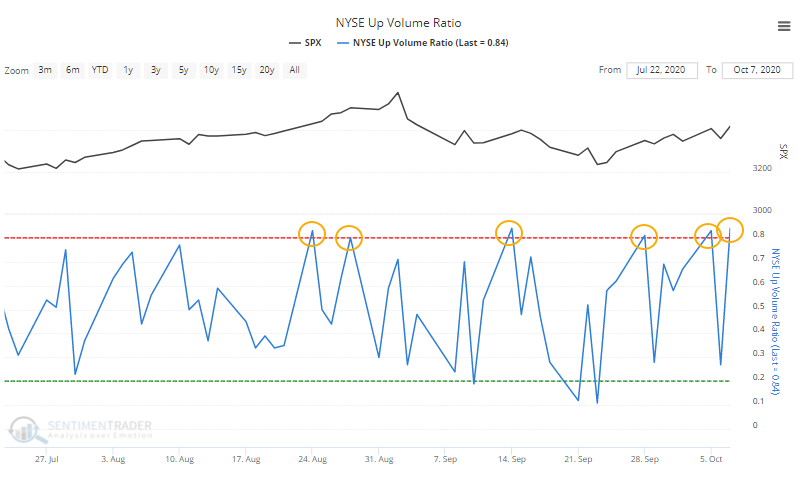

Lately, it has returned to a more normal market environment, and yet again on Wednesday, buyers were eager enough that more than 80% of volume on the NYSE exchange flowed into advancing securities.

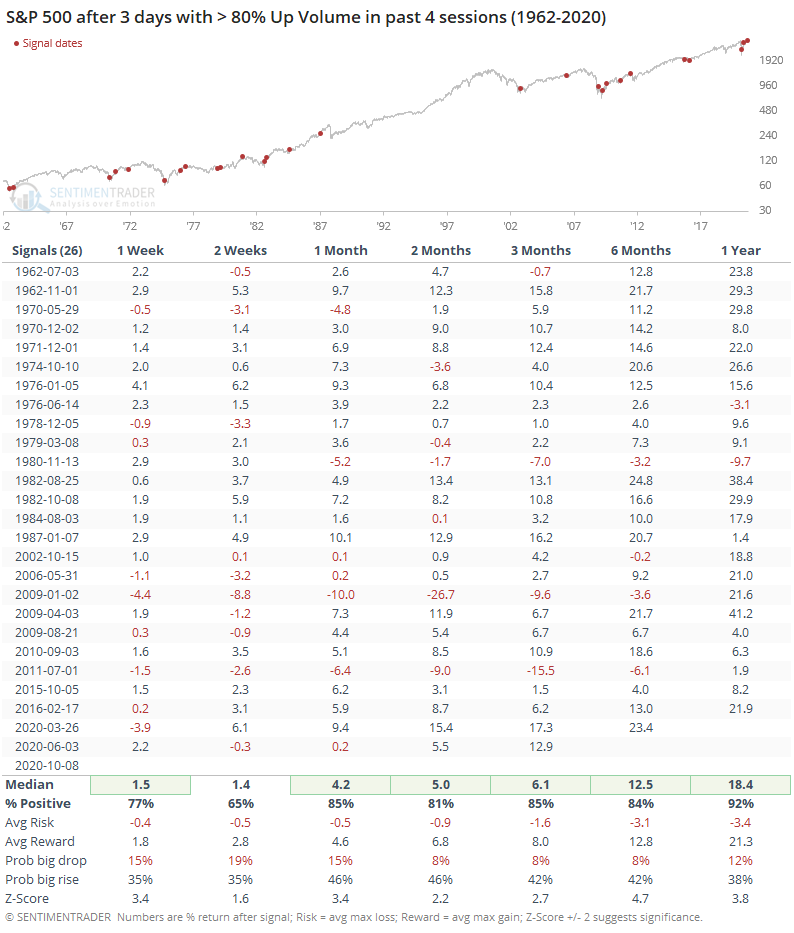

That marked the 2nd day with more than 80% NYSE Up Volume in just the past 3 sessions.

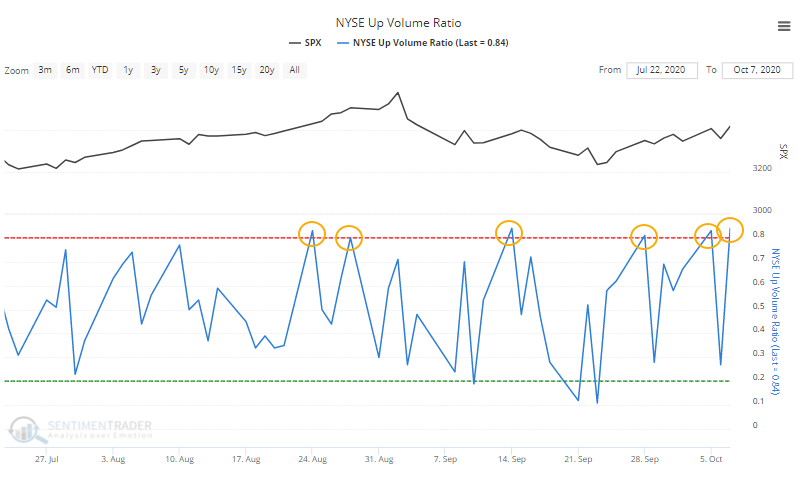

It's not uncommon to see tight clusters of these days during big downtrends, as volatility is high. It's more unusual to see it when stocks are relatively close to their highs. When it has happened, it's been a good sign for forward returns.

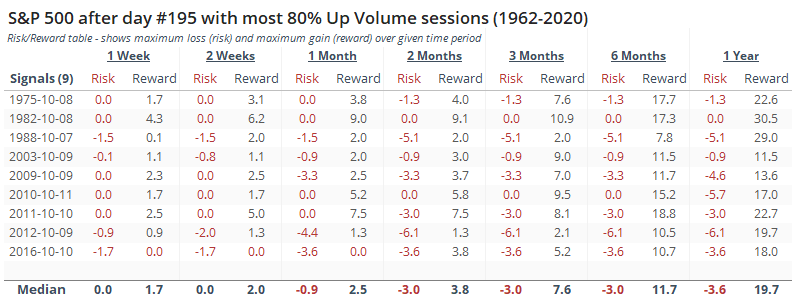

Over the next 3 months, there were 4 signals that saw a maximum loss of -5% or more at some point, compared to 16 signals that saw a maximum gain of +5% or more at some point. That helped skew the risk/reward ratio heavily to the positive side.

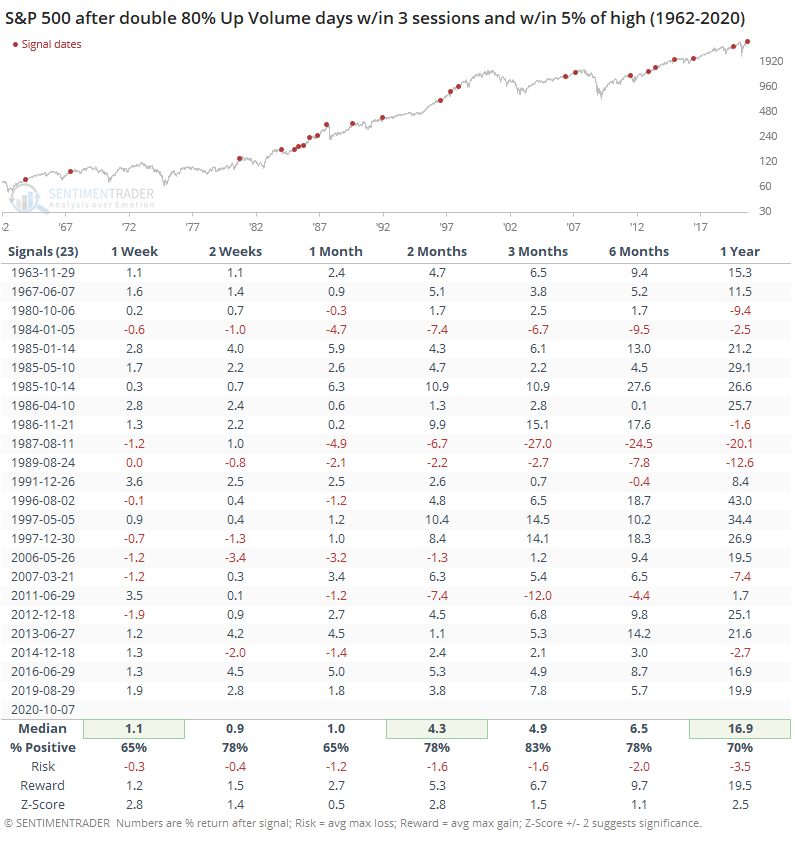

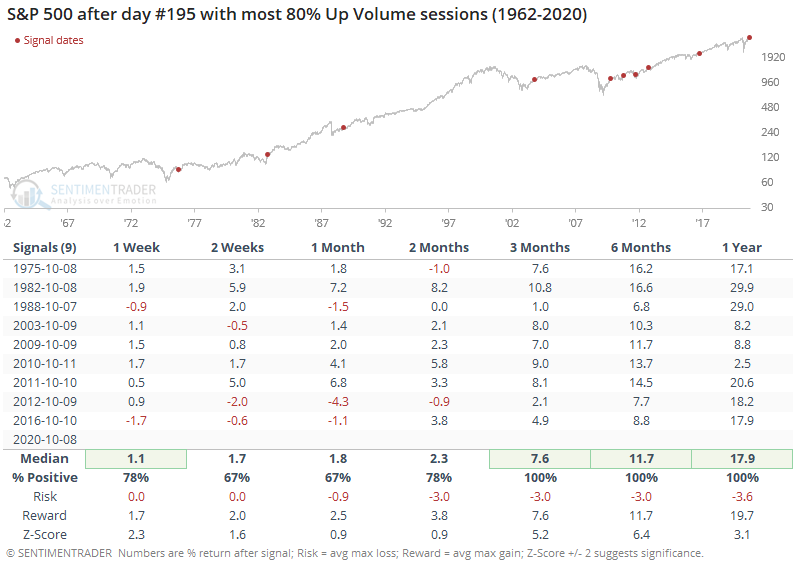

We can see from the chart above that the past few days have added to a multitude of 80% or greater Up Volume days since late August. Since the start of the year, there have been 33 of these days, nearing the all-time record dating back to 1962.

Years with a lot of these big up thrusts tended to be volatile, of course, but that didn't prevent extremely positive returns going forward.

The risk/reward following these signals was almost ridiculously positive. During the next year, the most that any signal lost at any point was -6.1%. That compares to a maximum gain that was +11.5% or more after every one of them.

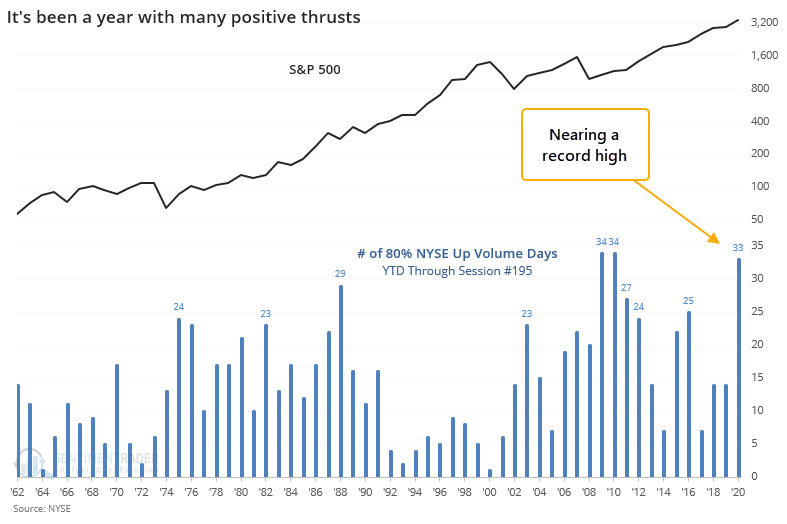

EDIT: The day this was published, Up Volume once again closed above 80%. This marks the 3rd day in the past 4 that saw a ratio above 80%. Below, we can see that tight clusters of such heavy buying pressure have preceded consistently positive returns.

When sentiment is positive enough that buyers are willing to plow into almost any stock that's up on the day, it says a lot about the attitude out there. Clusters of these days, like we saw several times during the spring, have an essentially unblemished record of pointing to higher stocks over the medium- to long-term. While there are troubling issues like the continued speculation of options traders, as long as we keep seeing breadth thrusts like this, it's hard to get too negative over a longer-term time frame.