Buy The Dip Is Dead; December Reversal; Smart Money Is Covering

This is an abridged version of our Daily Report.

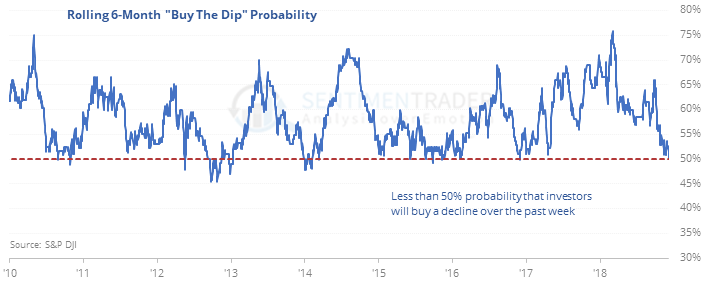

Buy-the-dip is dead

Over the past six months, there has been a dramatic decrease in the probability that buyers will step in after weakness. After reaching a 20-year high earlier this year, the probably that investors will buy the drip has dropped below 50% for the first time in two years.

When the probably is above 50%, the S&P’s annualized return since 1928 has been 13.1%. When it’s below 50%, that drops to -1.5%. It’s not necessarily just a feature of bear markets, but stocks generally do better when investors are willing to step in after weakness (of course).

December reversal

The S&P 500 formed a hammer by falling to a new low then reversing by the close. These look nice but have been poor signals in the short-term. A better sign is that stocks have dropped so much in December, which has a strong tendency to reverse in the month ahead, with a 90% win rate since 1950.

Smart money is covering

Large hedgers established a near-record short in equity index futures in September and have been covering ever since. They’re getting close to going net long but have a bit more to go. As of last Tuesday, the latest data available, they were still holding about $2.9 billion worth of contracts net short. If they continue to cover those shorts in the week(s) ahead, we can see from the chart that it’s been a good sign for the broader market.

The latest Commitments of Traders report was released, covering positions through last Tuesday

The 3-Year Min/Max Screen doesn’t show any new extremes. Hedgers have been heavily reducing their longs in 10-year Treasuries but have a long way to go to match where they were at when bonds peaked in June 2016 and September 2017.