Buy-losers-and-sell-winners hits historic proportions

Monday's session was one for the record books for multiple reasons. We went over some of them yesterday, with the overall tone being positive due to the types of stocks that were seeing the most buying interest.

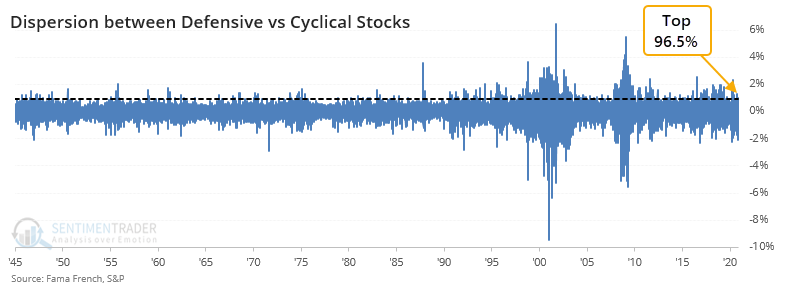

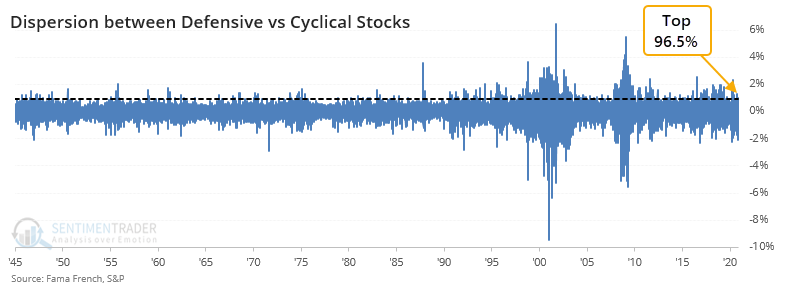

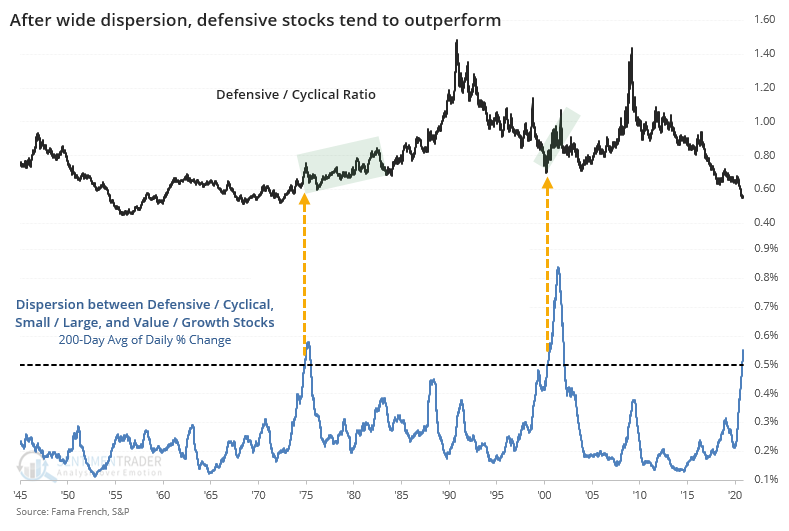

There was a clear shift from former winners to former losers. The spread in daily returns between defensive and cyclical stocks on Monday ranked in the top 96.5% of all readings since 1945.

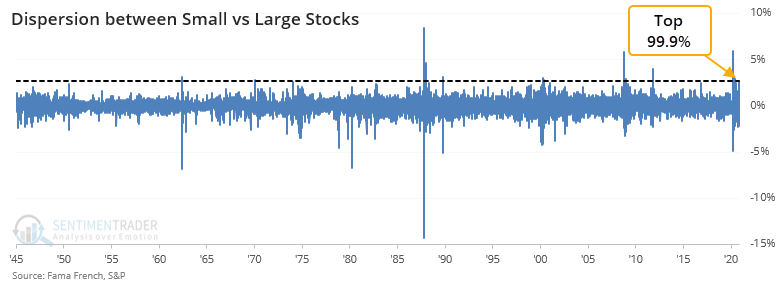

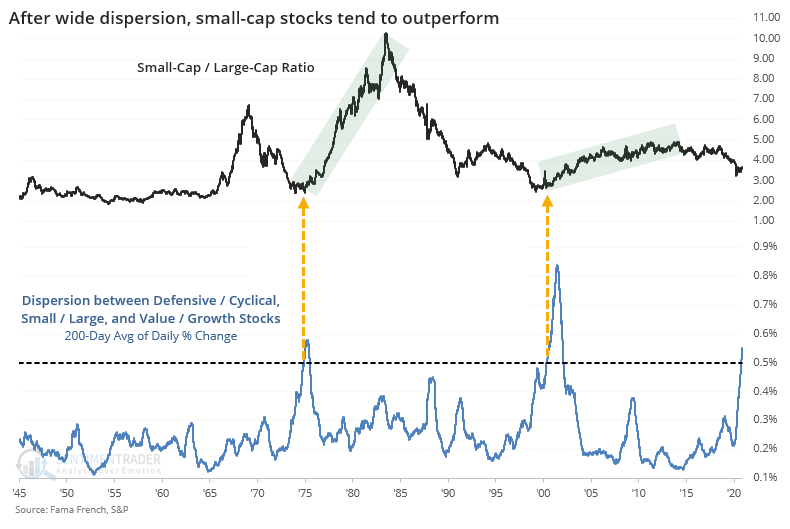

It was even starker between small- and large-cap stocks, with Monday's difference ranking in the top 99.9% of all readings.

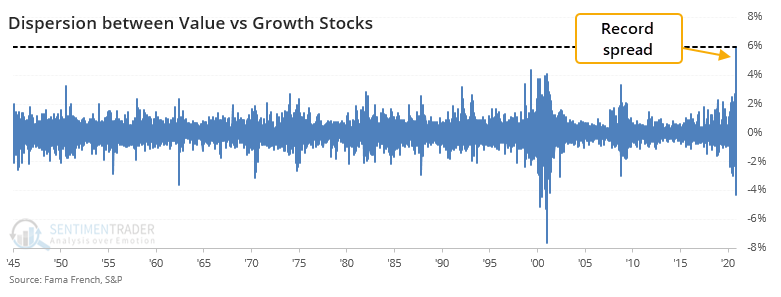

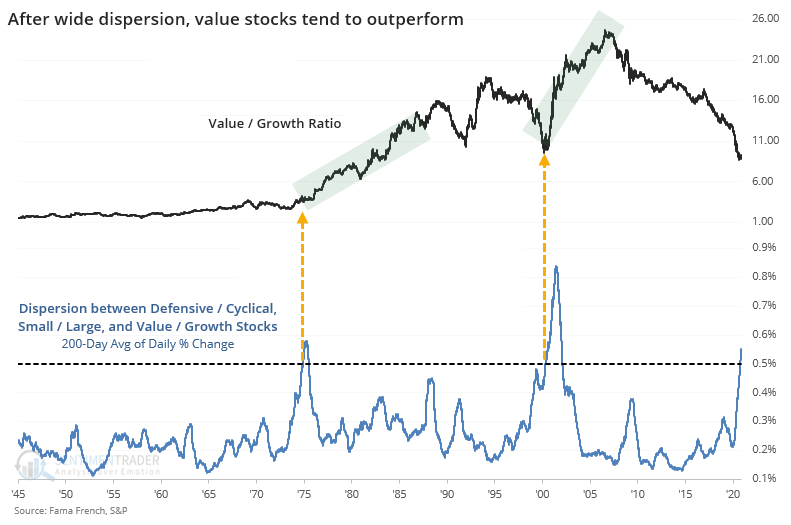

And greater still between value and growth stocks. The shift from growth to value on Monday had never been more extreme in the past 75 years.

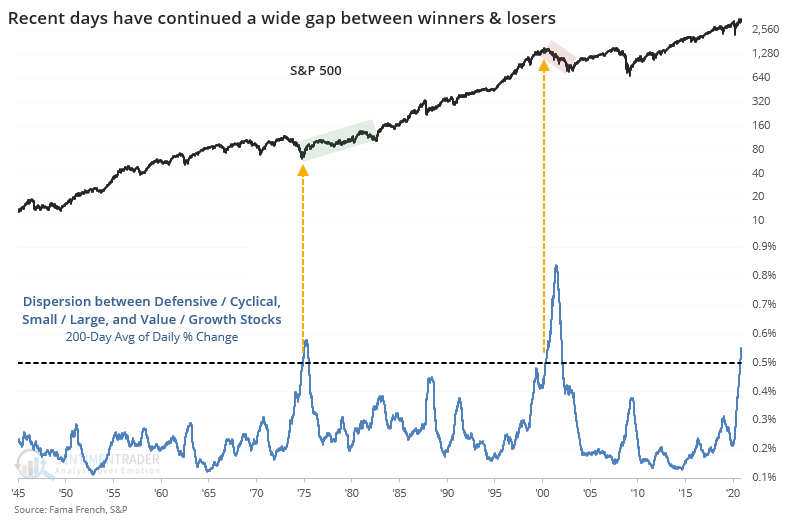

If we look at those charts, then it's not just Monday's activity that stands out, but the wild differences in returns that have been evident for months. When we look at the absolute difference in price changes between all 6 factors over the past 200 days, then we've seen one of the truly extreme risk-on vs risk-off environments ever.

The only two time periods which exceeded the current one were in late 1975 and late 2000. Both coincided with important turning points in the broader market, one a trough and one a peak. There were 4 lesser extremes in 1983, 1988, 1991, and 2009, all following big dislocations in stocks, and all leading to higher prices for the S&P 500 going forward.

Let's look at these periods of wide dispersions versus the various factors. When we do that, we can see that defensive stocks typically did better than cyclical ones but it was not very consistent.

It was much more consistent to see small-cap stocks outperform large-cap ones. The two periods with dispersions as great as they are now both led to extended periods of smaller stocks doing better than larger ones.

The same pattern holds true for value versus growth stocks. By the time dispersion among the factors reached the current level, value stocks were about to embark on multiple years with massive outperformance relative to growth.

Investors have been looking for a turn in these relationships for years, and yet in most respects, they just keep getting more extreme. It seems like Monday's shock, building on the massive differences in positioning for most of this year, is enough to equate to some of the most notable changes in 75 years, and that has been a very good relative sign for small and value stocks.