Burst Of New Highs As Optimism Hits 30-Year High

This is an abridged version of our Daily Report.

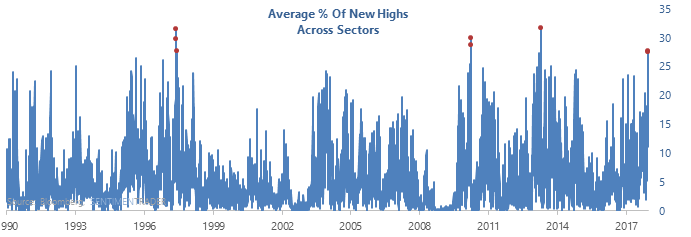

A rare burst of new highs

Most of the major indexes and sectors had more than 25% of their stocks hit a 52-week high on Tuesday. Only Staples and Utilities saw fewer than 10% of their stocks hit a new high. On average across indexes and sectors, 27% of stocks reached a fresh high, among the best average readings since 1990.

Similar surges led to poor short-term returns, and excellent long-term ones.

Where da bears at?

The Investor’s Intelligence survey of newsletter showed the fewest bears in 30 years this week. Prior to 1987, the survey was more volatile, and there were more than 50 weeks with fewer bears. Those weeks led to poor returns in the S&P 500, while sectors like Utilities and Energy held up very well.

Reversing the reversal

The S&P 500 futures completely reversed its negative reversal from Tuesday. This is adding a rarity on top of a rarity, and future returns were mixed, at least until 3 months later when they were good.

Upside volatility

While the VIX is often referred to as the “fear gauge”, it simply measures how options traders are pricing moves over the next 30 days. It almost always increases as stocks decline as options traders bid up the price of put options. But in rare cases, the VIX can rise along with stocks for the same reason.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.