Bulls Reach 30-Year Highs On Futures Gap

With relief about President Trump's speech last night (or whatever other excuse you'd like to insert), stock futures are once again pushing to new all-time highs. And while there are some holdouts, many sentiment measures are also pushing multi-year or multi-decade records.

The latest release of the Investor's Intelligence survey shows the percentage of bullish newsletter writes at the highest level since 1987. January, not October before the crash. January of '87 has turned up several times in recent studies as a precedent to the kind of price action we've seen lately.

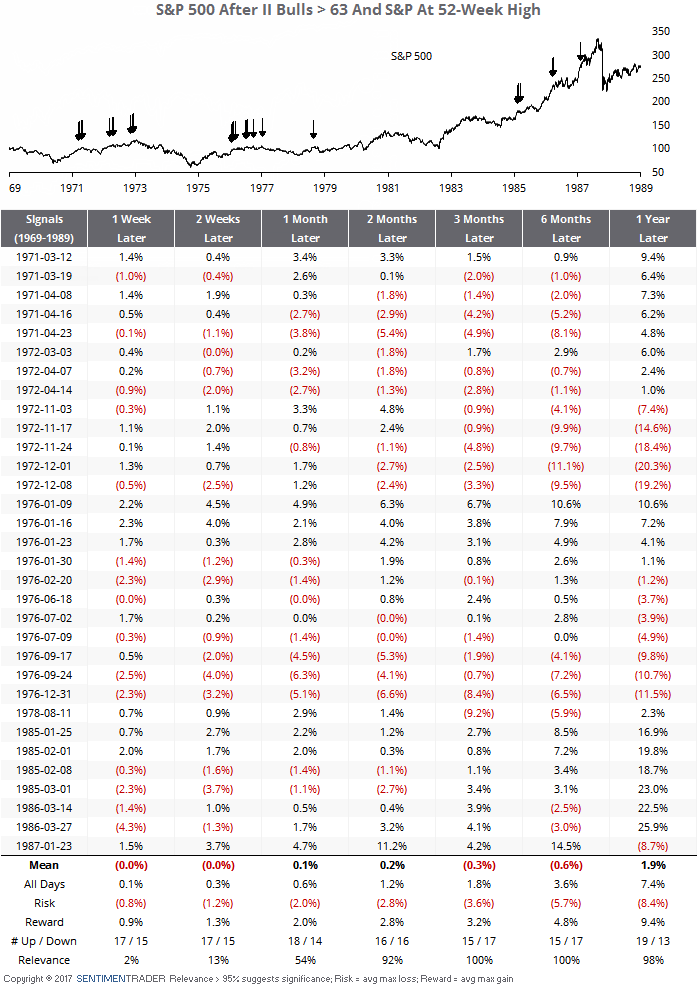

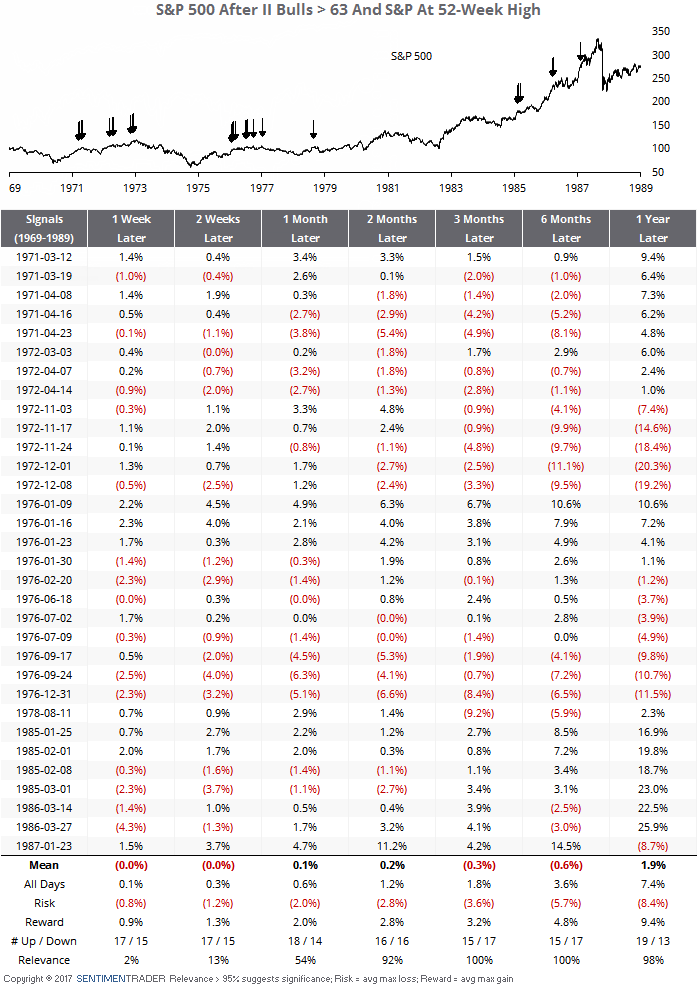

In the survey's history, there have been numerous times that bulls were this optimistic and prices were at one-year highs. The survey was much more volatile prior to the past 30 years, so after 1987 we haven't seen extremes like this.

So let's focus on the 70s and 80s when the survey swung back and forth more, and look at the times when the percentage of bulls exceeded 63%. Results are shown below.

It was not necessarily the precursor to an immediate peak (witness 1987), but returns were below-average in the weeks and months ahead. Over the next 3-6 months, the S&P had a negative return, negative risk/reward ratio, and was negative more often than positive.

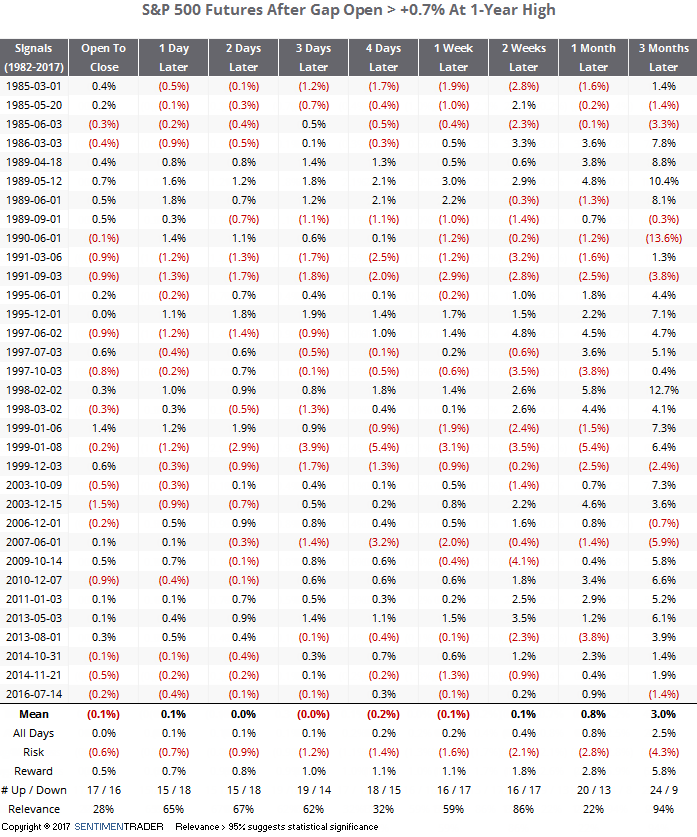

We've seen that in most studies in recent weeks, all to no avail. Futures are showing largish gains this morning and are trading above all prior prices. The table below shows every time since the inception of S&P 500 futures when they gapped up as much as they are indicated this morning, and trading at the highest price in the past year.

It's happened once during the past year, last July. Futures stalled over the next day, which was pretty typical. Across most time frames up to two weeks later, average returns were flat or negative and the risk/reward was skewed to the downside.

This is more of the same as we've seen in recent weeks, with poor risk/reward skews for those looking to buy into this momentum. Nothing has worked, so perhaps this is just more hooey. It's hard to ignore the history, though.