Building on a very good year

In February, a double-digit gain for the year in the S&P would have seemed perfectly reasonable. A few weeks later, it would have seemed nearly impossible. And yet here we are.

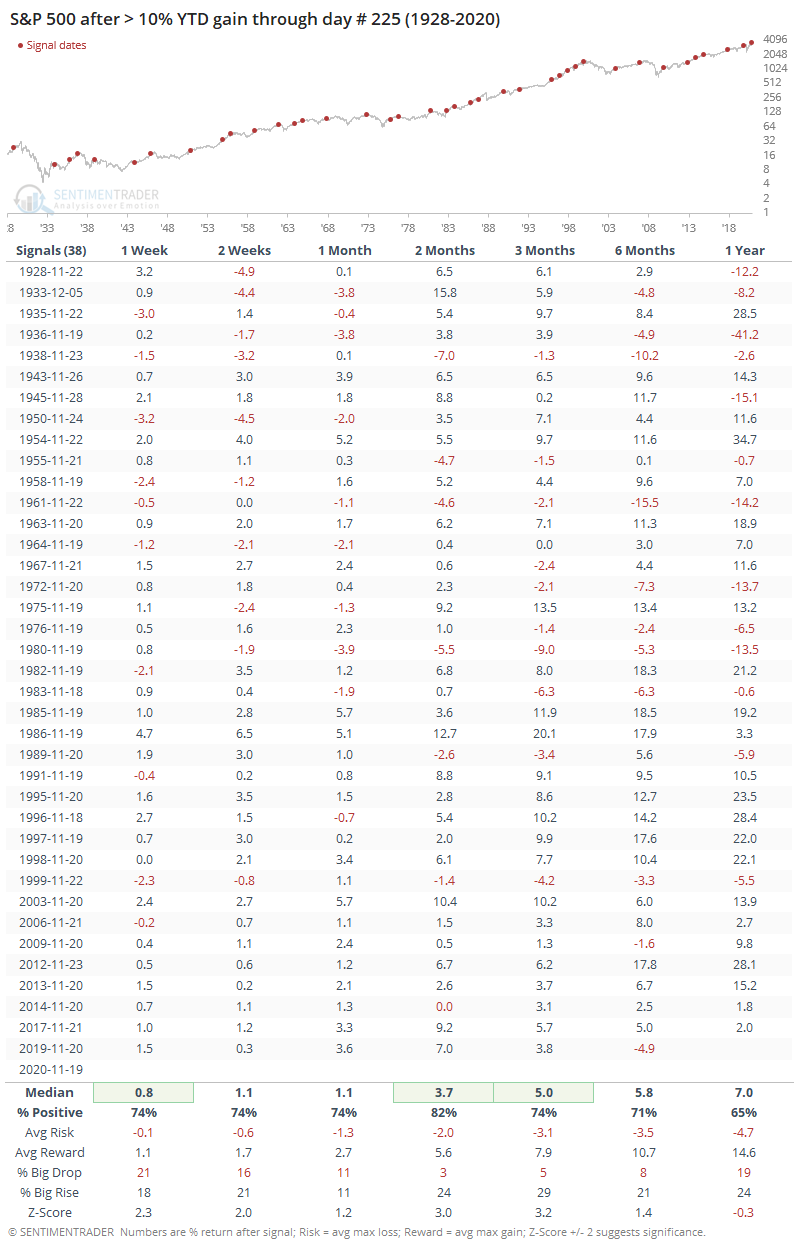

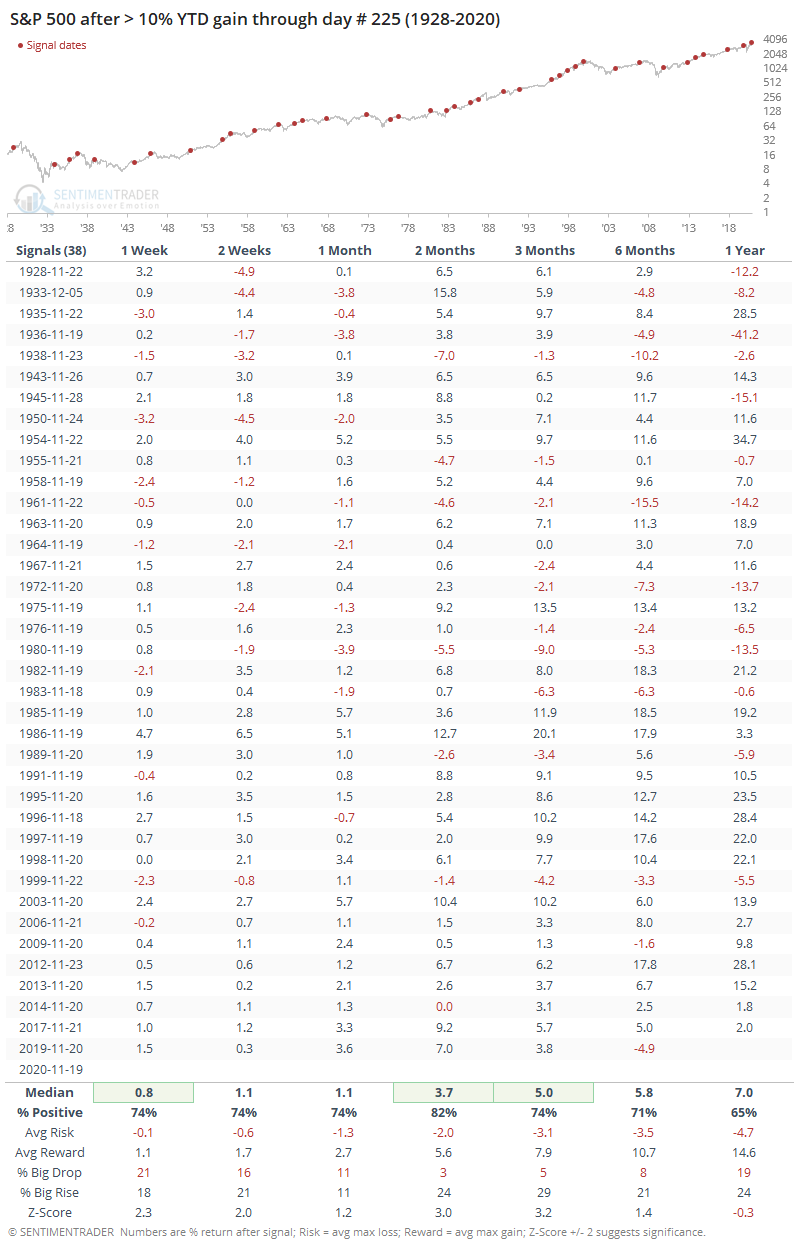

Investment strategist Callie Cox from Ally noted that a double-digit gain in the S&P through these many days of the year has had a good record at preceding even more gains in recent decades as positive momentum builds on positive seasonality.

If we go back to 1928, then there is a long table of instances, and indeed the forward returns were impressively consistent.

Since 1985, there was only a single loss either 2 or 4 weeks later, and both were less than -1%, so recent history has been very kind to these setups.

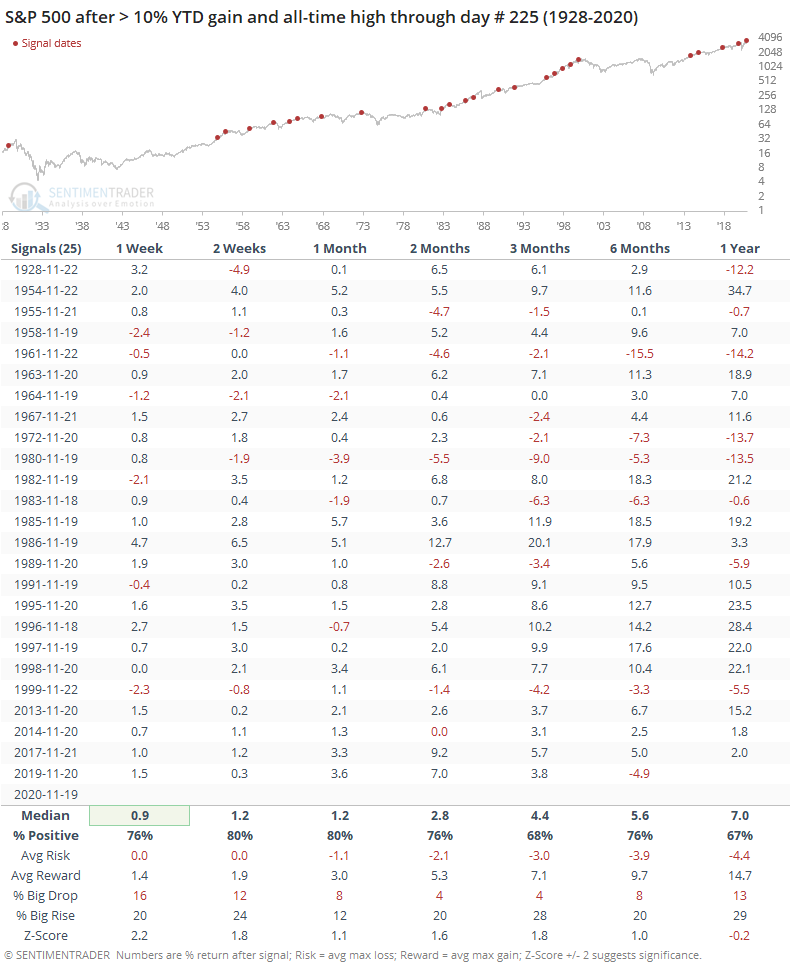

If we further stipulate that the index must have reached an all-time high at some point during the year, then it turns a little less positive, but mostly still showed gains over the next 2-4 weeks.

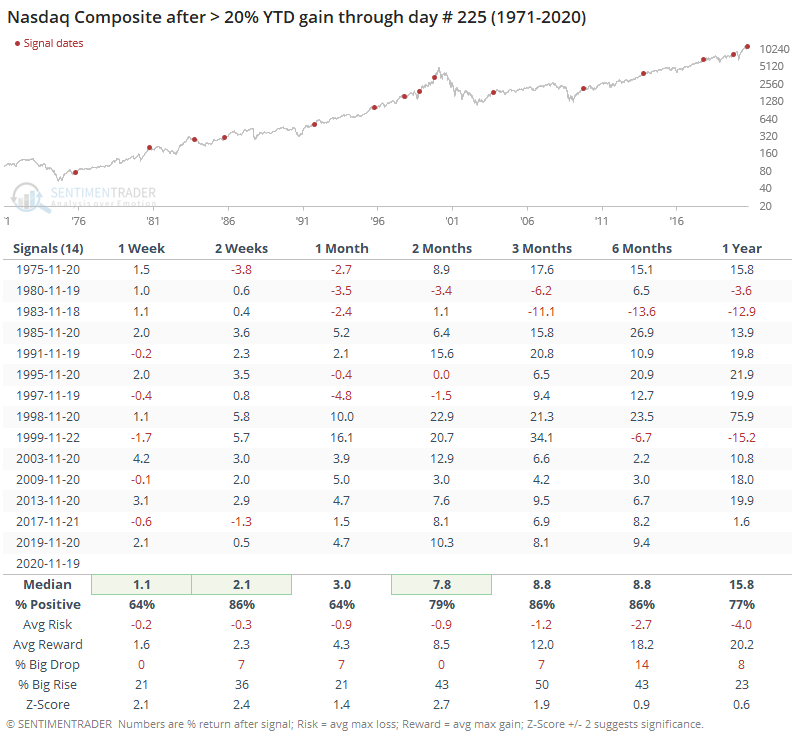

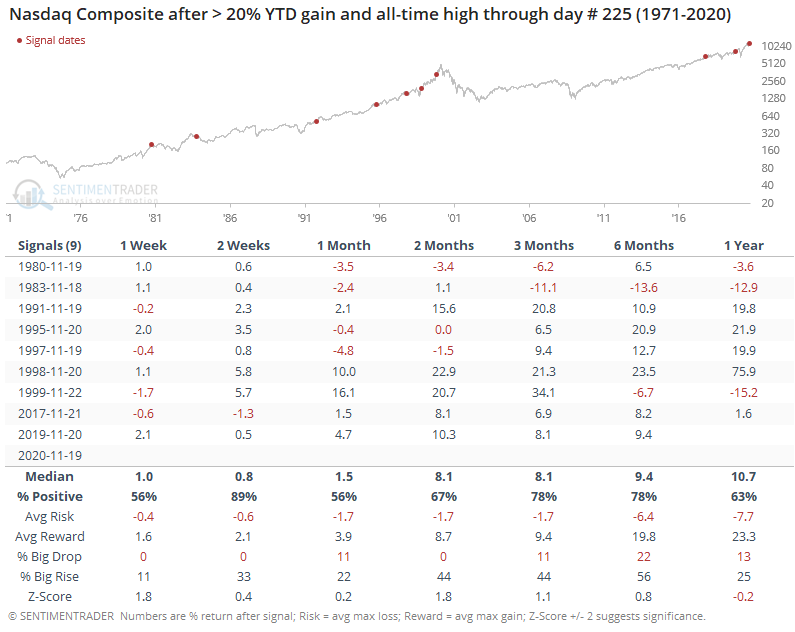

The Nasdaq has been even more impressive, with more than a 30% gain. If we relax that to a 20% gain to generate more of a sample size, then we can see that it, too, tended to continue to rally going forward.

When it had also hit a fresh all-time high during the year, returns moderated somewhat like they did with the S&P, but over the next couple of weeks, there was only a single small loss that was quickly erased.

With a look at recent breadth thrusts and other signs of momentum, we've seen strong evidence that displays like the past couple of weeks have a strong tendency to persist. Seasonality is an iffy factor when it comes to stocks, but the combination of the two have been a compelling sign that the probability of a large and sustained decline seems relatively low.