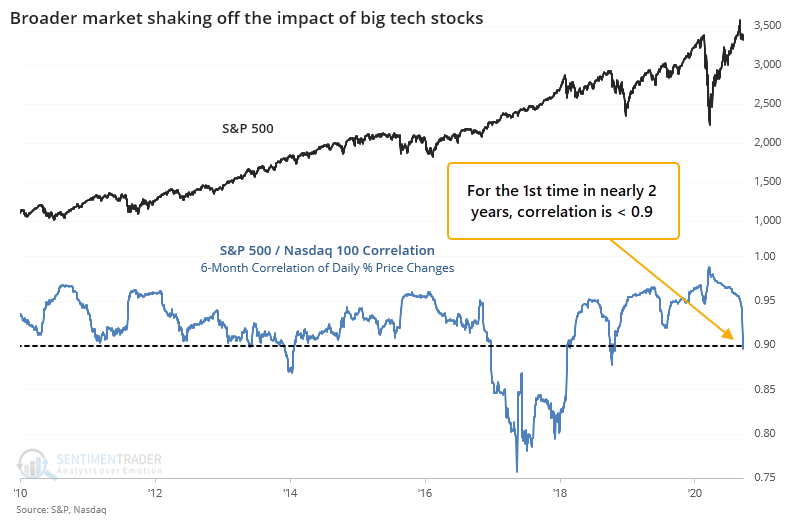

Broader market is shaking off the influence of Big Tech

For the first time in almost 2 years, the broader market is shaking off the influence of the biggest tech stocks.

The newsletter Daily Shot noted that over the past 90 days, the correlation between the S&P 500 and Nasdaq 100 has dived. It's gone on longer than that - over the past 6 months, the correlation between daily changes in the two indexes has dropped below 0.9 (on a scale from +1.0 to -1.0). That's the lowest since 2018.

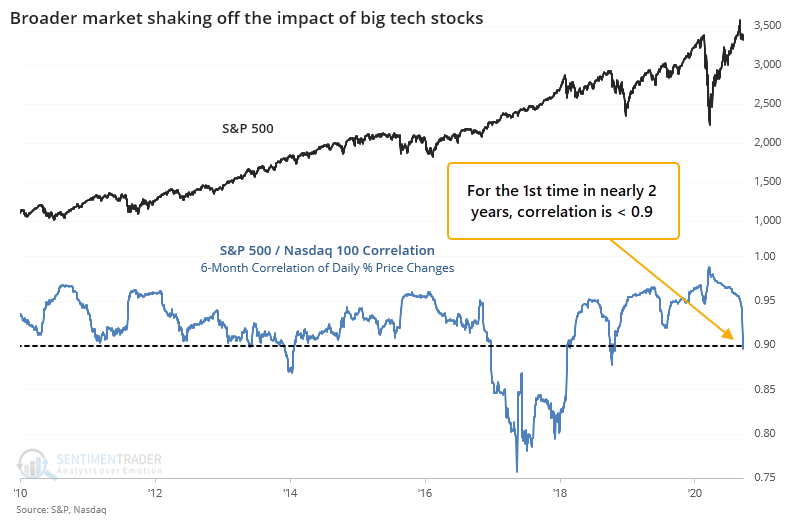

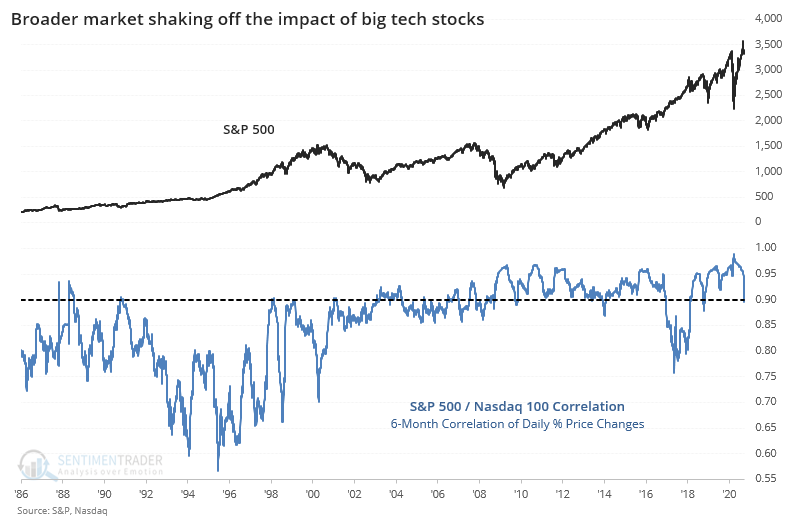

Historically, such a high sustained correlation like we've seen in the past decade is unusual.

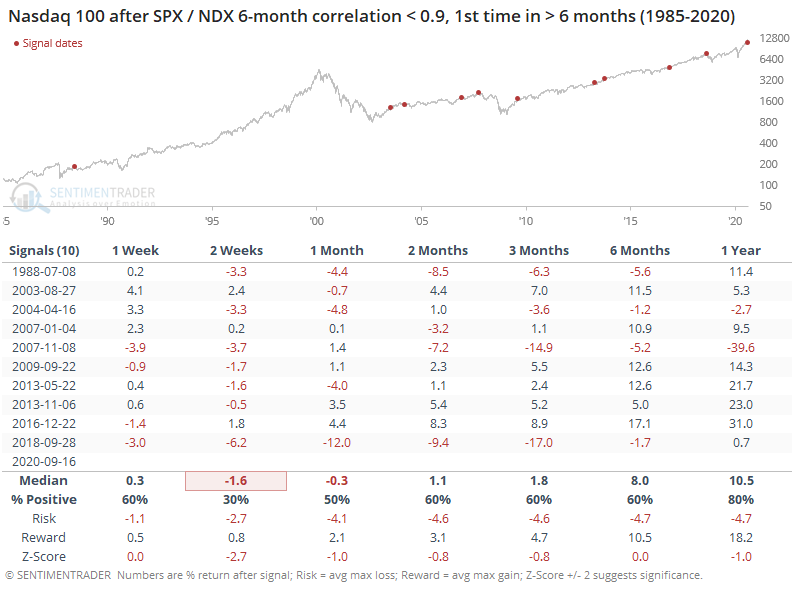

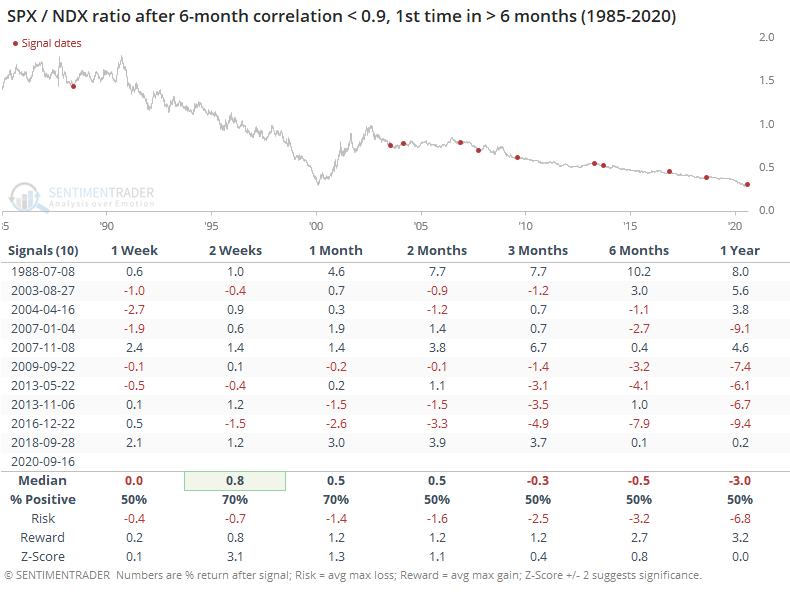

When big tech stocks' influence started to wane for the first time in a while, it weighed on their shorter-term returns.

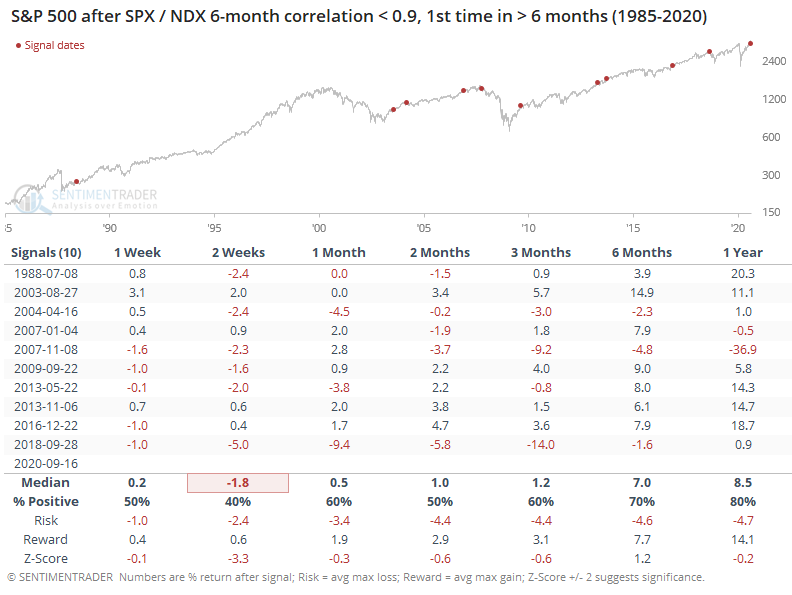

Same for the broader market but to a lesser degree.

That means the ratio between them favored the S&P over the shorter-term but since so many of the signals occurred in the past 20 years, the longer-term trend was still away from the S&P and toward the Nasdaq.

While these big stocks led the market on Monday, when their influence starts to wane, it's been at least a shorter-term positive influence for the broader market.