Broad display of medium-term uptrends during long-term downtrends

As we monitor the rally for health and watch how many stocks, industries, sectors, and countries are able to hold their trends, we're seeing an unusual battle between time frames.

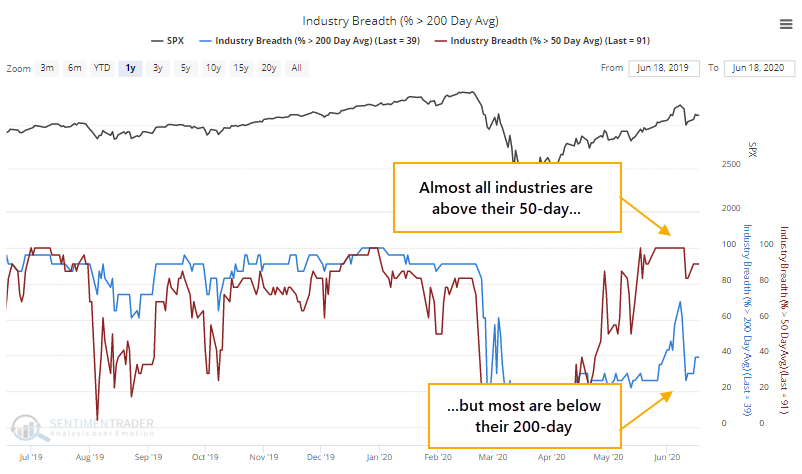

For about half of the trading days over the past month, almost all industry indexes have managed to hold above their 50-day moving averages, but not even half of them have held above their 200-day averages.

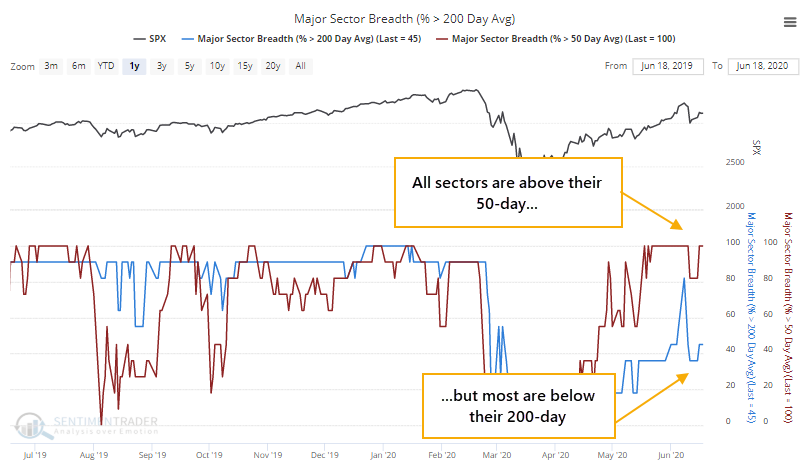

Same goes for the major sectors. Because there are fewer of them, it's even more extreme. All sectors have consistently held above their 50-day, while less than half of them have managed to hold their 200-day.

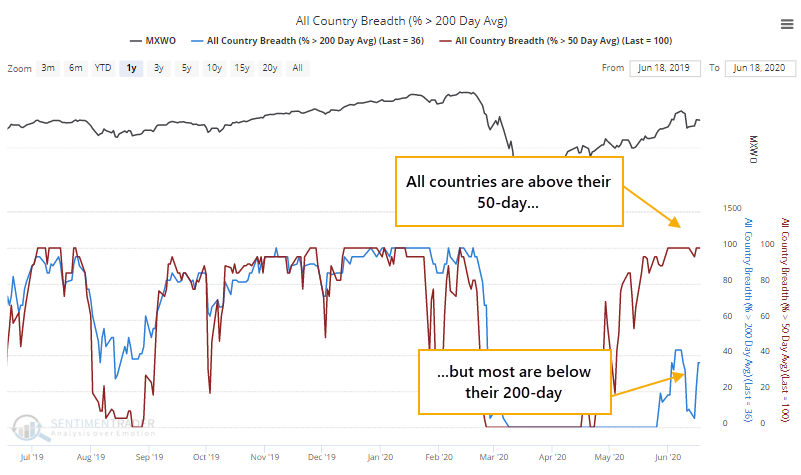

We're seeing almost the exact same thing among major world equity indexes, with all of them above their 50-day but few above their 200-day.

When we see breadth thrusts, like an overwhelming majority of stocks and indexes trading above their 50-day averages, it has consistently signaled intense buying interest that tends to continue. But when we see fewer than 60% of stocks and indexes holding above their 200-day averages, that has tended to occur during unhealthy markets, like we saw on Thursday.

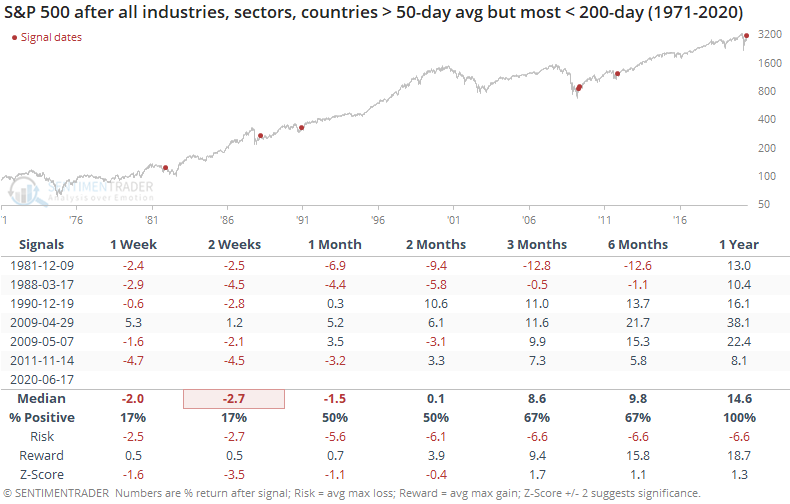

Going back as far as we can, the table below shows other times when there was this kind of protracted battle between all (or almost all) industries, sectors, or countries trading above their 50-day moving averages while less half of them managed to hold above their 200-day averages. The signals only include dates when this tension triggered for at least 10 out of 20 sessions.

It's no surprise that every one of them triggered during the initial kick-off from deeply oversold conditions. These are times when a market decline was protracted and deep enough to push almost all equities into downtrends, then there was a medium-term burst of optimism and buying pressure.

By the time it reached this level, stocks were tired. The S&P managed to add to its gains only once over the next couple of weeks. The decline persisted in 1981, but that was really the only false signal. The rest were good indications that the bulk of the decline was over, and markets were on the path to recovery.

Like most of the other developments we've seen in recent weeks, this suggests shorter-term risk, but longer-term reward.