Breaking the S&P's medium term trend

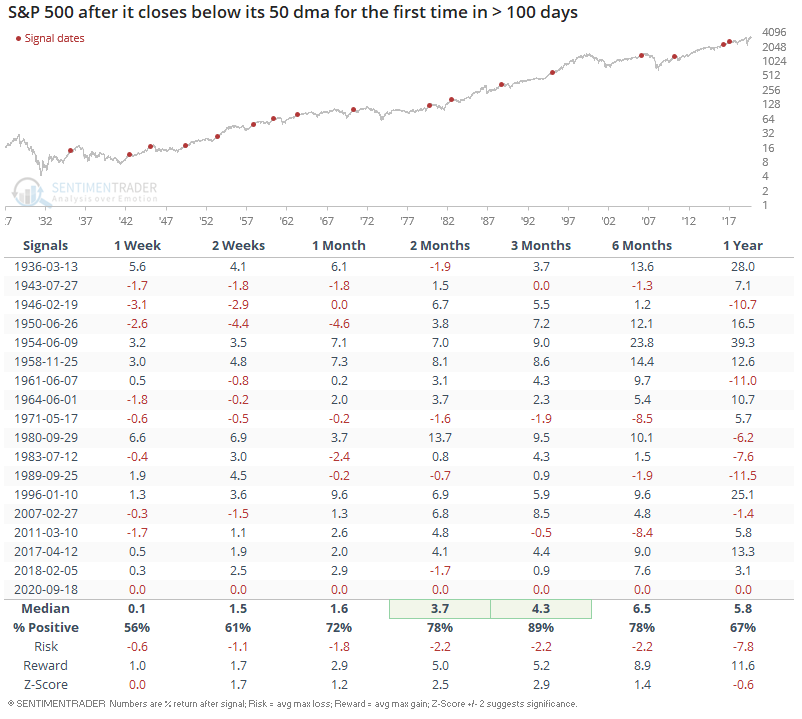

The S&P 500 has finally closed below its 50 dma, its medium term trend. A rather common belief is that a breakdown below the 50 dma leads to a follow-through on the downside, although empirical evidence proves that this belief is little better than a 50-50 coin toss.

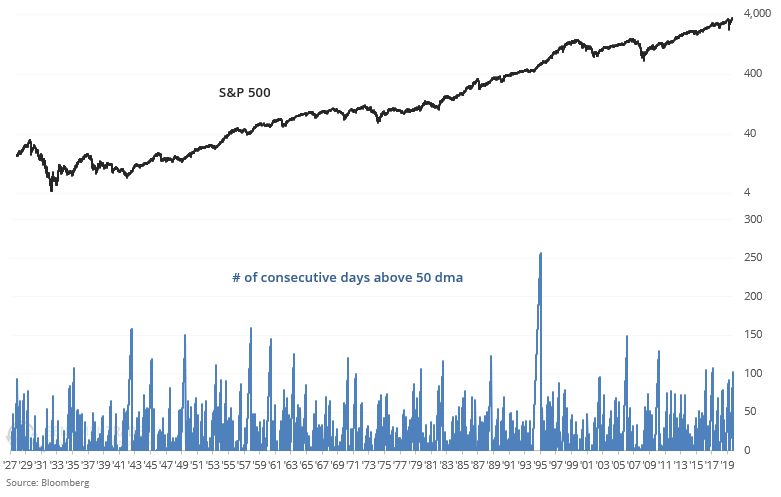

However, there is somewhat of an edge when such breakdowns occur after a long streak:

When the S&P closed below its 50 dma for the first time in more than 100 days, the S&P usually rallied over the next 3 months. This is an example of strong momentum:

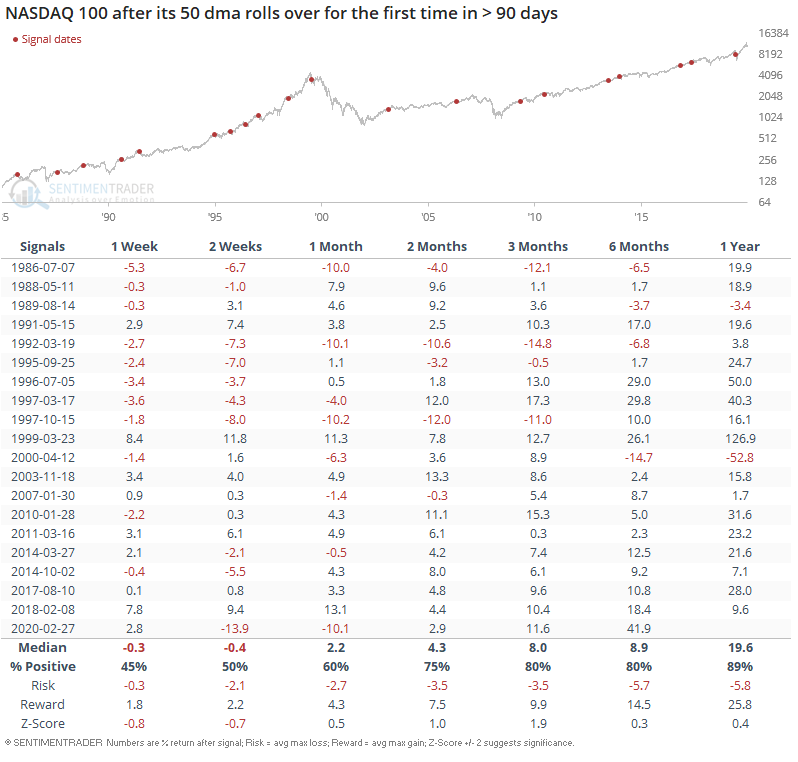

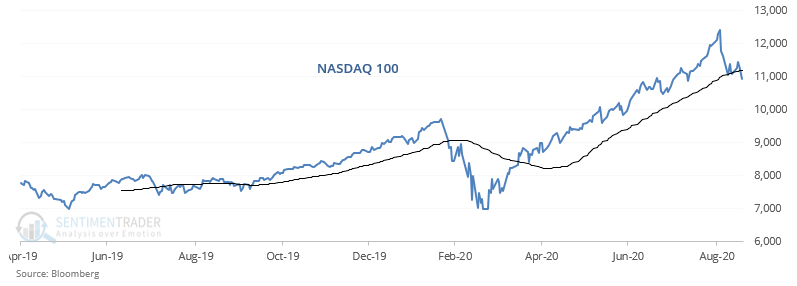

Moreover, the NASDAQ 100's 50 dma will soon roll over for the first time in many months:

Similarly, such strong momentum led to above average returns over the next 3 months: