Breadth thrust reaches the high-yield bond market

Key points:

- The McClellan Oscillator for high-yield bonds has surged to an extremely high level

- Similar displays of internal momentum preceded weak short-term returns but strong medium-term ones

- High-beta funds like QQQ, IBB, and EEM also did well, as the VIX tended to drop hard

A surge in high-yield internal momentum

We've looked at breadth thrusts a lot in recent weeks, including surges in the McClellan Oscillator for the S&P 500 and the entire Nasdaq exchange.

It's not just in stocks; it's also happening in the high-yield bond market, an important development. We already saw that the market was oversold, with heavy and persistent selling. It has tried to recover over the last couple of weeks and has been relatively successful. While there are still fewer bonds rising to 52-week highs than falling to 52-week lows, a major no-no, there are some nascent signs of recovery.

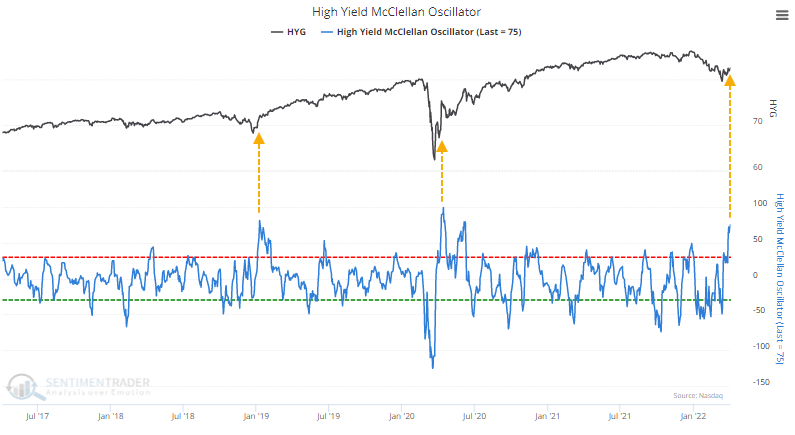

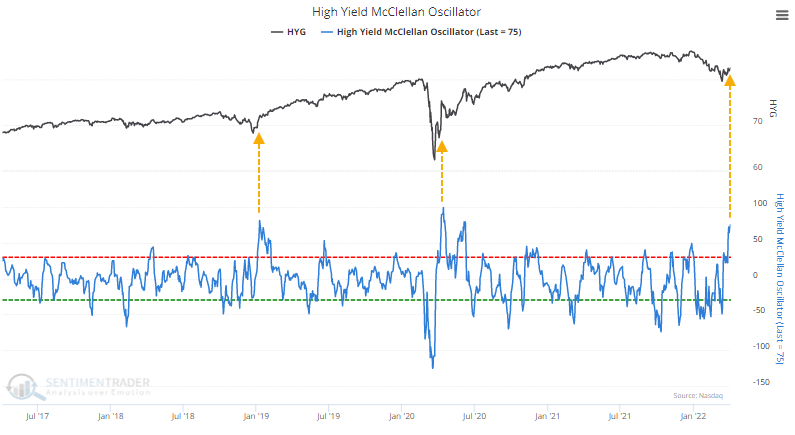

As we saw in the S&P 500 and Nasdaq, the McClellan Oscillator for the high-yield bond market has surged. The indicator looks at the spread between short- and medium-term moving averages of the net number of advancing high-yield bonds each day. It just hit +75 for only the 3rd distinct time in the past 5 years.

The Backtest Engine shows that since the inception of the data, which unfortunately is only 15 years ago, there have been 29 days when the Oscillator reached this high of a level. The iShares iBoxx High-Yield Corporate Bond Fund (HYG) showed consistently weak short-term returns as buyers took a breath. But by 2 months later, the momentum reasserted itself, and returns were exceptional in the months following. Granted, most of the study period was dominated by healthy market environments.

The high-yield bond market has a high correlation to the stock market. If we substitute the S&P 500 for HYG in the backtest, we can see similar behavior in that index. The S&P struggled in the short-term but showed impressive medium to long-term returns.

High-beta funds tended to do well, volatility funds not so much

According to Bloomberg calculations on a list of popular ETFs and indexes, the most positive 3-month correlations to HYG are mostly higher-beta stock funds. Funds with a correlation higher than +0.65 include popular ones like QQQ, IBB, and EEM.

Using the Backtest Engine to test surges in the high-yield Oscillator against the QQQ Nasdaq 100 tech fund, returns were very weak short-term but exceptional from 3-months and beyond.

We can see similar behavior in biotechnology funds like IBB.

Emerging markets also had a high positive correlation. While EEM didn't suffer as much short-term, medium- and long-term returns were fantastic.

The table below shows funds with the most negative 3-month correlations to HYG. It's dominated by volatility funds, which struggle even in the best of times, but when stocks rally, volatility tends to contract, and these funds burn money.

Indeed, the VIX performed very poorly. Only a single day out of 38 total managed a positive return 6 months later, and that was a low 2%.

What the research tells us...

It's important for stock investors to see positive momentum in the high-yield bond market. We've witnessed the first signs of that, but that has typically preceded a short-term pullback as buyers retrench. While history is limited, other times we've seen this kind of surge among high-yield bonds, any short-term retracement tended to be a strong buying opportunity for medium- to long-term investors in funds like HYG, SPY, QQQ, IBB, and EEM.