Breadth Thrust In Euro Stocks

With the big rally in major stocks in the eurozone (at least in euro terms), the most impressive breadth readings in the world have now been recorded in those stocks.

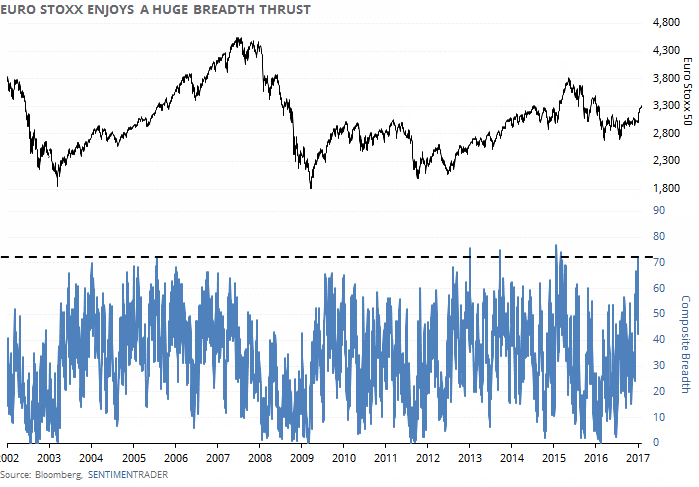

Looking at an array of indicators across time frames, we can see that there has been a huge block of buying interest in the stocks that make up the Euro Stoxx 50 index.

- % of members > 10-day average: 86%

- % of members > 50-day average: 96%

- % of members > 200-day average: 82%

- % of members at a 1-month high: 70%

- % of members at a 3-month high: 58%

- % of members at a 1-year high: 40%

All of those readings individually are among the highest in 15 years, so it's no surprise that if we take a simple average of them, the current reading of 72% is also among the best in that span.

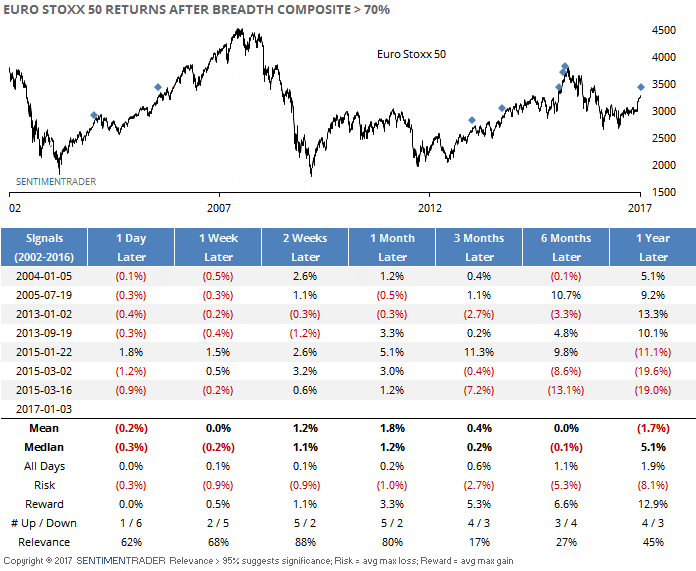

It's hard to see from the chart what that led to, so the table below outlines the returns in the Euro Stoxx 50 index when this composite breadth reading exceeded 70%. These are in euro terms.

We can see that other than a short-term breather, the index tended to do well over the next several weeks. Its best performance was 2-4 weeks later when it was higher 5 out of 7 times, with an impressive average return and risk/reward ratio. After that, it was less consistent as some selling pressure came in.

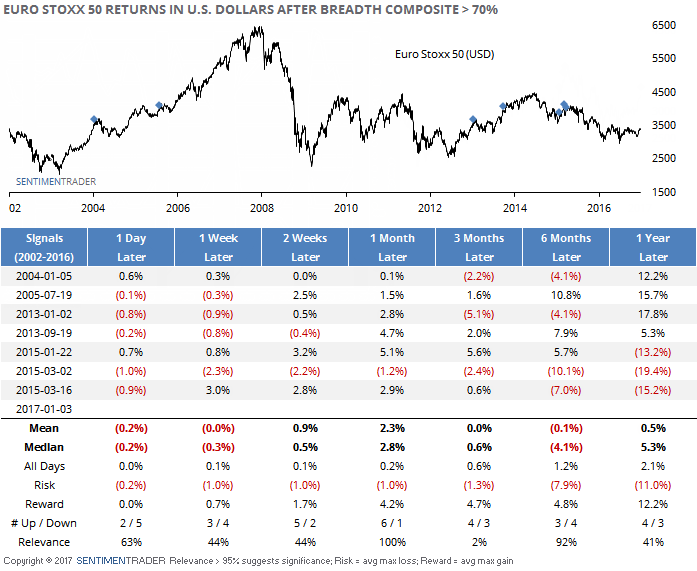

Now let's look at it in U.S. dollar terms:

The same pattern holds, but it tended to do even better over the next month, and worse over the next six months as currency effects had more of an impact.

The thrust we've seen to start the year in these stocks should lead to something of a pullback in the short-term as buyers rest, but in the weeks ahead, it would be unusual if that was "it" for the momentum and we didn't see another run higher. In the U.S., the most popular ETF that mimics the index is FEZ.