Breadth Thrust From The Low; Record Stock And Bond Fund Outflows

This is an abridged version of our Daily Report.

Get me in

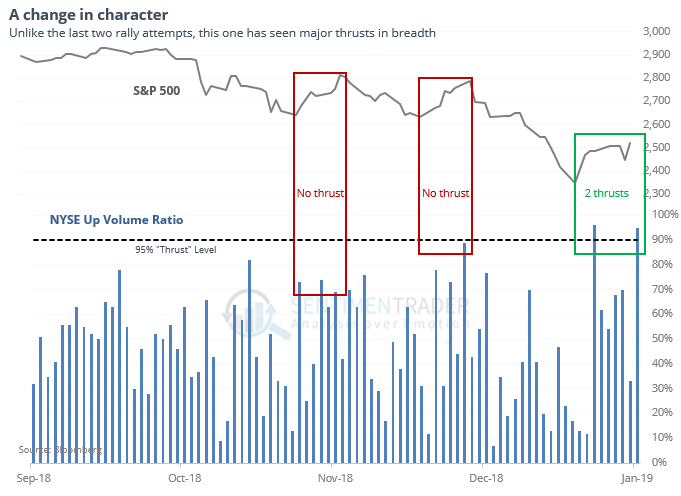

During rally attempts in November and December, one worry was that there were no strong thrusts in breadth. Both failed. During this latest rally, there have been two such days, so strong that there are few historical precedents.

Maybe it’s just a function of machines, but if this is actual human demand, it has impressive implications for forward returns. Since 1962, the S&P rallied over the next three months all 7 times.

Get me out

Leading up to this rally, investors had been heaving their stock and bond funds. Over a four-week period, outflows from both stock and bond funds exceeded more than 0.2% of assets on average each week, a 15-year record for both markets.

Both markets rallied after other large outflows from investors.

Okay, out then in

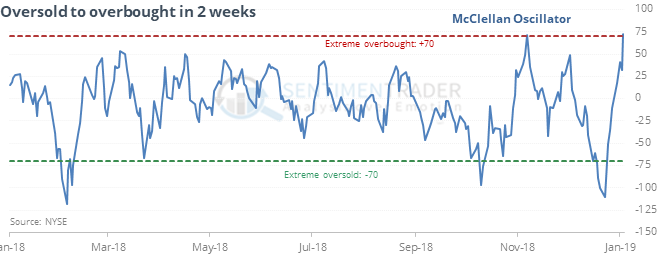

The McClellan Oscillator has gone from an extreme oversold reading to an extreme overbought one in near-record time.

This kind of quick switch from one extreme to the other has preceded long-term trend changes. Over the next year, every signal was positive, and with an impressive average return.

NOTE: The Commitments of Traders report will continue to be delayed as long as the Federal government shutdown persists, so hedger positions et al cannot be updated.