Breadth Momentum Improves As Equal Weight S&P Lags

This is an abridged version of our Daily Report.

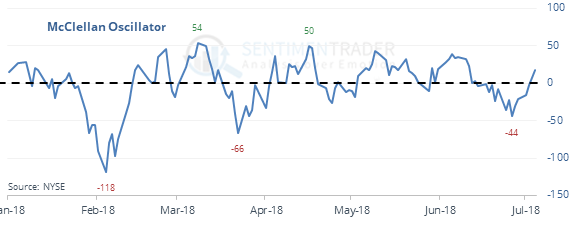

An uptick in momentum

The McClellan Oscillator has turned positive after weeks below zero.

In a bull market, that has led to good medium-term returns, especially since 1984 when it led to gains over the next 6 months 18 out of 20 times.

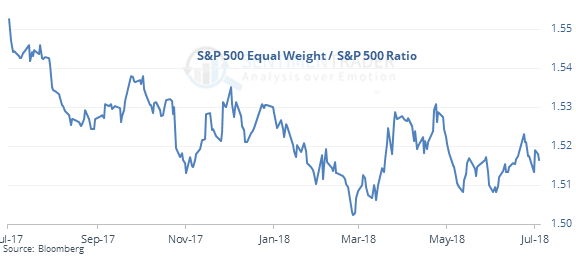

Don’t forget the troops

An equal-weight S&P 500 index is lagging at a time when small-caps are leading.

This is exceptionally unusual and has led to future outperformance for the equal-weight S&P 500 index relative to the capitalization-weighted one.

Nice move in biotech

The Nasdaq Biotech fund, IBB, gapped up more than 1% then added another 1% during the session, closing at a 100-day high. Over the funds history, it has added to the gains over the next couple of days 9 out of 13 times.

Coffee relief

On Thursday, we saw how coffee had a rarely-seen level of pessimism. On Friday, futures jumped the most in a year. Since 1980, coffee has gone from a 52-week low one day to the best gain in a year the next day 3 times.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |