Breadth is recovering, too

Earlier, we looked at recoveries in sentiment from deep pessimism. Short-term returns were not encouraging, especially during unhealthy market environments. If stocks can continue to recover despite "not pessimism," it will go a long way toward the idea that we're still in the midst of a mostly positive long-term market trend.

Optimism has been returning because more and more stocks have been coming along for the ride.

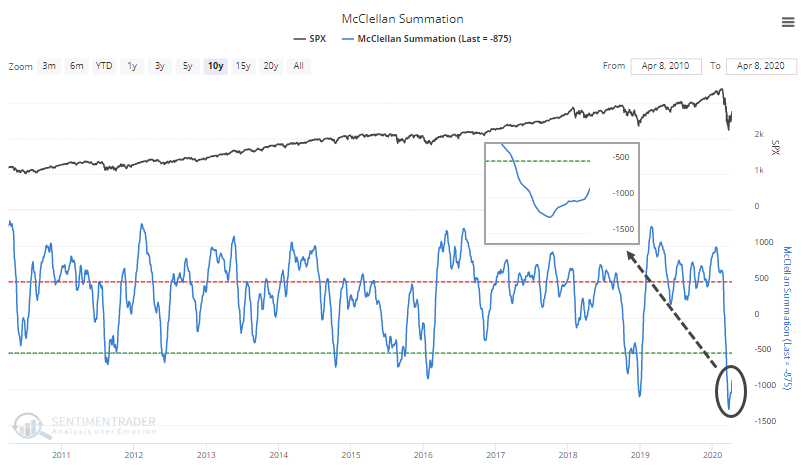

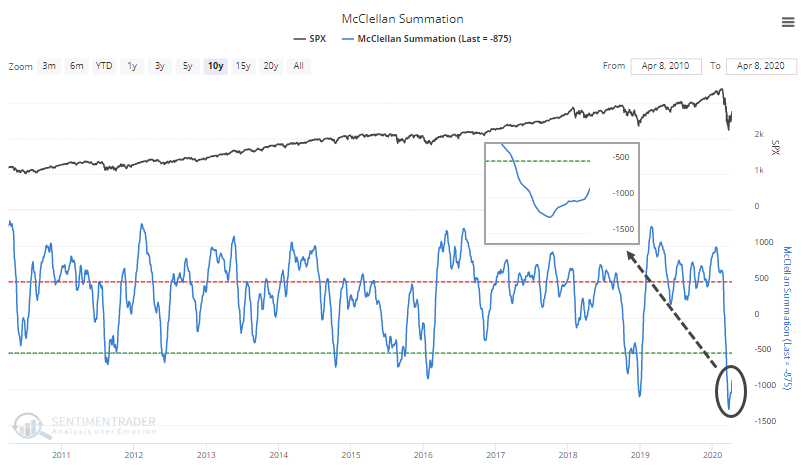

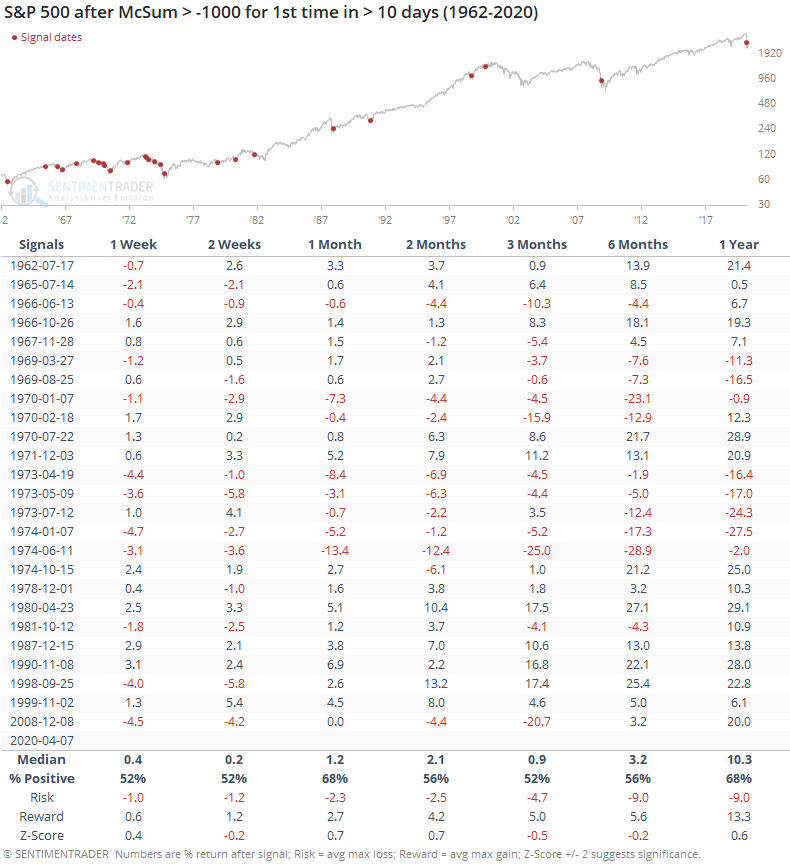

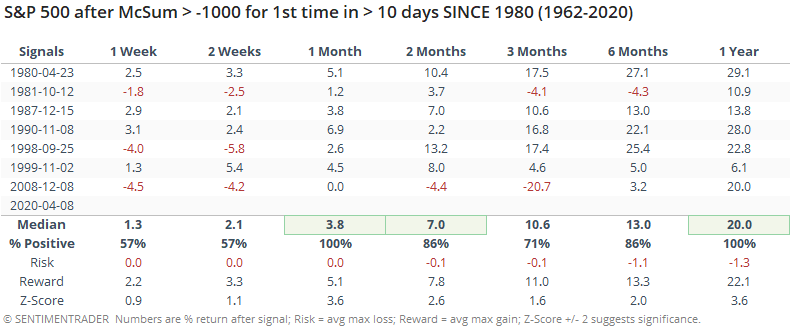

The long-term McClellan Summation Index is curling higher after the most oversold reading in a decade. It has climbed above -1000 after several weeks below.

Similar recoveries led to a mixed bag of returns, especially in the 1970s.

In recent decades, returns were much more consistently positive.

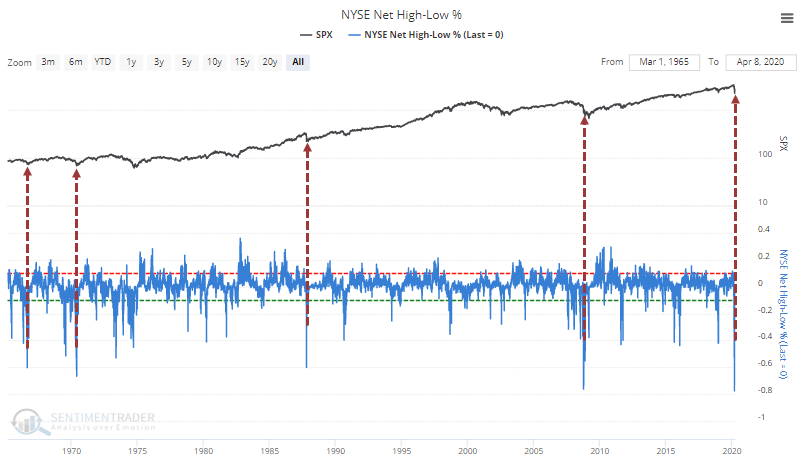

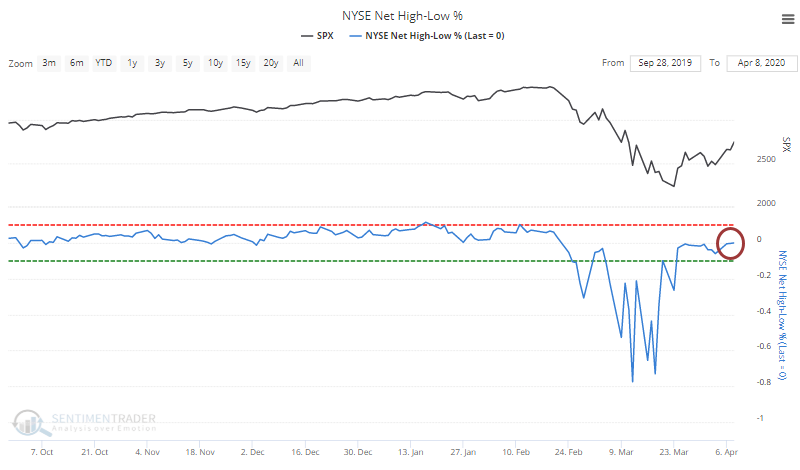

In March, we noted that 52-week lows were hitting rarely-seen or even record levels.

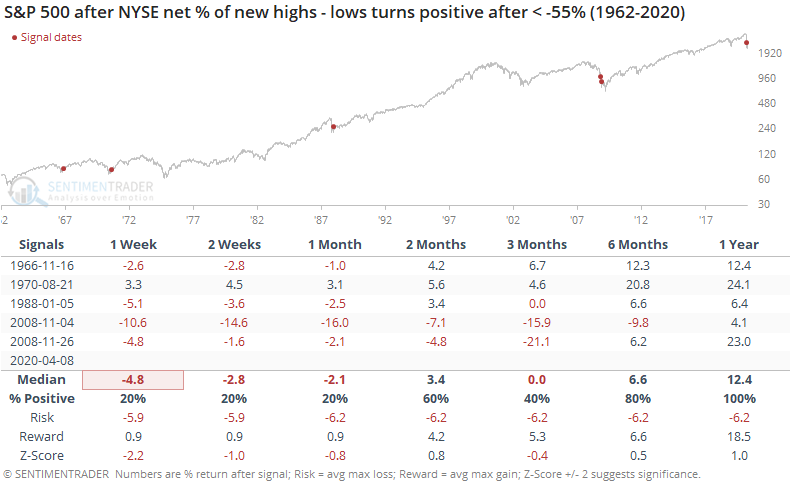

By Wednesday, there were finally more securities hitting 52-week highs than 52-week lows on the NYSE, reversing more than a month with more lows than highs.

Similar recoveries preceded some short-term ugliness, but longer-term positive returns. A year later, the S&P was higher all five times. Those false starts in November 2008 were painful, though.

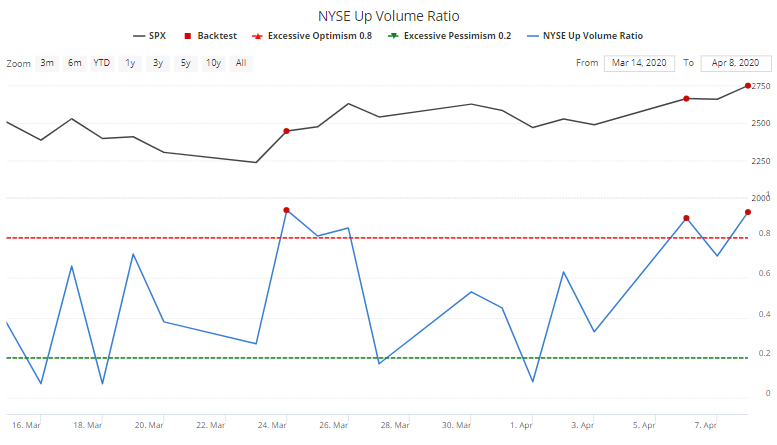

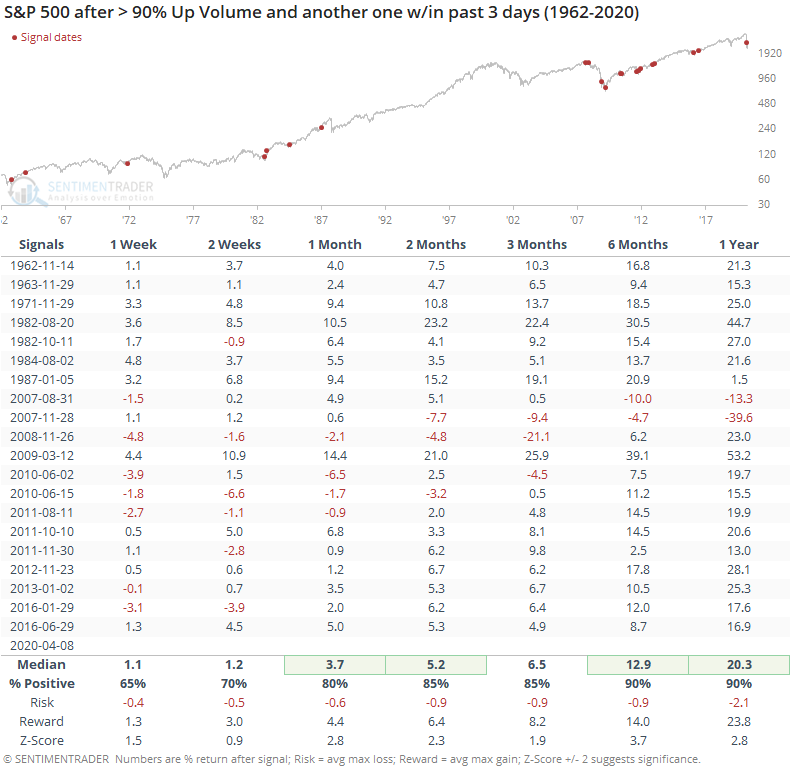

Several times over the past two weeks, we've looked at breadth thrusts as buyers returned to stocks in force (here and here and here). It's been the single most compelling aspect to this recovery, and it continued on Wednesday. Many analysts consider it important when more than 90% of NYSE volume flows into issues that advanced on the day. It's now done so twice in within 3 days.

Seeing multiple 90% Up Volume days so close to each has led to impressive returns, with an even more impressive risk/reward ratio.

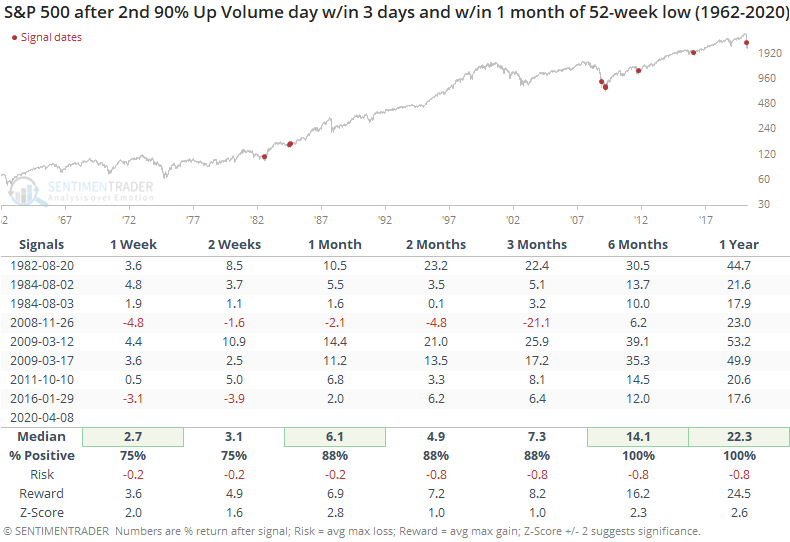

While we should always be skeptical of anything that claims to be perfect, when we've seen these double 90% days within a month of a 52-week low on the S&P 500, future returns were, indeed, perfect over the next 6-12 months. Those 1-year returns are stunning.

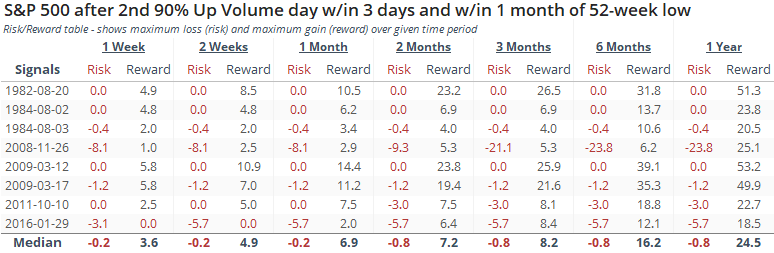

The risk/reward following these were excellent with the sole exception (and it was a big one) being November 2008.

Like we saw after times when sentiment recovered from deep pessimism, recoveries in breadth have preceded some heavy short-term volatility, usually meaning a drop over the next week or two.

The biggest mitigating factor - and it's been a factor for two weeks now - is the overwhelming thrust in buying pressure. Even if markets are being driven by algorithms making breath data less reliable, until these measures fail consistently they deserve attention. And nothing is screaming louder than these repeated days with huge buying interest. The short-term outlook is increasingly cloudy given the recoveries in so many indicators, but it's suggesting more and more that longer-term returns should be positive.