Breadth is breaking out

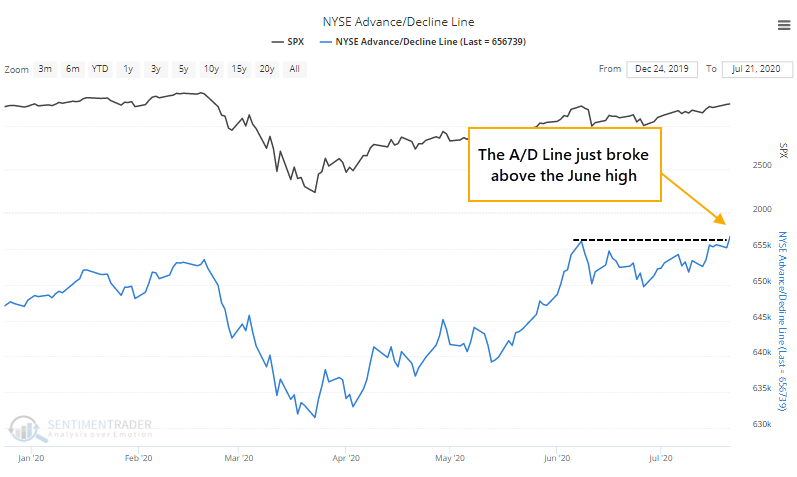

The NYSE Cumulative Advance/Decline Line has just broken out to a new high, exceeding its peak from June, which in turn exceeded the peak from February.

The line is constructed simply by adding each day's difference between the number of advancing and declining securities on the NYSE to the prior day's total. The more consistently we see more securities rising than falling, the higher the line will climb.

This is supposed to be a good sign, especially with major indexes not necessarily breaking out at the same time. If most securities are mostly rising, then it should eventually drag stocks higher.

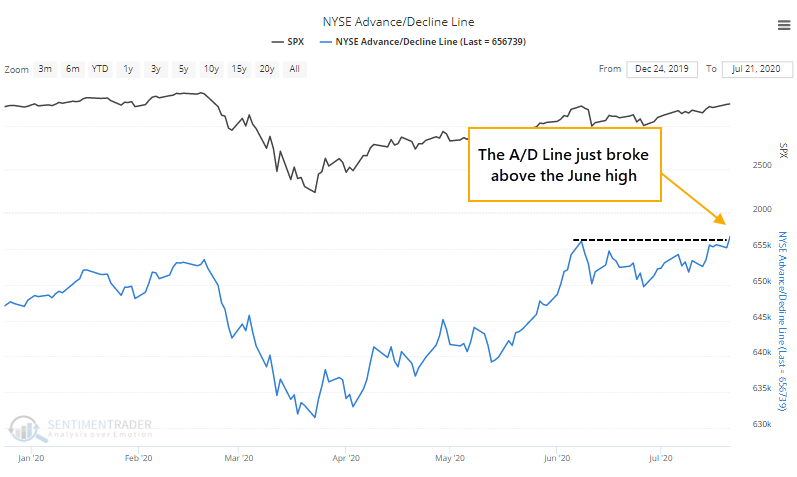

Well, let's check. Below, we can see every time since 1940 when the S&P 500 was more than 3.5% below its own 52-week high as the Advance/Decline Line breaks out.

While it's always tempting to think that a breakout in the Advance/Decline Line is a sign that liquidity is plentiful and it's only a matter of time before the S&P gets pulled to a new high as well, it took a median of 83 trading days before it did so. Its forward returns were mediocre at best, with most time frames showing below-average results (a negative z-score) and an uninspiring risk/reward ratio.

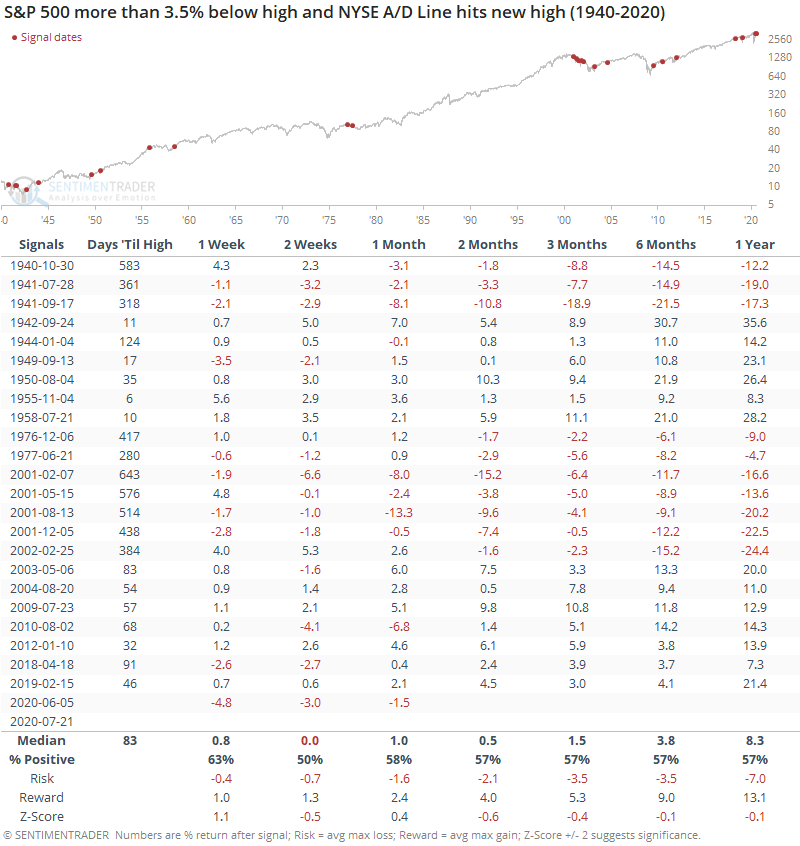

It's clear that "something else" is driving the Advance/Decline Line besides just stocks - there are all kinds of securities that trade on the NYSE. And we can see from the High-Yield Bond Cumulative Advance/Decline Line that many rate-sensitive issues, of which there are many on the NYSE, have been doing well. This isn't a bad thing.

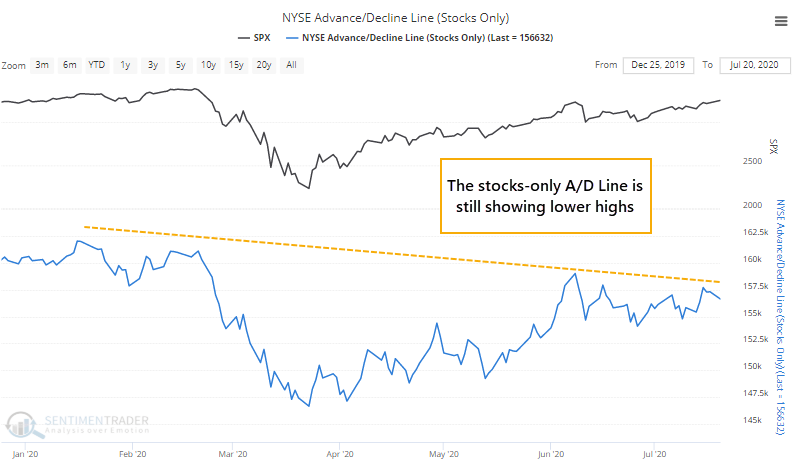

It's just a bit of a worry that the stocks-only line still hasn't broken out. Far from it. This line only includes common stocks, and excludes all the other "stuff" on the NYSE.

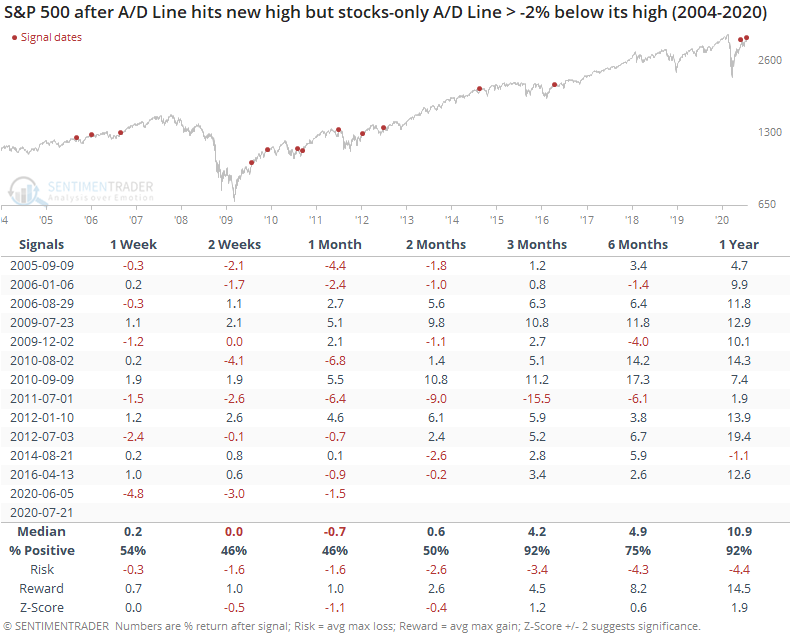

When the all-securities line breaks out for the first time in at least a month, but the stocks-only version lags behind, then the S&P's short-term forward returns were below average. The risk/reward was poor up to two months later.

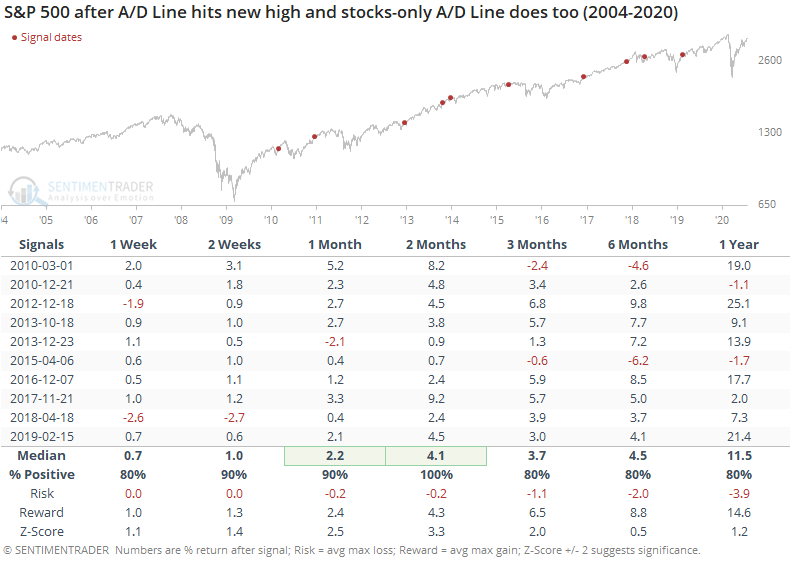

Contrast that to when both lines are at new highs together. Returns were much, much better, with minimal risk going forward.

The new high in the A/D Line is mostly a good thing, but it would be a much better thing if stocks (and the stocks-only A/D Line) were hitting new highs, too. Lags and divergences are generally not a good thing to see. There are also still a worryingly small number of stocks, industries, sectors, and countries trading above their 200-day averages. Healthy markets see these metrics rise, and hold, above 60%.

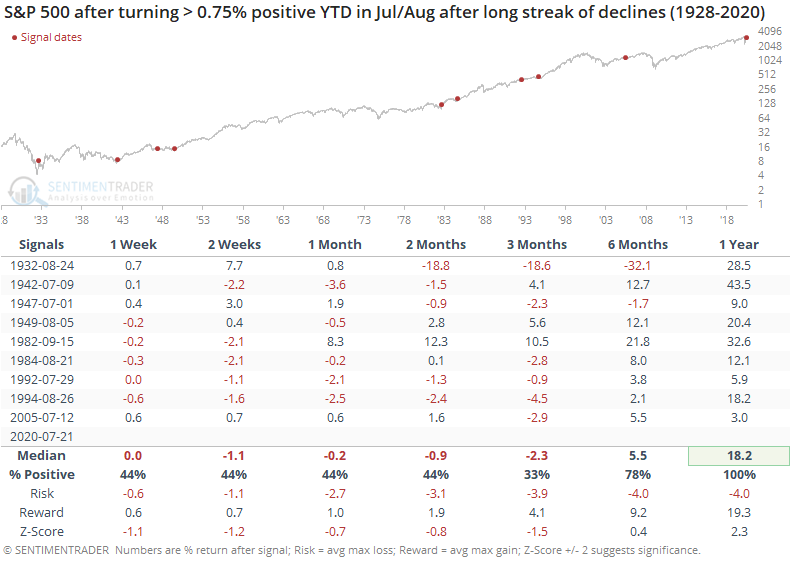

Even though the S&P is still several percentage points off its peak, one development that bulls might want to grasp onto is that the S&P 500 has turned positive year-to-date by nearly 1% for the first time in months. Seasonality isn't a help at this point, though, so when the index manages to come up for air at this point in the year, it hasn't been much help.

The short-term medium-term returns were very poor as stocks struggled through the rest of the summer months, as there wasn't much evidence of investors trying to chase the index higher. The 6-12 month returns, though, were quite good.