Breadth has broken out

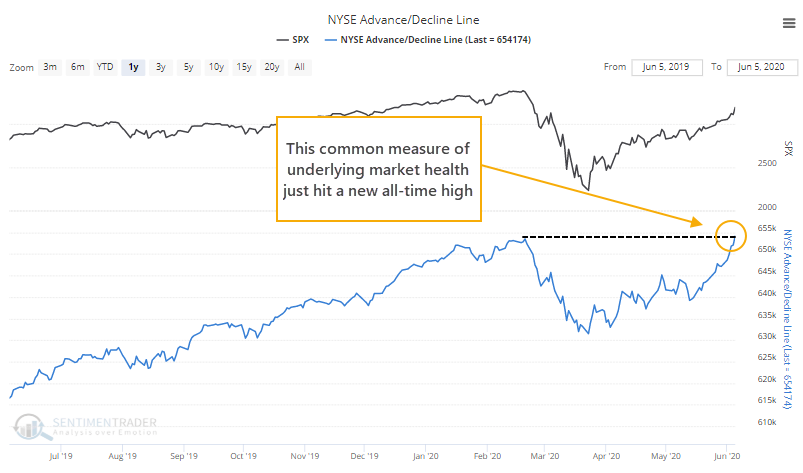

The Cumulative Advance/Decline Line has made a new high.

Reflecting the breadth thrusts and recoveries we've been looking at in recent weeks, enough securities on the NYSE have advanced relative to those that declined that this commonly-cited version of the health of the market has never been higher.

The advance/decline line is often considered to be a measure of liquidity, confidence, and sentiment. While some prefer a version that only monitors common stocks, we've always gravitated toward the one that includes everything that trades on the NYSE. It can be shaken if there are big moves in smaller stocks or those sensitive to interest rates, but that's more like a feature rather than a bug. Aberrant behavior in those sensitive stocks often gives a good heads-up to risks (or rewards) in the broader universe of common stocks.

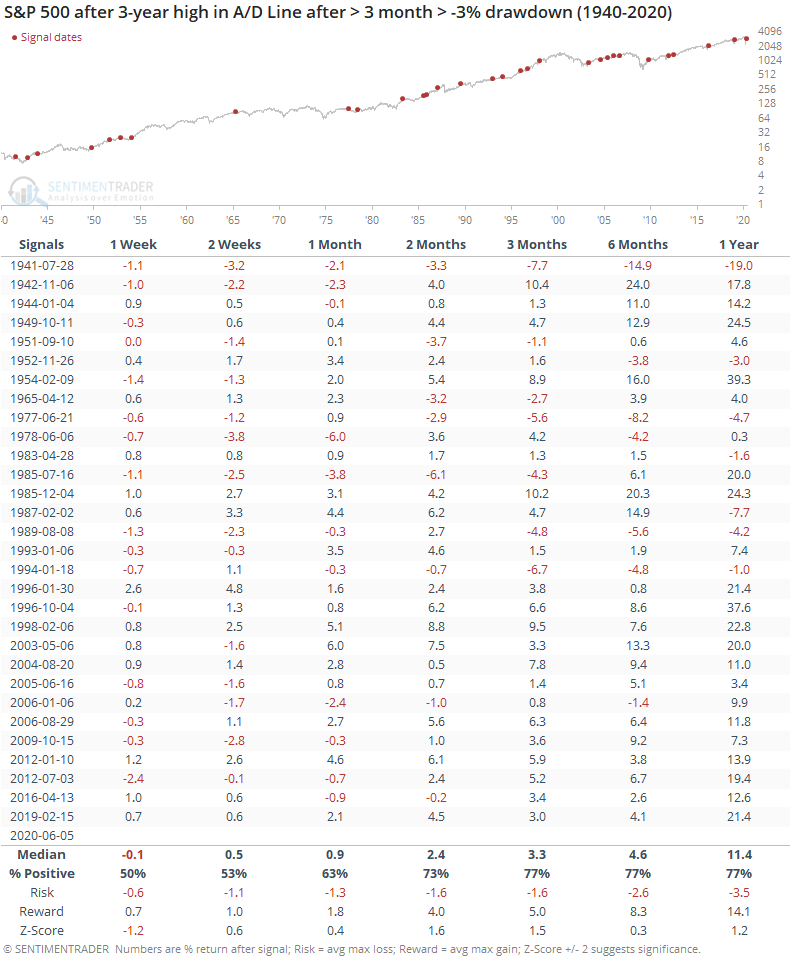

When the A/D Line has made a new high for the first time in months, following at least a moderate drawdown, it has been mostly a good sign.

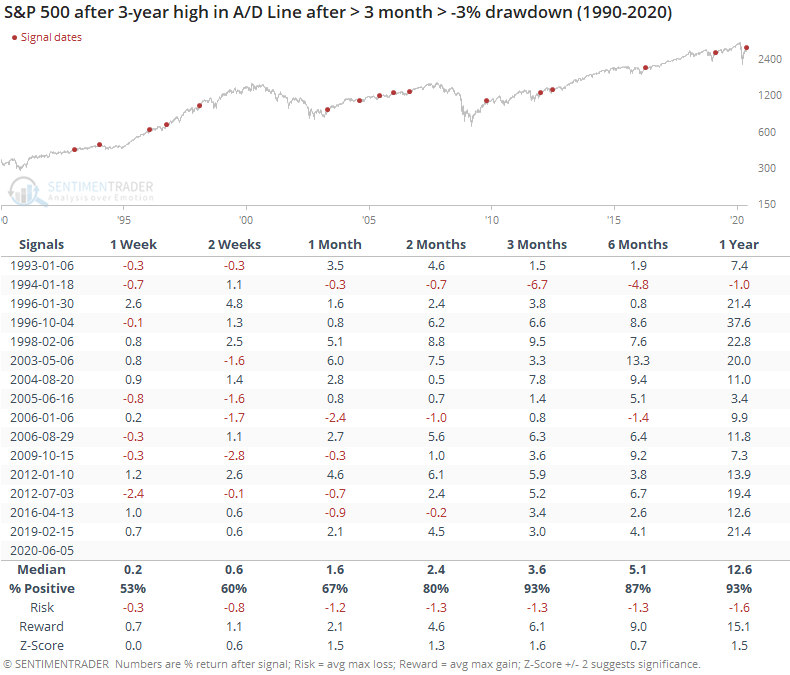

Most of the negative returns triggered in earlier decades. It has been a much better sign over the past 30 years.

Since 1990, there have been only isolated losses, and even those were relatively small. The risk/reward skew during the next 2-12 months was impressively positive.

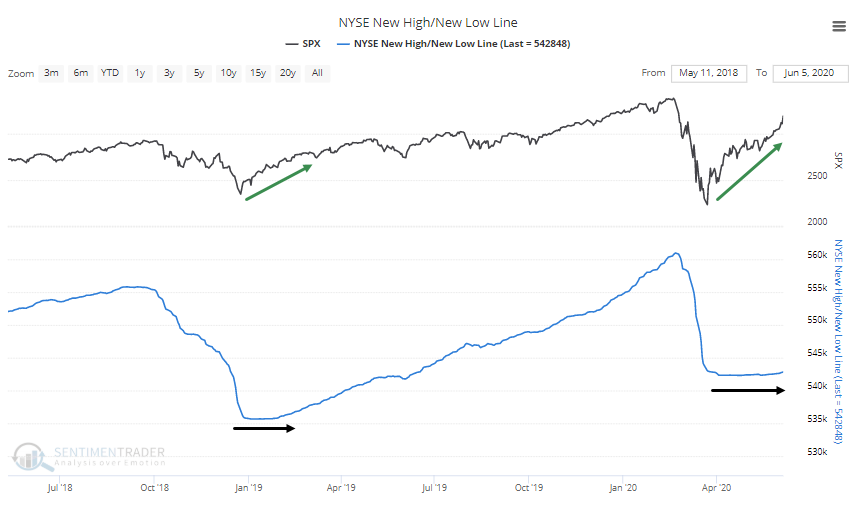

The cumulative line we calculate that uses the net number of 52-week highs and lows on the NYSE has barely budged. This seems like an issue, but because new lows were so overwhelming during the decline, it's going to take some time before that curls up in any meaningful way. The same thing happened in 2019, and 2009 before that.

Among sector and index ETFs, most of the Cumulative Advance/Decline Lines are at or near new highs, further supporting the view that it's been a broad rally.

Like the other breadth signs we've discussed, really since late March, there is little here to support any kind of bearish argument. A rising tide like this is very difficult to fight, and while signs of speculative excess on shorter time frames is a definite worry, these signs of broad-based recovery continue to be major longer-term support.