Breadth Gets Oversold As Consumer Confidence Rises

This is an abridged version of our Daily Report.

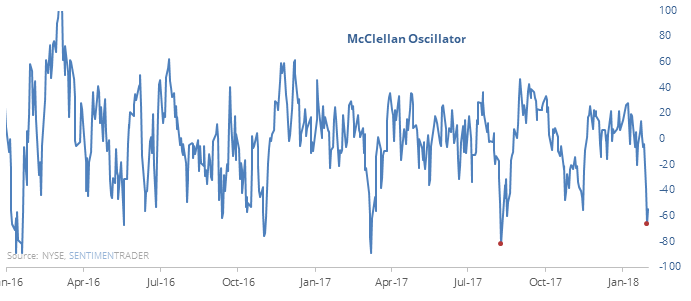

Oversold already

At least one primary breadth indicator is showing that recent selling pressure is extreme. It’s rare to see the McClellan Oscillator this stretched to the downside just a few days after an all-time high in the S&P.

Similar readings led to gains over the medium- to long-term, with much of the risk focused in the first month.

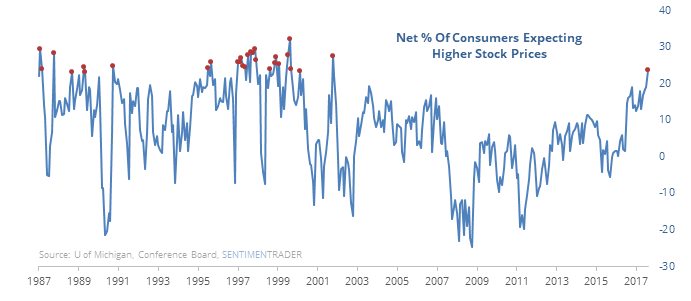

More bull

Consumers surveyed over the past month are the most confident in 15 years that we’ll see more of the bull market. The current readings far surpass any other during the past two bull markets.

Over the past 30 years, the S&P’s annualized return when consumers were this confidence was a lowly 2.7%.

Lost perspective

The surge into low-fee passive ETFs has opened new investors up to the risk of getting out at the wrong time.Reaction to Tuesday’s modest decline is eye-opening, if it’s any guide to their mentality.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.