Breadth coming back to normal

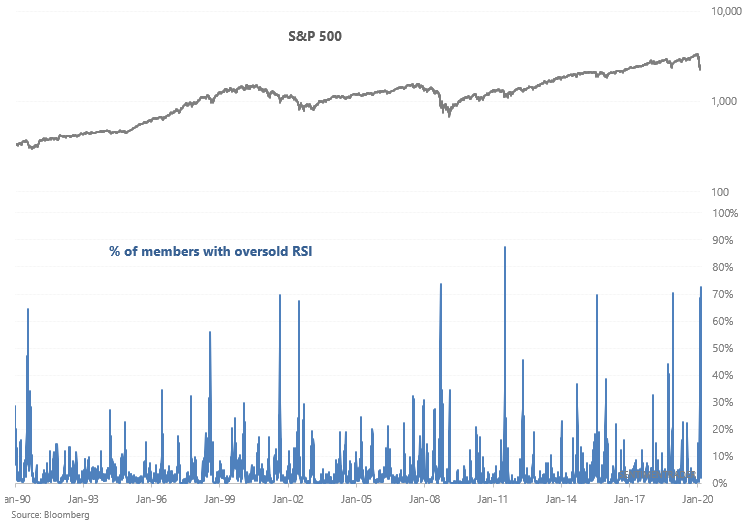

The stock market's crash over the past few weeks was so intense that the vast majority of stocks were oversold (14 day RSI under 30). This was one of the highest readings over the past 30 years, matched only by some of the sharpest selloffs in market history. The stock market is now trying to put in a medium term bottom. Regardless of whether this is a V-bottom or a bottom with lots of up and down swings, this condition is abating. Fewer than 2% of the S&P 500's members are now oversold:

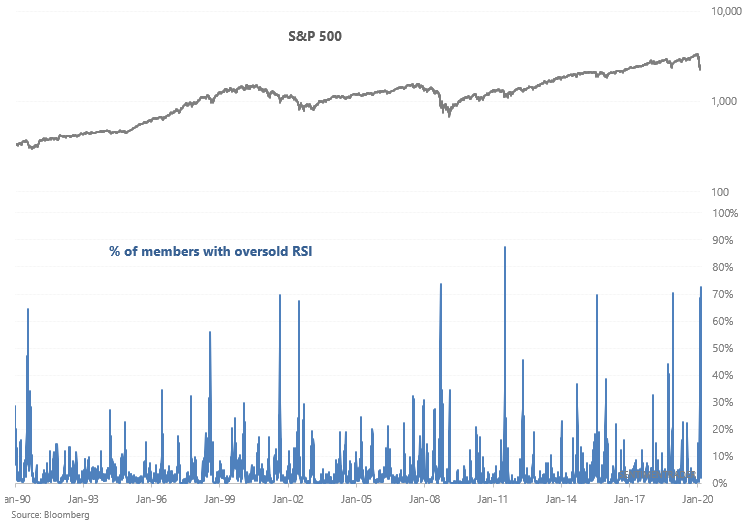

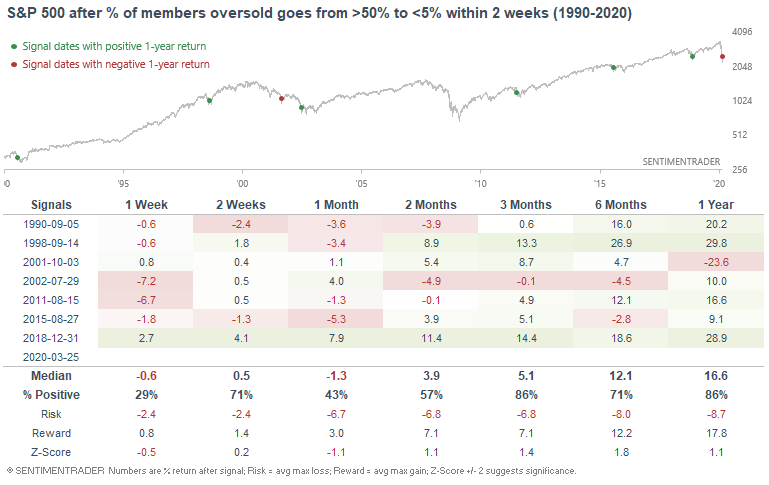

When the S&P went from a majority of members being oversold to less than 5% of members being oversold in less than 2 weeks, the S&P's returns over the next few weeks were mixed. The stock market often fluctuated up and down without a clear direction. But after the market chopped up and down for a few weeks, it usually rallied over the next 3 months:

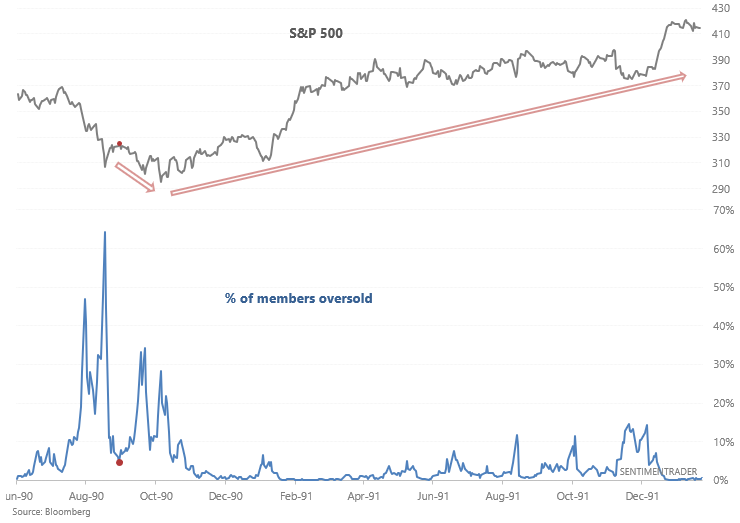

Here's 1990:

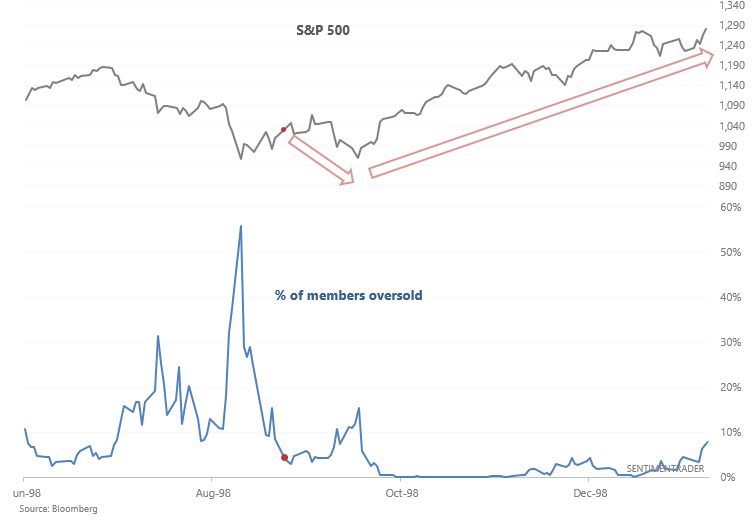

Here's 1998:

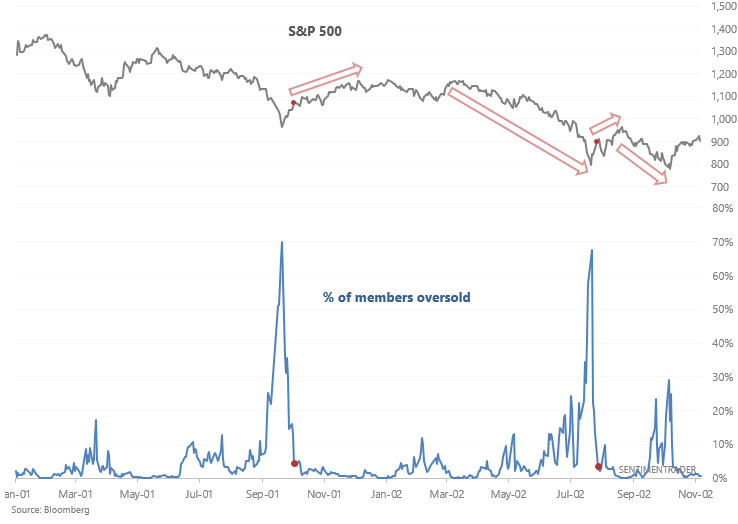

Here's 2001 and 2002:

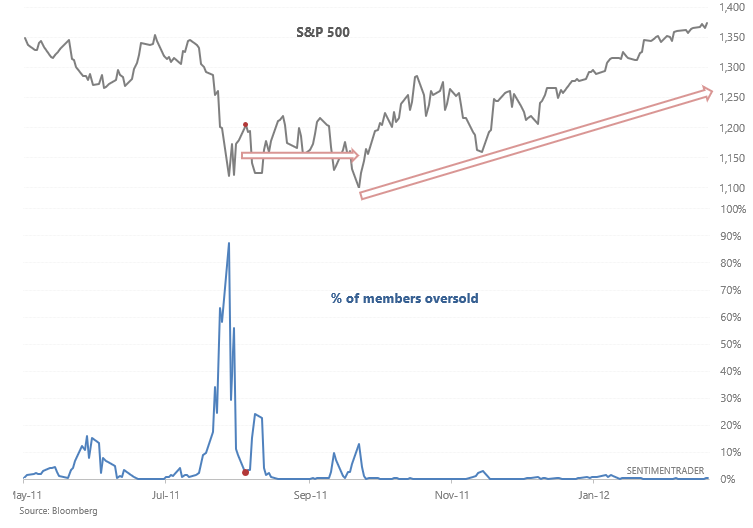

Here's 2011:

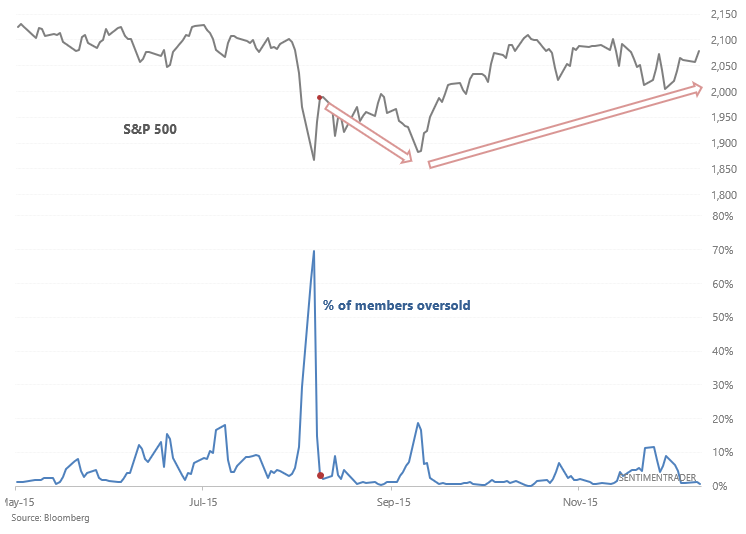

Here's 2015:

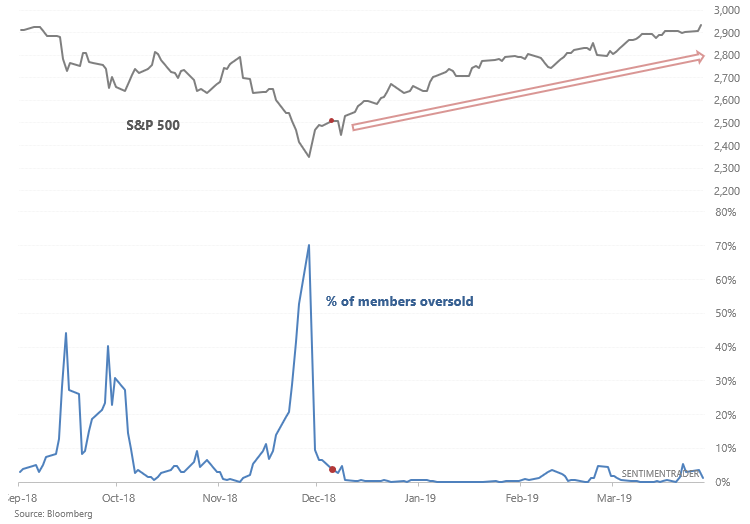

Here's 2018:

As you can see, a V-shaped recovery is unlikely, but not impossible. The last case (December 2018) was certainly V-shaped, while the rest usually saw a retest of lows before a more meaningful rally could begin.