Brazilian weakness leading to deep selling in emerging markets

Last week, we saw that even while economic reports in emerging market countries were gaining strength relative to countries like the U.S., many of the stocks in those markets were declining. The McClellan Summation Index for emerging markets was dropping well into oversold territory.

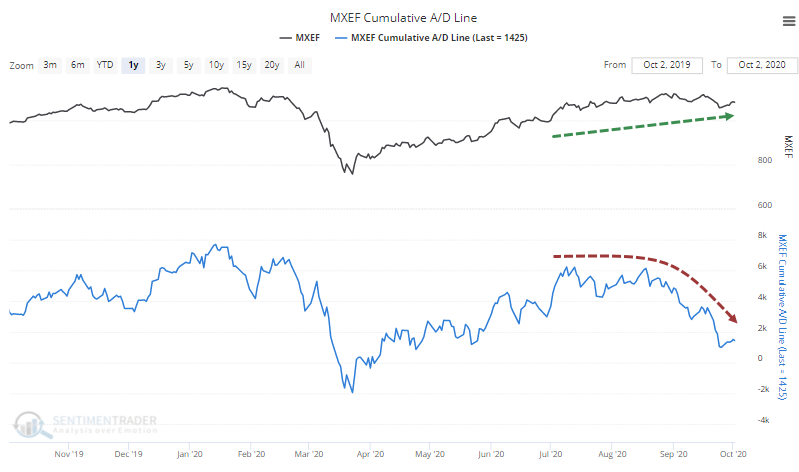

The oddity is that even while emerging market indexes have held up, it's not because of most stocks rising. The Cumulative Advance/Decline Line has plunged in recent months, diverging from the indexes.

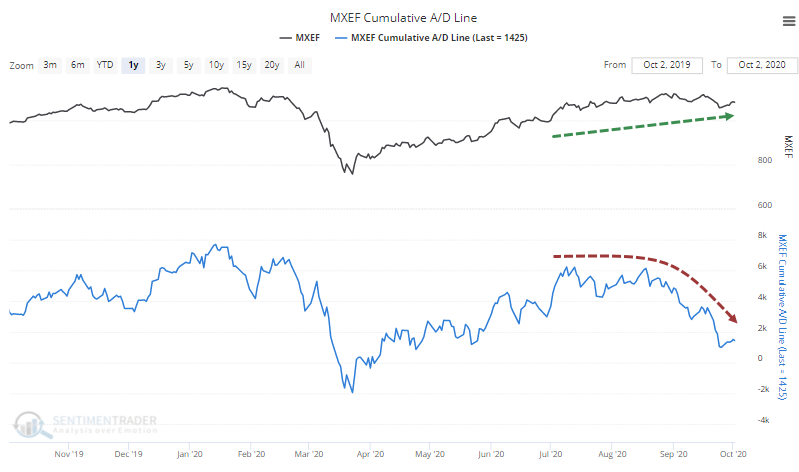

Over the past 50 days, an average of 80 more stocks declined each day than advanced. That's a historically extreme reading that's just now starting to improve. The Backtest Engine shows good forward returns when this has triggered before.

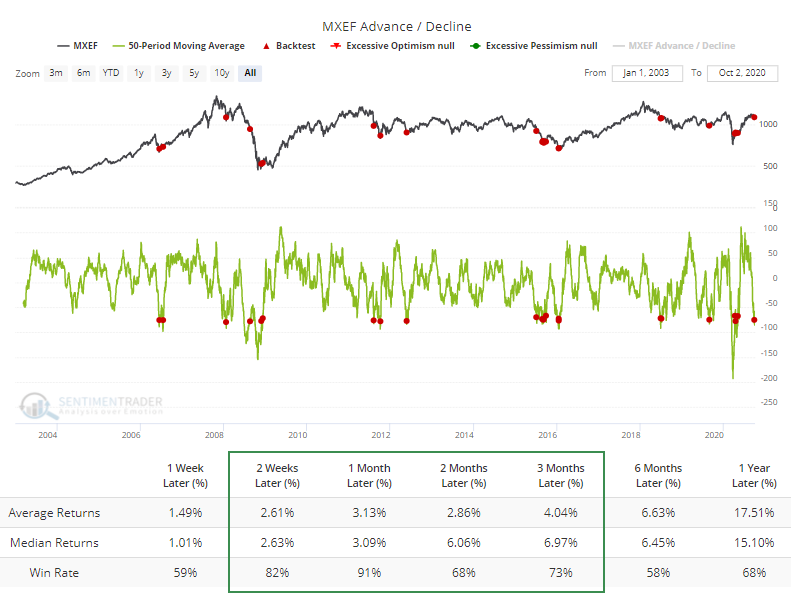

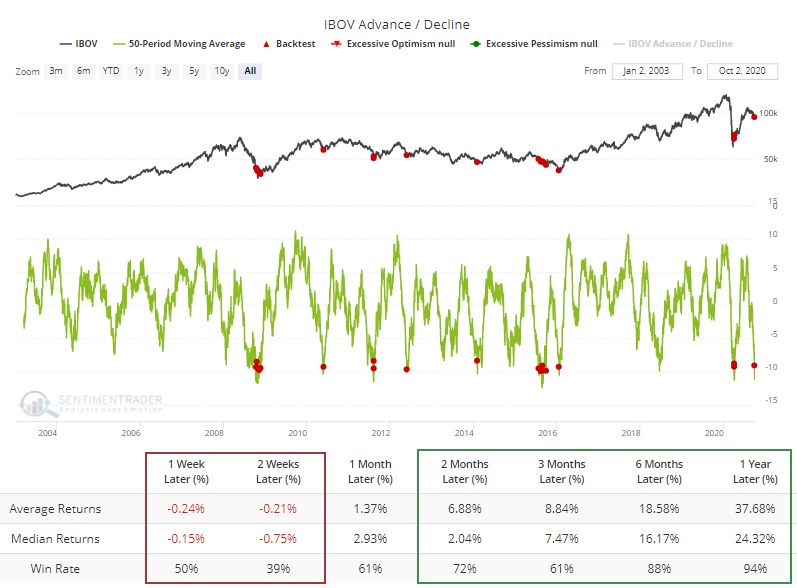

Part of this weakness comes from Brazil, where the Cumulative A/D Line has been even worse, now below even the March lows.

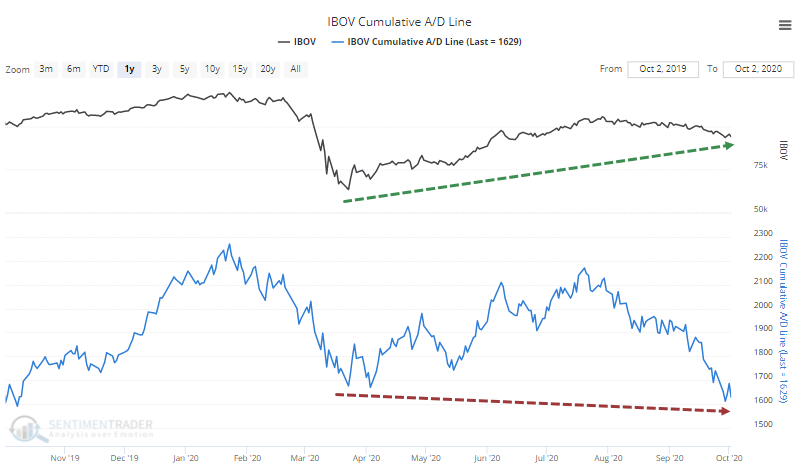

Again, over the past 50 days there have been an average of more declining than advancing stocks, enough to register a historical extreme that's only now starting to curl higher. The Backtest Engine shows poor short-term returns but excellent longer-term ones after prior signals.

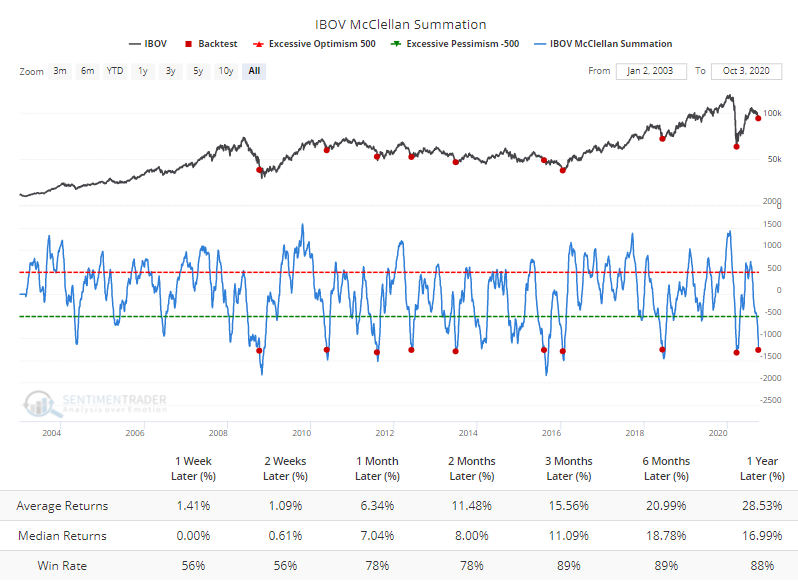

Such persistent internal weakness has pushed the McClellan Summation Index for the Ibovespa down to a rarefied extreme. Once again, the Backtest Engine shows impressive forward returns. The only real exception was in August 2015 when there was no sustained positive reaction to the oversold conditions. After the others, if there was any further short-term weakness, then it was quickly and emphatically reversed in the months ahead.

When markets reach these kinds of extremes and show signs of recovery, they tend to keep going, which is a good sign for the medium-term. One concern is that much of this weakness has been under the surface, as the indexes themselves haven't corrected much. Some would suggest that the indexes will fall in order to catch up with the weakness shown in the majority of stocks, but in historical tests, that theory is not reliable. From a medium- to long-term point of view, the internal selling has been enough to consistently precede positive returns.