Brazilian Stocks Showing Washout Breadth

Brazilian stocks have been getting smoked since June. The Ibovespa is down about 10% from its peak, while the EWZ fund traded in the U.S. and priced in dollars is down more than 15%.

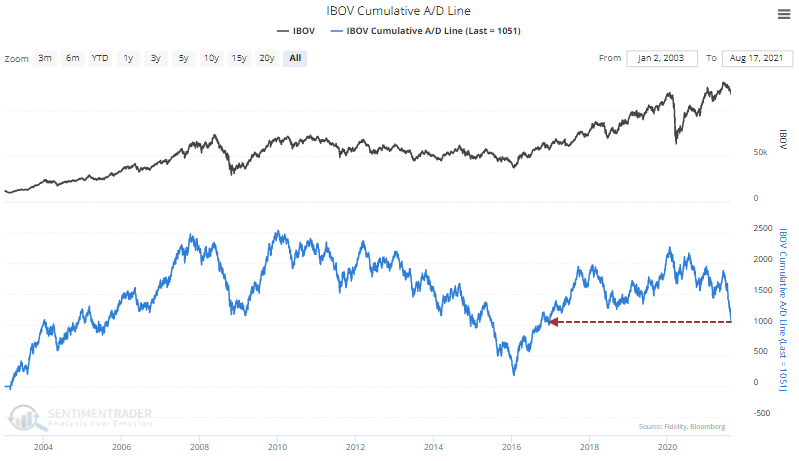

The Ibovespa is kind of like the Nasdaq in that its Cumulative Advance/Decline Line has a bugger of a time consistently rising. Apparently, quite a few crappy stocks dragging down the averages. With its latest plunge, the A/D Line for that index is at its lowest point in 5 years.

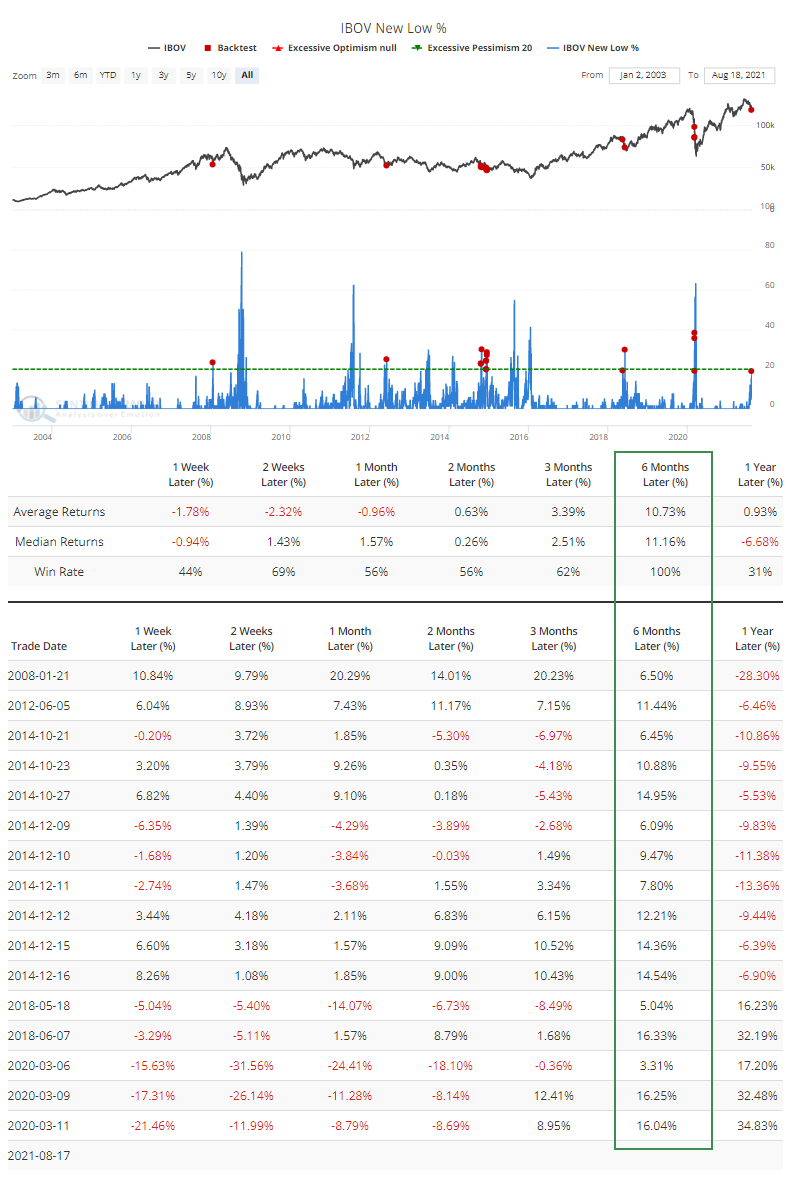

This has started to generate some extremes. Nearly 20% of stocks in the Ibovespa fell to a 52-week low this week. Using the Backtest Engine to look for readings this high when the 200-day moving average is rising, it preceded gains in the Ibovespa over the next 6 months every time. The pandemic crash was uncomfortable, for sure.

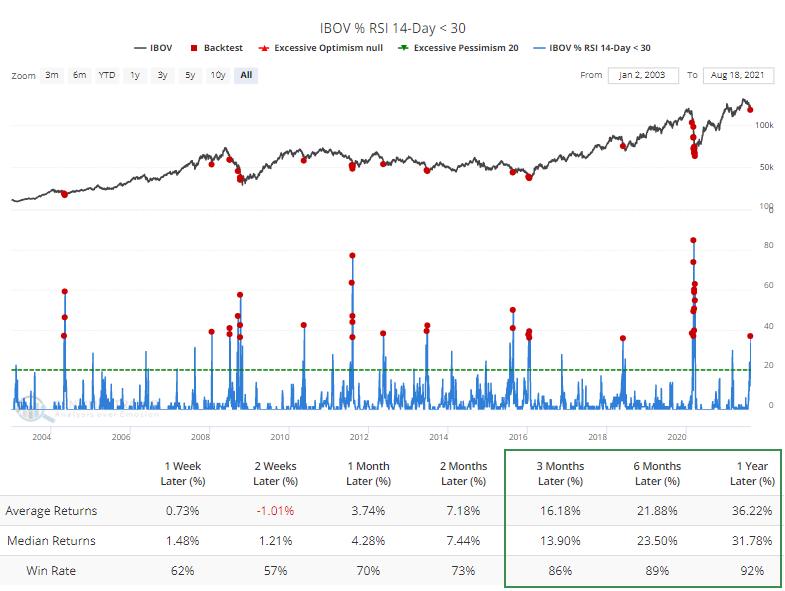

The latest puke-fest triggered an oversold reading in more than 35% of the stocks. Once again, the Engine shows few losses over a medium- to long-term time frame.

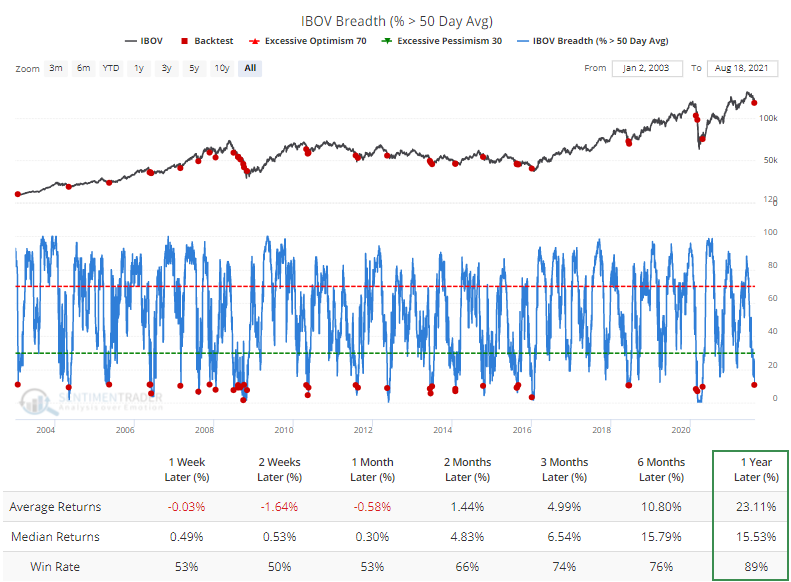

Some of the medium-term trend indicators are showing moderate extremes, with the percentage of stocks above their 50-day moving averages falling below 11%. Not great short-term returns, but good long-term ones, per the Backtest Engine.

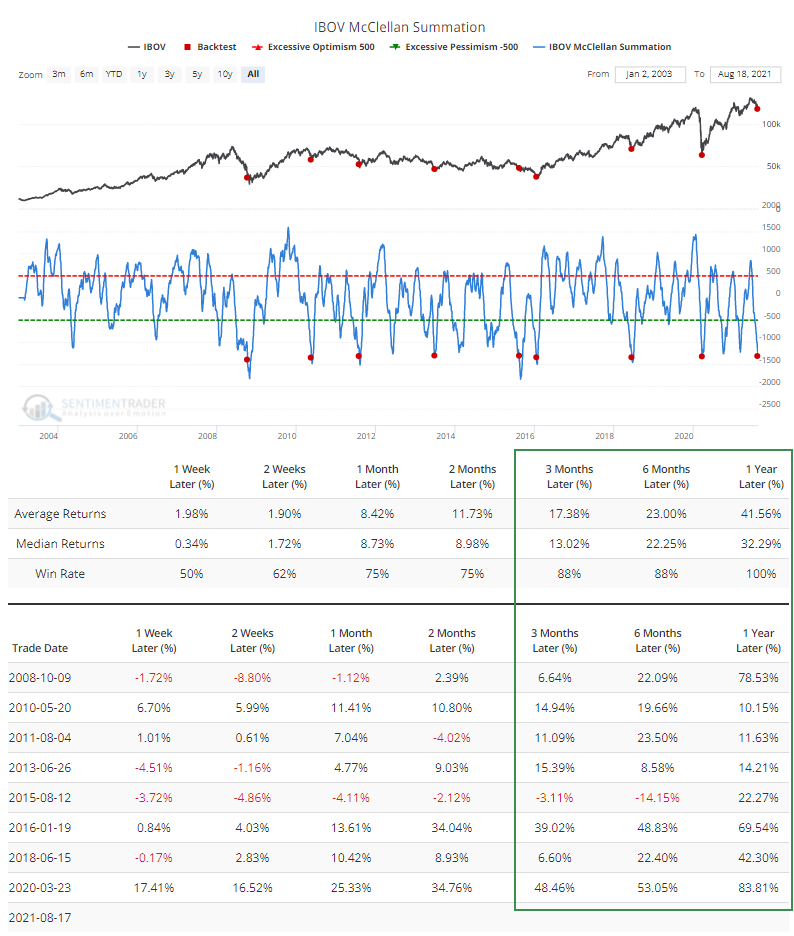

Here's the kicker - the recent internal momentum has been so poor that the McClellan Summation Index for the Ibovespa dove below -1300, one of the worst readings we've seen. The Engine shows no losses over the following year, with a whopping average return of +42%.

Ideally, we'd see a quick spike in 52-week lows to 40%+ of all issues, and then a rebound. That has marked the largest lows, but also came after much greater losses. For intermediate-term declines, the current extremes are about as egregious as it gets. The Summation Index extreme is compelling for those looking for longer-term opportunities.