Both Smart and Dumb Money are pretty bullish

Key points:

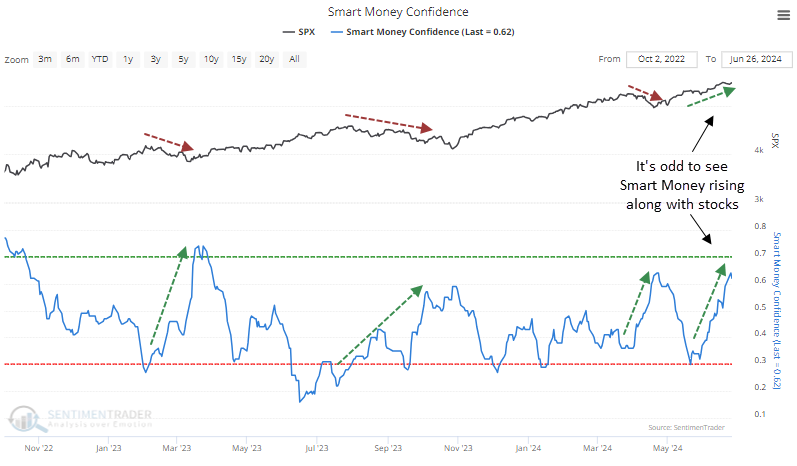

- Smart Money Confidence jumped even as stocks rallied, which is the opposite of typical behavior

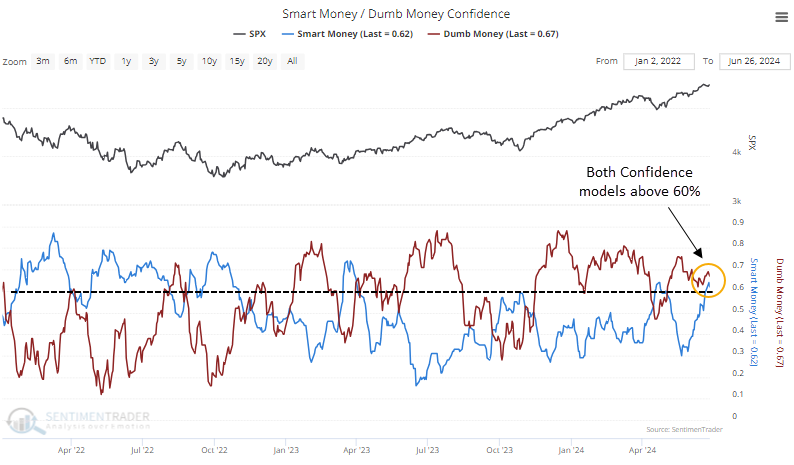

- Both Smart and Dumb Money Confidence are above 60%, another oddity

- S&P 500 returns after similar behavior was inconsistently weak over the next couple of months

More odd behavior

Optimism has been ebbing lately. That may seem like good news for contrarians - the "wall of worry" and all that nonsense - but we saw last week that bull markets need more bulls, not fewer.

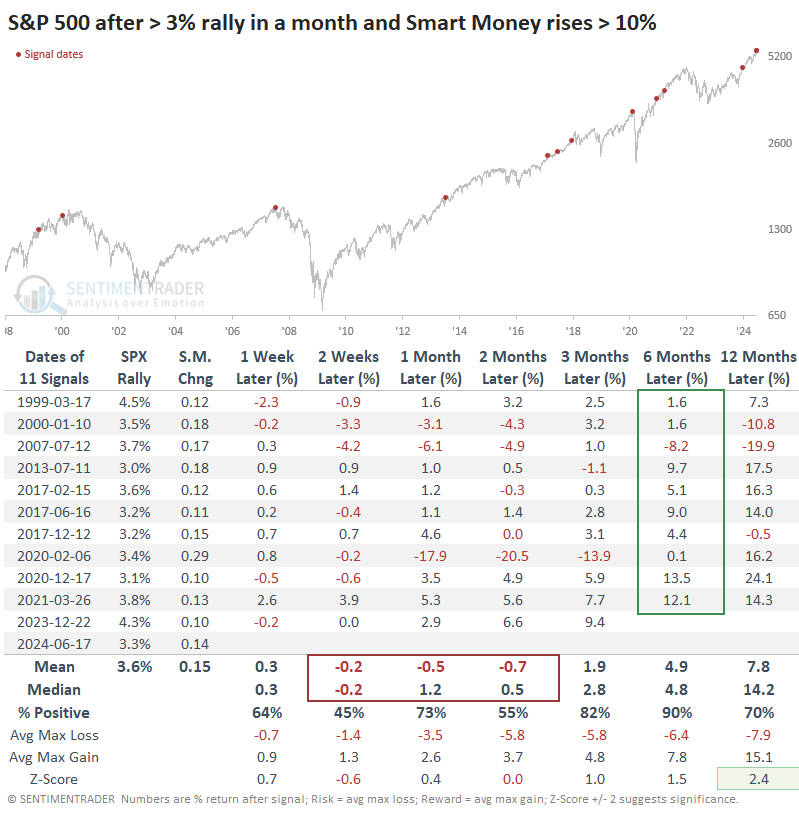

Among the several oddities happening in technicals right now is that sentiment is acting rather oddly. Dumb Money Confidence has been stagnant, but Smart Money Confidence is rising. This model comprises data that mainly reflects institutional activity, and institutions most often buy as stocks decline and vice-versa.

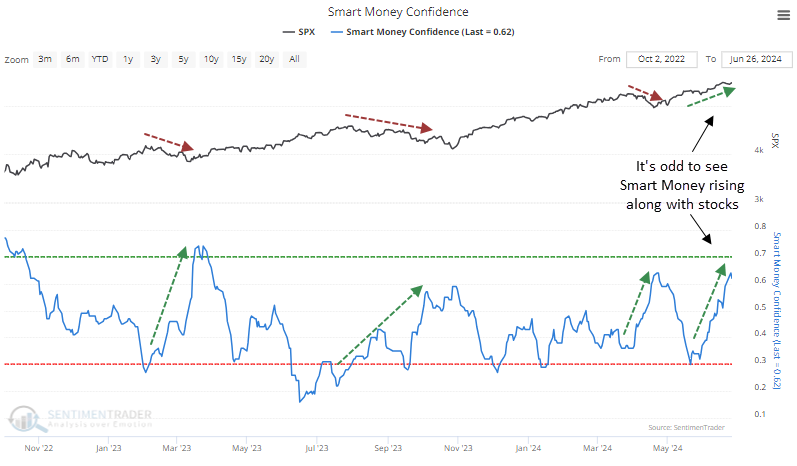

It's strange to see Smart Money rise by 10% or more during a month when the S&P 500 rose significantly. The table below shows that other times it happened, the S&P showed uninspired returns up to two months later, though the last few signals were excellent. By six months later, the index suffered only a single loss (but that was the global financial crisis).

Is everyone pretty bullish?

Because Smart Money has been rising and Dumb Money is still high, both models are above the 60% confidence level at the same time. This, too, is highly unusual.

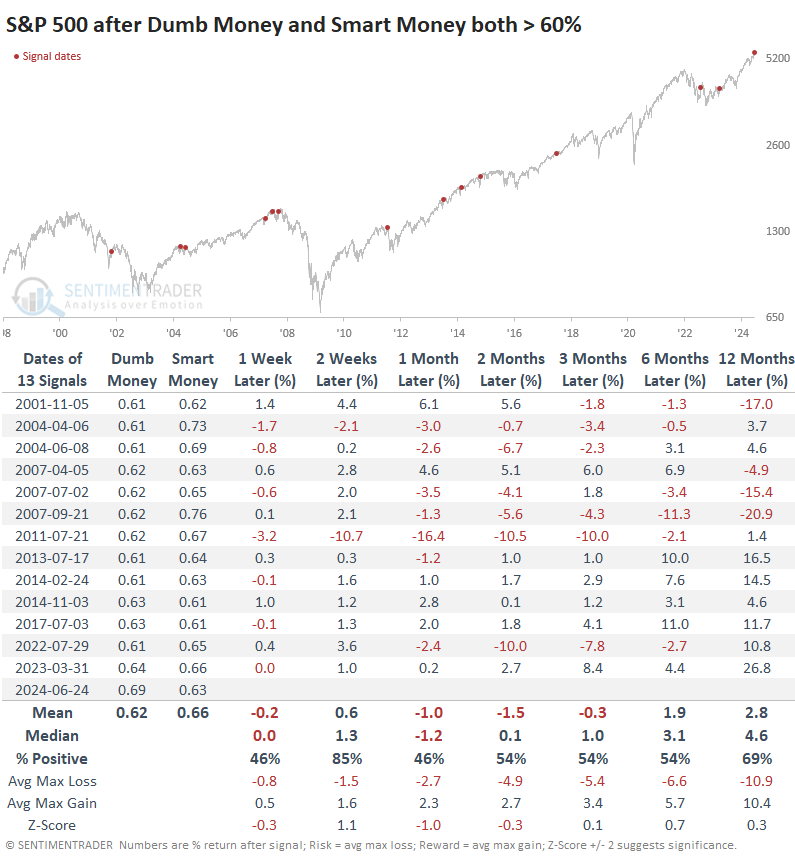

Since the models' inception in 1998, this is the highest Smart Money Confidence reading when Dumb Money was above 65%. If we relax the parameters to 60%, we get the results in the table below.

Again, returns weren't all that great. Up to three months later, the mean return was negative, and the median was just barely positive. Risk outweighed reward across time frames, even up to a year later, even though the win rate improved. The last few signals all ultimately showed double-digit gains a year later, though two of those were triggered when stocks were well off their highs.

What the research tells us...

We don't like "odd." It's better when markets do what they should be doing, and investors behave like they should be behaving. That's been the case, with few exceptions, since the fall of 2022. It started to change in January of this year and quickly corrected itself. Then, about a month ago, we began to see oddities pile up in a more worrisome manner, and it continues today.

Most of the concerns we've discussed are more intermediate, ranging from weeks to months. Most haven't seen consistently weak results extend much beyond a few months, so long-term concerns are still relatively few and minor so far.