Boom goes bust

Peak volatility

When thinking about volatility, most people gravitate toward the VIX "fear gauge." It's a handy measure for sure, but only goes back to 1990, or 1986 if we use the old calculation.

In the past, we've looked at a simulated VIX indicator that uses several different models to recreate what the VIX might have done if it existed at the time. Over the past couple of decades, the model has a 90% correlation to the VIX itself, so it's done a good job. Any model will have a hard time with outliers like the Black Monday crash in 1987 and this was no exception.

This simulated VIX (SimVIX) just peaked above 80%, which was barely eclipsed by a few days in 1987 and 2008. The key term there might be "peaked." The SimVIX has gone from its highest level in years to a 5-day low as of Tuesday.

A 5-day low might seem insignificant, but when this indicator turns from an extreme, it has tended to keep going longer-term. For stocks, this typically meant a lot of shorter-term swings, usually to the downside, while hammering out important low points.

Boom goes bust

Economic data released in March wasn't all that terrible since most of it was for readings from February. But economic data released in April will be terrible, no doubt.

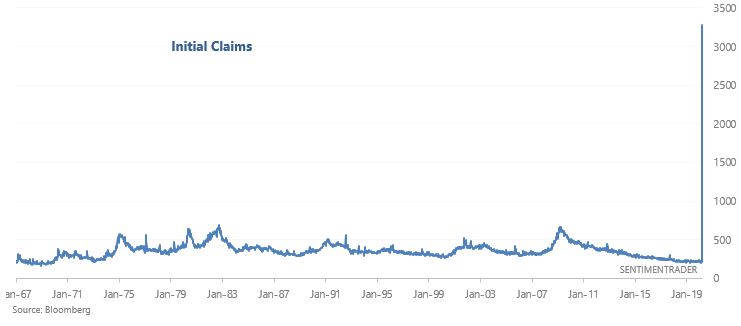

Among some popular models that use fundamental inputs, the Yardeni Boom-Bust Barometer has already crashed to the lowest level in years. But why did it collapse? The Barometer is calculated by dividing the CRB Raw Industrial Price Index by Initial Claims. Initial Claims spiked to the highest level ever, causing this indicator to crash. That's why the "Boom-Bust" barometer collapsed.

Other plunges in the Barometer tended to occur near the worst of economic readings, but not necessarily the worst of losses in stocks.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- There are lots of shorts in UK stocks

- What happens when volatility peaks