Bond volatility falls more than for stocks

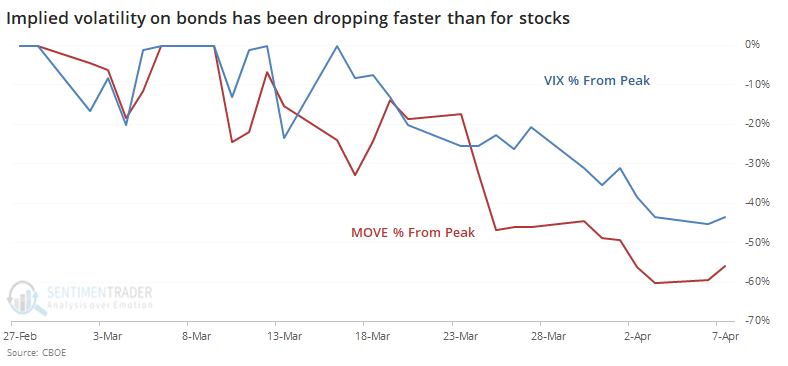

Last week, we saw the unusual situation with implied volatility in the Nasdaq 100 (VXN) falling below that of the S&P 500 (VIX). Per Bloomberg via the fine folks at Leuthold, volatility in bonds (MOVE) has been dropping faster than the VIX, too.

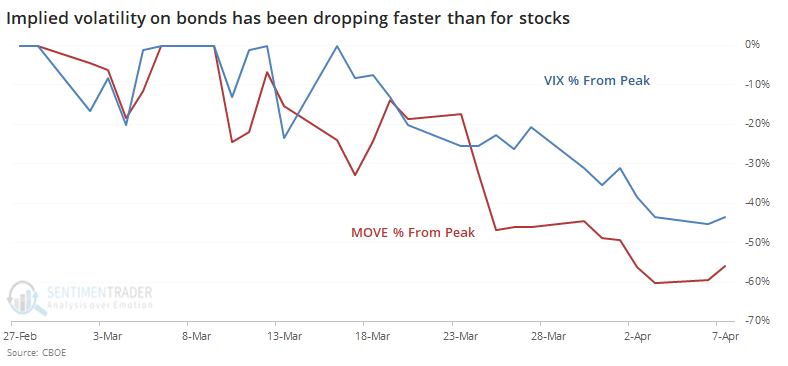

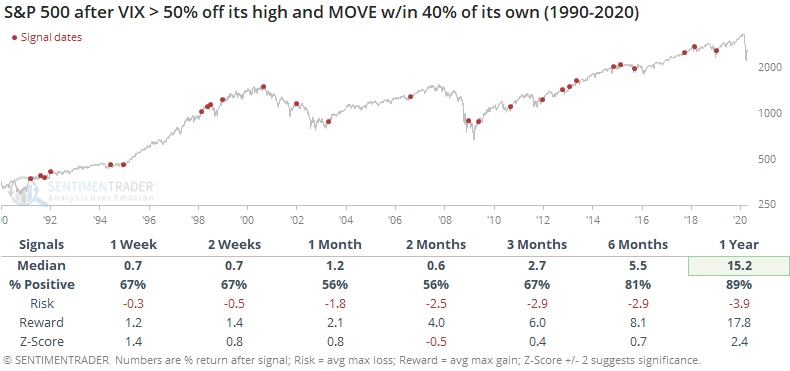

When we've seen MOVE drop further off its high than the VIX, it has preceded mostly good returns for stocks. Over the next 6-12 months, the S&P was never lower.

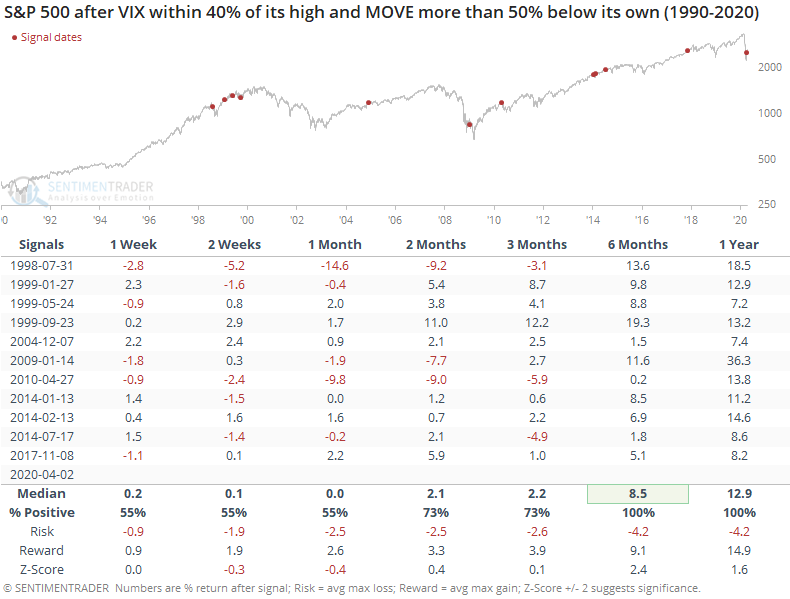

For 10-year Treasury note futures, it wasn't such a good sign.

When an indicator or study is robust, not only do we see strong returns when the conditions are met, we also usually see strong returns in the opposite direction when the inverse of the conditions are met. That's not always the case, but it's a good test to see if what we're looking at tends to work in both directions, and lends a little more confidence to the results.

If we look at the opposite conditions from the above, when the VIX fell much more than MOVE, then we should see more negative returns. That wasn't really the case, which dampens the conclusion somewhat.

A persistently high VIX is not necessarily a good thing. Bulls should want to see traders becoming more and more comfortable with the idea of a rally, causing the VIX to fall. About the only good sign when it comes to the VIX is that implied volatility in other parts of markets are falling more, and that has usually been a good thing.