Bond sentiment is coming back from the brink

Bond sentiment reverses from extreme pessimism

Investors ditched bonds a few weeks ago, and now they're gingerly coming back.

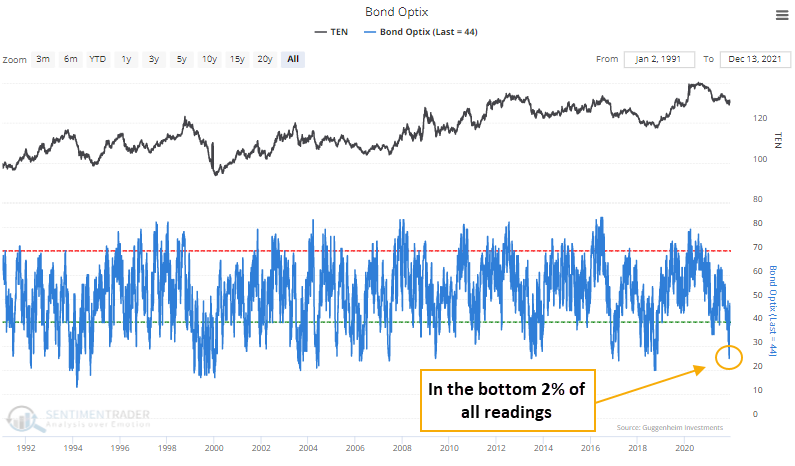

The Optimism Index (Optix) for bonds plunged to 25% in late November. Since then, it has rebounded and not set another low, raising the possibility that sentiment has troughed.

That heavy pessimism from before Thanksgiving was in the bottom 2% of all days in the past 30 years.

Let's make the assumption that not setting a lower low in sentiment for 15 consecutive days, after recording a reading below 30%, suggests that investors have finished panicking. Then we can see if that improved forward returns. For 10-year Treasury futures, it did, but only modestly. Other bond products fared better, and other indicators support that view.

| Stat box Wednesday marked only the 12th time in history that stocks and bonds had such a pronounced reaction to a FOMC meeting, with SPY rising more than +0.75% and TLT declining more than 0.75%. |

Using small-caps as a canary for interest rates

Small-cap stocks can be more sensitive to economic conditions. So, it makes some sense that when those stocks are outperforming, bond yields tend to rise.

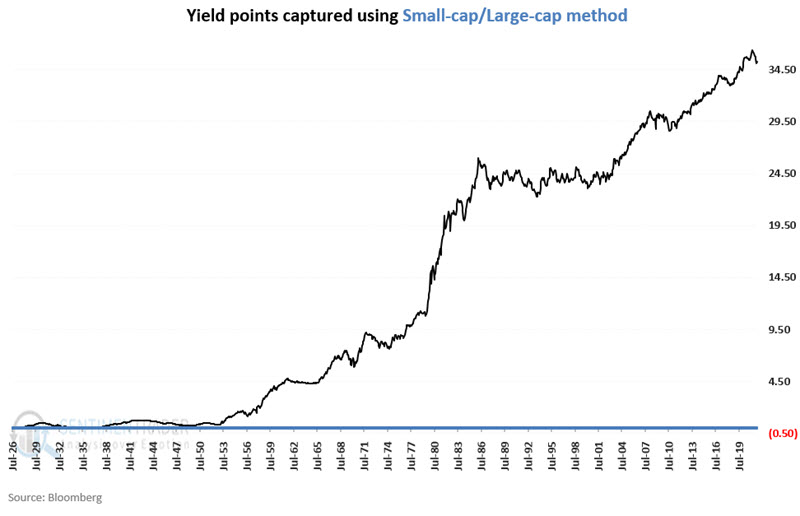

Jay looked at a small-cap index and a large-cap index starting in 1926, using a simple trend-following method on the ratio between the two to determine its impact on interest rates.

To measure the efficiency of this simple method for tracking interest rates, let's use the following methodology:

- Add changes in yield points if the small-cap/large-cap trend is up

- Subtract changes in yield points if the small-cap/large-cap trend is down

The chart below displays the cumulative yield points captured using this method since 1926.

The ebb and flow between small-cap and large-cap stocks have demonstrated a high degree of correlation with the fluctuations of interest rates over the past 95 years. Tracking this relationship as described above can help an investor stay in tune with the primary interest rate trend and filter out a lot of the "noise" generated on the topic.